13 July 2022

By Dean de Nysschen, Senior Research & Investment Analyst at Glacier by Sanlam

There are many important considerations when investing offshore, but investors often tend to focus their attention exclusively on the rand. Many are reluctant to invest when the rand has weakened. In this article I explain why the benefits of directly investing offshore could potentially outweigh the gains made by trying to time the investment decision.

Timing the externalisation of funds

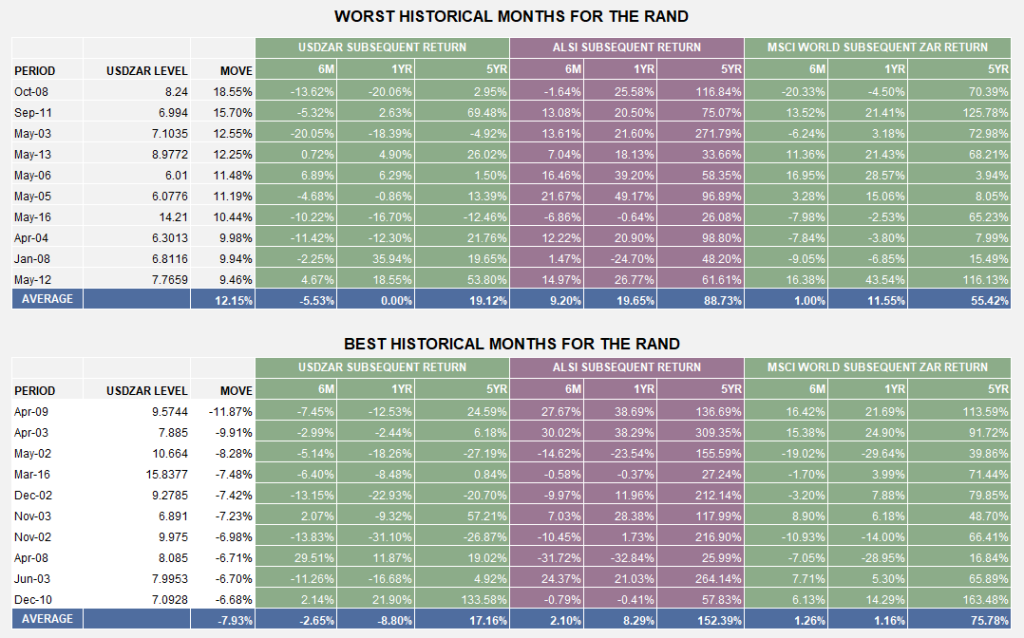

When we evaluate the most extreme monthly movements of the exchange rate over the past 20 years (see below), we see a few interesting trends.

First, it is unsurprising that the worst month for the local exchange rate was in October 2008 (in the middle of the global financial crisis), when the exchange rate weakened by 18.55%. Six months later the South African rand (ZAR) had strengthened by about 14%, while over a one-year subsequent period (until October 2009), it had strengthened by 20%. This would seem a rational development, and may be a good example of why investors tend to avoid externalising when the ZAR has substantially weakened – the belief being that the exchange rate should normalise back to its fair value. Interestingly, however, if we look at the average of the 10 worst months for the exchange rate (12% depreciation), we see that while the ZAR tended to strengthen by around 5.5%, six months after the blowout – over a subsequent one-year period – the result is actually a zero percent change. Perhaps most importantly, over a subsequent five-year period, the ZAR continued to weaken by approximately 19%, and this already provides a good reminder that externalisation should be a strategic and long-term decision, rather than one based on shorter term market movements.

Second, let’s take a closer look at the above historical periods when the ZAR strengthened the most (the scenarios after which investors would naturally be most tempted to externalise). On a subsequent six-monthly basis, the average movement of the ZAR after severe strengthening was approximately 3% further strength, a reminder of the difficulty in timing the currency. A further endorsement for this is the fact that subsequent one-year returns, after periods of significant rand strength, would – on average – indicate that the exchange rate should proceed to weaken approximately another 9%. This is inferior to the average of 0% ZAR weakness we observed above, after periods of extreme ZAR weakness. In other words, you would have been better off one year later, even if you had externalised after the most extreme point of ZAR weakness.

The takeaway? Although the expectation for the exchange rate to normalise after a blowout is reasonable, history shows that over the shorter term, it could actually go either way. On a longer-term basis, however, the currency will continue to depreciate (as the subsequent five-year returns suggest in both sets of historical returns), regardless of your entry point. Surprisingly, on a subsequent five-year basis, subsequent rand weakness was, in fact, 2% more pronounced after periods of ZAR weakness.

What is the best course of action?

Given the trends outlined above, if an investor expects the ZAR to weaken, then they shouldn’t necessarily be fixated on waiting for the perfect investment entry point. What the data shows us is, regardless of your entry point, a well-planned and longer term externalisation strategy can reward you over time.

Theoretically, the ZAR is a depreciating currency, relative to developed market countries (with lower inflation and lower interest rates), and, therefore, over a longer period, this depreciation trend will continue. The best course of action for investors is to externalise their investment for strategic reasons – according to their unique goals and risk profile – and for the several benefits these offshore markets can provide (we explore these below in more detail).

Offshore investing is for the long-term investor

An offshore component is an important part of any well-diversified portfolio, but should generally be reserved for funds that an investor is willing to invest in for the long term, and that are not needed to match rand-based expenses.

