The Glacier AI Flexible Fund of Funds (FoF) (“AI Fund”) is celebrating its third year. With emotionless-decisions, lower fees and quicker response time, the Fund - which is based on artificial intelligence and machine learning techniques - has withstood a global pandemic and evolving markets.

What is Artificial Intelligence (AI)?

AI is intelligence demonstrated by machines using algorithms to generate knowledge and solve tasks similar to humans. It refers to the theory and development of computer systems that can complete mundane to complex tasks which normally require human intelligence and capability, such as recognising speech and making decisions.

If all this sounds foreign, then it is perhaps useful to explain it in terms of baking a cake: An algorithm, which is simply a sequence of instructions and rules telling a computer what to do, simulates the purpose of a recipe for baking a cake -

100g of butter, 100g of sugar, two eggs, 100g of flour,

OR

today’s S&P 500 price versus yesterday’s price, versus five days ago, etc.

The fuel that drives the simple objective of AI is based on its ability to self-learn, retain information, continuously evolve by recognising patterns in data and re-writing its own algorithms as it gets confronted with new data. For example, AI gathers our data from Google searches, Amazon shopping or Netflix viewing behavioural patterns, then makes predictions and suggestions for the most suitable content based on this data.

This is a golden age where AI has a competitive advantage over algorithms written by humans.

Why use AI to drive investment decisions?

“We cannot solve the problems of the future with the solutions of the past”

These words of Albert Einstein ring true in that financial markets have become more complex, while at the same time, information has become far more accessible. This accessibility means there is less opportunity for an information advantage between investment managers.

However, information can often simply be ‘noise’, adding no value in the decision-making process. The real skill lies in the ability to efficiently process and accurately interpret information and data, which is where AI solutions continue to lead.

Investment managers’ strategies have not evolved much over the years. Most still base their investment theory on Modern Portfolio Theory, which was developed in the 1950s, and is largely based on the premise that diversification of portfolio through strategic asset allocation (SAA) supplies an investor with an optimal portfolio in terms of return and volatility. While this was true for many decades, where equity market cycles consisted of both a bull and a bear market, the world has shifted slightly.

Since the turn of the century, the emergence of a global marketplace has rendered SAA largely ineffective as a risk management tool. This is evident as when US equities decline, we see global equities typically follow. More concerning is that when US equities decline, many other asset classes correlate and fall at the same time. For example, when equities fell during the 2007-2009 Global Financial Crises and the 2020 COVID-19 crash, it was only a select few that did not move in tandem. In fact, were it not for the historically unprecedented central banks’ interventions, most investors would have suffered significant equity and corporate bond losses. These are the types of losses that often take years to recover from.

Tactical Asset Allocation (TAA) has the potential to become a significant contributor to portfolio returns and risk and therefore can materially improve an investor’s journey and outcome.

Most investment managers define portfolio risk in volatility terms. The problem with this definition is that true portfolio risk encompasses capital loss and time in loss risk. This is represented by the terms “maximum drawdown” and “time-in-maximum drawdown”. These stats usually manifest in a bear market where maximum drawdowns are typically three to four times worse than volatility. For example, an investor in a balanced fund with a 10% volatility is easily subjected to a -30%+ maximum drawdown in a bear market which frightens many investors and leads to redemptions at the worst possible time.

While the Glacier AI Flexible FoF works within the framework of SAA boundaries from a regulatory and investment sector/category perspective (Flexible Category), it utilises the full spectrum of TAA that is available to the portfolio. Most importantly, it does this without emotion or behavioural bias because 100% of the asset allocation and available instrument selection decisions are made by the AI engine.

The core aim of the AI engine’s DNA is to supply investors with a smoothed investment journey by minimising capital loss and time in loss risk during a market cycle, while keeping the return target in mind.

Tell me about the AI engine behind the Glacier AI Flexible FoF?

