13 July 2022

Francis Marais, Head of Research at Glacier by Sanlam

The case for investing offshore has received renewed attention lately, driven by two recent developments.

The first and arguably the most important one, at least from a longer-term strategic perspective, was the change to Regulation 28 and the amount that South Africans may now invest offshore through their retirement funds. To most, this was a surprise, and for a while there seemed to be some confusion about what exactly it meant. In hindsight, it was actually quite clear, but the change was so significant that many of us were in disbelief (let’s call it that).

The second development was the significant outperformance of local risky (South African equities and property) compared to global equities and property. When thinking about your clients’ portfolios and investments, what should South Africans make of these developments, and which are more important over the longer term?

Why it’s a good idea to increase offshore exposure

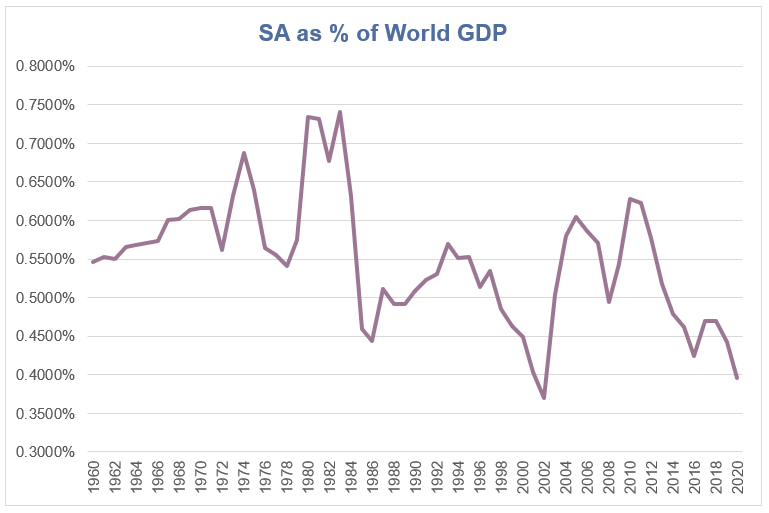

South Africa has always been a relatively small economy when compared to the rest of the world. We’ve had times of strong economic growth, but even at the best of times, we’ve never been more than 1% of global GDP (World Bank, 2022). We’ve made some inroads since 2002 (the point at which we were least consequential from a global GDP perspective, ie 0.37%), up to 2010, when we were at 0.6277%. We can refer to this period as our post-1994 golden era. We all know what happened after that, and those gains were largely reversed. Today we’re sitting again at below 0.4% of global GDP, which implies that our local economy presents a very small investment opportunity set, with poor relative growth fundamentals relative to the rest of the world.

Not only is the investment opportunity limited in terms of size and growth, but the instruments we use to access this growth – listed equities – have also declined significantly since 2000, down from roughly 600 on the JSE to just under 300 today (288 as at the end of 2021).

To add, our local market provides us with limited opportunities to benefit from emerging industries such as nanotechnology, robotics, artificial intelligence (AI), biotechnology, health and pharmaceuticals, and the internet of things (IoT), plus its related industries such as semiconductors, augmented and virtual reality, 3D printing, genomics etc. The list goes on, but suffice it to say, there is a long list of industries not sufficiently represented in our local market.

Finally, as a country, we have some unique and well-publicised structural economic and political issues that, at times, detract from potential growth rates and therefore may negatively impact future earnings growth of South African equities.

But first, heed these risks:

Shorter-term tactical considerations

Most of the current opinion pieces that advocate against an immediate adoption of increased offshore allocations seem to be making a point about current valuations of South African equities relative to the rest of the world. We need to highlight a couple of things here, though.

First, it seems to be a shorter term, tactical consideration, with few denying that over time their allocations could drift to additional offshore allocations. We think there is merit in this valuation argument, but the point also needs to be made that when they refer to relatively higher valuations globally, they tend to refer to specific regions such as the US or certain industries such as technology or growth stocks.