Let’s conduct a thought exercise, referring to the above historical data once again. We assume that the MSCI World return data could serve as a proxy for externalised investments and provide an indication of the type of returns investors could experience with an improved opportunity set. Furthermore, we then also assume that investors who prefer not to access these markets would invest in the local ALSI Index instead. Interestingly, the above data (reflecting 20 years of data) – on average – implies that the subsequent five-year returns, after periods of both ZAR strength and weakness, would be greater when keeping your on local shores (five-year returns on the ALSI are larger than that of the MSCI World for both sets of data). This may seem strange, but could potentially be explained by two factors.

First, the local ALSI Index has become dominated by rand-hedge counters, especially when considering a standard market-weighted index (the impact of rand-hedge counters is often the reason cited by investors who are of the opinion that externalising is not necessary).

Second, and perhaps most importantly, 20 years of data includes index returns of the early 2000s. This was a particularly fruitful period for a far less concentrated local stock market, supported by a strong South African economy, which was experiencing significant foreign capital inflows at the time and, consequently, led to bouts of significant rand strength.

Unfortunately, the economic state of affairs has drastically deteriorated over the past 20 years in South Africa and, therefore, it may be more appropriate to evaluate more recent data below.

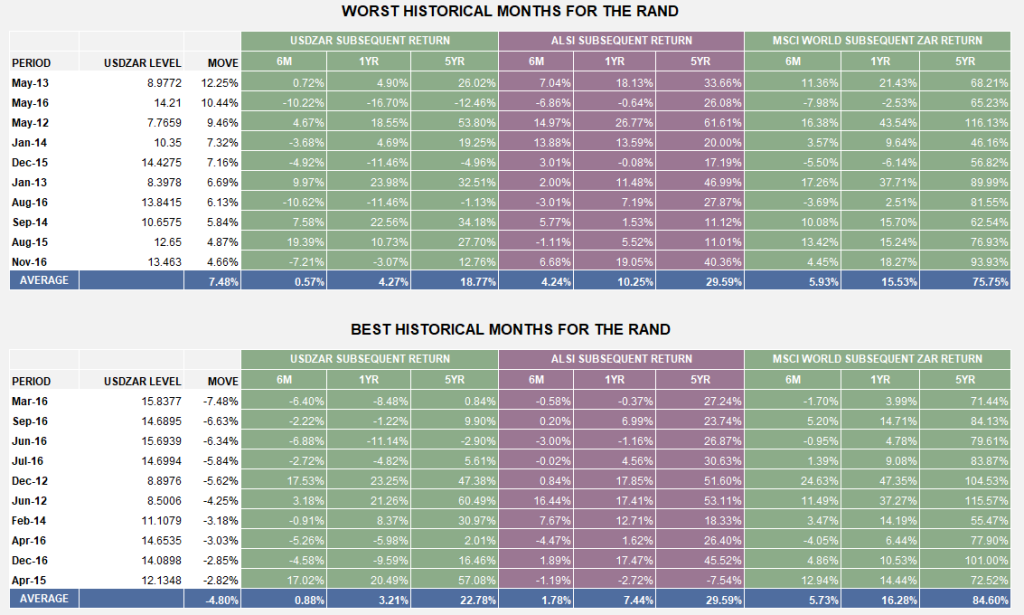

The above data applies the exact same methodology used previously, with the only difference being that the past 10 years of exchange rate data were used (rather than the past 20 years used before). Here we observe that in both cases (best and worst historical periods for the ZAR), the average five-year subsequent index returns for the MSCI World are significantly higher than for the local ALSI Index.

This outperformance provides a valuable reminder that the ability to access a broader opportunity set (which should theoretically provide a greater chance of improved returns) is of critical importance, especially in the face of severe macroeconomic uncertainty. When considering the fact that the local market index is 10 times more concentrated than the internationally diversified MSCI World, the quality of your opportunity set may, in fact, be just as important as your entry point. Ultimately, these factors should not be seen as being mutually exclusive, and should be considered holistically when making your decision to externalise.

6 Good reasons to invest offshore – no matter what currency movements are doing

- Access a far greater opportunity set, in terms of geographies, currencies, industries and companies. South Africa still makes up less than 1% of the global economy, so diversifying offshore is essential. To add, a struggling local economy and shrinking South African GDP have, in turn, influenced the local opportunity set – with the number of locally listed businesses decreasing by approximately 40% over the past 20 years.

- Obtain portfolio construction benefits. A greater opportunity set brings more opportunity to introduce that are uncorrelated (produce returns under different circumstances and at different times). The higher the long-term return you require, the more offshore exposure you need in your portfolio.

- Get exposure to different currencies. Our local currency is not only vulnerable to inflation risk, and significant volatility, but as an emerging market economy, can be substantially influenced by the commodity cycle. Exposure to currencies that are less volatile and have less dependence on commodities can help with risk management.

- Grow your investment to match your liabilities. When externalising funds, you can – to some extent – match your liabilities in your local currency. For example, our petrol price is matched to the oil price in USD terms, and much of our food is imported. A weakening rand will have an impact on these costs, which is unavoidable. By externalising your , you also hedge against local inflation, as your currency depreciates based on the inflation differential.

- Avoid sovereign risk (the risk of a government defaulting on its risk payments) by externalising a portion of your portfolio.

- Maximise tax efficiencies. Realising gains (within a CGT context) is more efficient in times of rand weakness, when invested in a direct offshore investment. There are also many efficient rand-based vehicles, or “wrappers” that offer tax- and estate-planning advantages when investing offshore.

*The above data tables reference the top 10 most extreme months for the exchange rate over the past 20- and 10-year periods, respectively. Only data with subsequent five-year return figures was considered for the exercise.