The Glacier AI Flexible FoF uses an AI engine called PIE, which stands for Predictive Investment Engine. It was first worked on 15 years ago and has been running live portfolios since 2015.

PIE represents an end-to-end investment engine and can run long-only, long-cash or long short portfolios based on liquid investment instruments. It also consists of three main components: A Data Processor, Predictor and Risk Manager:

The purpose of the Data Processor is to clean and enrich the data set to make it more interpretable for the engine. It does this with techniques such as detrending and rescaling the data.

The purpose of the Predictor is to predict the price direction and magnitude of each instrument in the portfolio from one observation point to the next. This fund offers such an observation point every two weeks, which translates to 26 complete TAA and instrument selection decisions per annum vs. the usual once a quarter SAA rebalance by most managers. The Predictor currently consists of 600 AI analysts and one AI head analyst, who distils the collective AI analysts’ predictions into a single prediction per portfolio instrument before handing it over to the Risk Manager.

The Risk Manager then constructs an optimal portfolio of instrument weights in order to meet the portfolio’s risk and return objectives over a market cycle.

How has the fund performed?

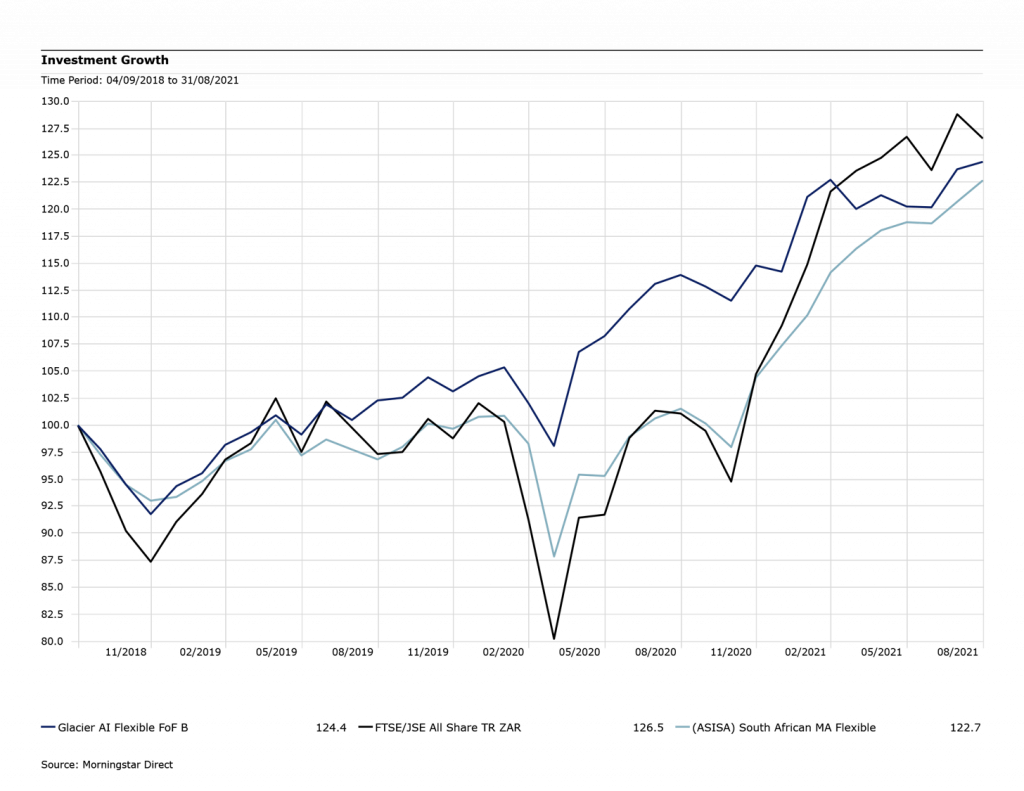

Total Return vs. sector

In total return terms the fund has provided investors with a superior outcome vs. its sector, however as evident in the above chart, it has done so with a materially smoother investment journey.