A cursory glance at both the MSCI World Value Index and MSCI EM Value Index reveals that there are plenty of value opportunities globally. South Africa is not represented in the former, but even in the latter our representation is small, falling into the ‘other’ bucket at around 22%. Perhaps it’s a coverage issue, or a local bias one, or perhaps our managers prefer to stick to their knitting. There is nothing wrong with the latter and, indeed, such self-awareness and humility needs to be applauded, but the first two are obvious issues.

The South African market offers global earnings exposure

Another argument is that on a look-through basis, our market offers enough global exposure from an earnings perspective. Fair enough, but are South African listed companies always the best vehicles to access these earnings? Richemont is perhaps a great company, but is it always a better option than LVMH?

ZAR volatility

A big argument against higher offshore allocations seems to be based on ZAR volatility and managing South African liabilities with global . But let’s look at this a bit more closely.

Firstly, the ZAR vs USD has depreciated at an annualised rate of about 5.8% since December 1984, which tracks the inflation differential of average South African inflation and US inflation over the same period closely, ie 5.4%. This is, of course, to be expected as theory and purchasing power parity would dictate. Therefore, investing offshore doesn’t imply you lose out because South African inflation is higher than in the US, for instance, and you are, in fact, hedged against relative higher local inflation (the pace at which your liabilities grow) by investing globally. These are average inflation numbers, however, and we aren’t carbon copies of the average human being, so portfolios need to be constructed based on an individual’s unique needs and circumstances. Similarly, a person saving towards retirement and therefore arguably more focussed on longer term growth needs a different portfolio to a post-retirement investor, where volatility and sequence of return risk can have a significant impact on their monthly income and portfolio longevity. But here, too, investors need to be careful.

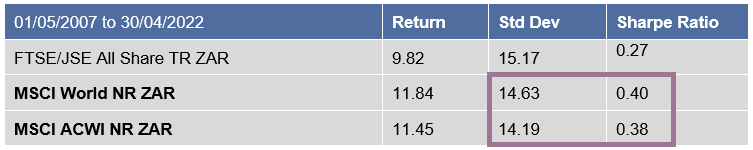

Even when you are retired, you still need a decent amount of growth in your portfolio and, indeed, as humans live longer, including growth becomes even more important. So, how does global equity stack up? Well, unfortunately currency volatility is once again a factor, but this is a bit short-sighted in our view. Closer inspection reveals that global equities (MSCI World USD) and our local currency movement are actually very lowly correlated to each other, so the combination of the two, ie MSCI World in ZAR, which is the more rational way of looking at it, does not really add any additional volatility to your portfolios. So, if volatility is the main concern, investors should be ambivalent to choosing either local listed equities or offshore equities. The table below sets this out in a bit more detail:

Local vs global equities

Again, one can argue that 15 years is a short period, and that if one looks at a longer period – say, since 1900 – South African equities have outperformed global equities. But here, too, one needs to be careful. Global equities don’t have to imply a neutral index like the MSCI World, which most people use as a proxy. Indeed, most managers make a massive active and overweight call investing in South Africa in any event, so the same should apply to other markets. South Africa had been a top-performing equity market since 1900, but so was Australia and the US. US equities outperformed our market in USD over the same time period, and New Zealand delivered a similar performance) as per Credit Suisse’s Global Investment Returns Yearbook for 2020. Will the next 120 years be the same as the previous 120 years?

Financial planning is a holistic process

We ultimately believe that there is strong case for increased exposure to global and, indeed, those exposures should drift upwards over time. The case becomes even stronger if you have substantial like a house, holiday home, South African business or a farm. It is also possible that, due to the increased importance of offshore in local portfolios, South African investors may, in future, choose to access offshore through specialist actual offshore managers as opposed to local managers offering offshore exposure via their local equity or multi-asset funds, but time will tell. This would most likely be in the pre-retirement phase as opposed to post-retirement.

As always, financial planning is a holistic process and the inclusion of or additional allocation to offshore needs to be looked at in the context of the investor’s entire portfolio and their unique circumstances and needs, along with their willingness and ability to tolerate risk. While additional offshore exposure may make sense for younger clients with a longer-term horizon and looking to build wealth or looking to settle internationally, it may not make sense for clients in the post-retirement phase of life, settled in South Africa and dependent on a monthly income.