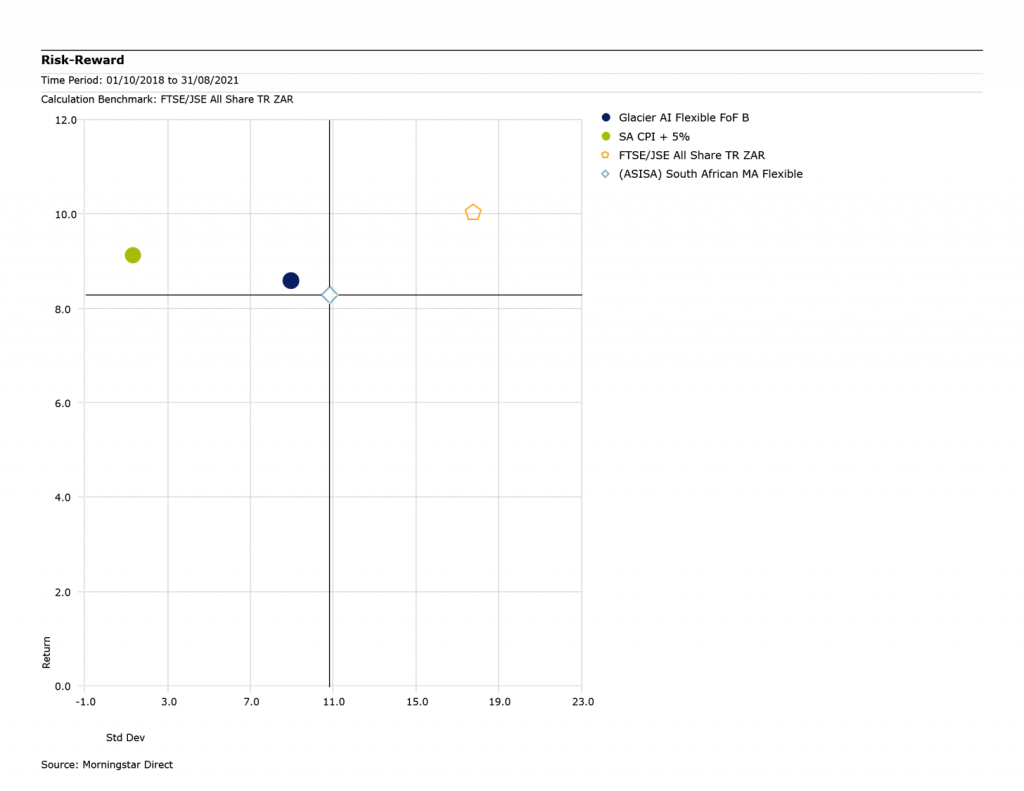

Vol/Return vs. sector

Volatility, as measured in Standard Deviation, has remained well below the fund’s peers since inception.

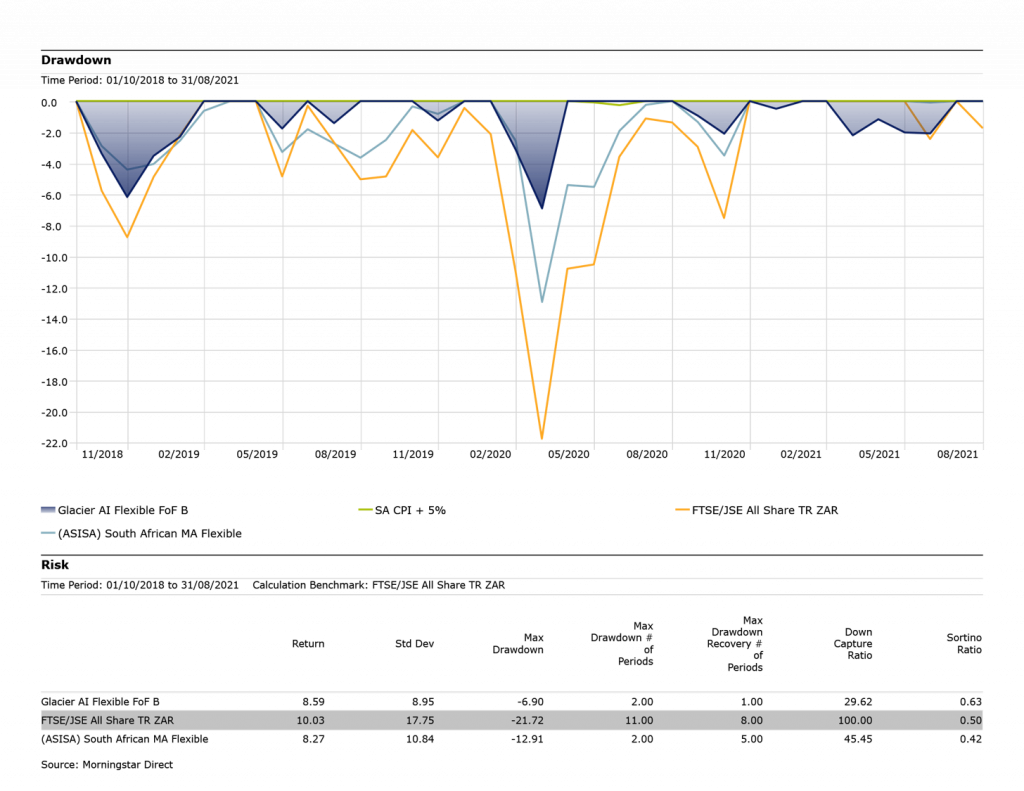

Max Drawdown vs. sector

Most importantly, drawdowns have been kept tighly under control which is the primary reason for the Fund’s smoother investment journey profile.

For those not familiar with drawdown charts, these only display those times a fund is trading below its previous high or what many call ‘underwater’ periods and it shows both depth and breadth of drawdowns.

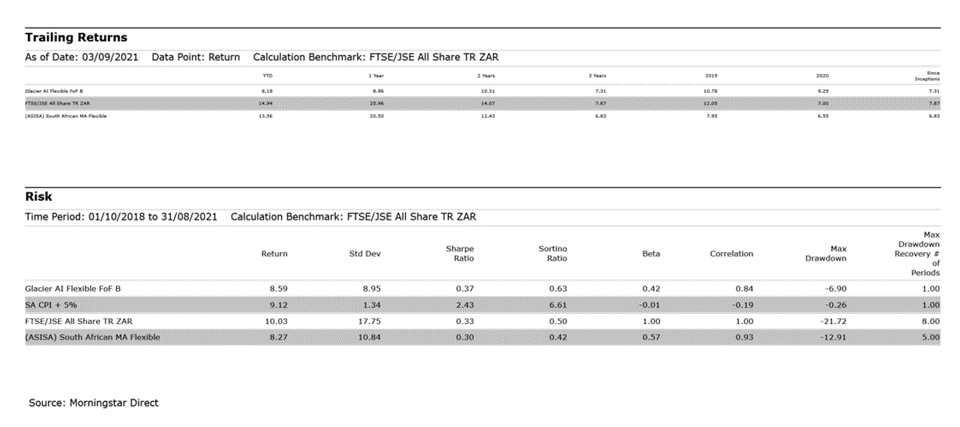

Return and Risk Summary vs. sector

Finally, while we are pleased with the total returns and the consistency of returns since inception, we trust investors and their advisers are mostly pleased with the lower volatility, shallow drawdowns and higher risk adjusted returns which is what makes this fund such a complementary portfolio addition.

Conclusion

“The essence of investment management is the management of risks, not the management of returns.” – Benjamin Graham

The Glacier AI Flexible FoF offers advisers and investors a core portfolio holding that represents genuine diversification of their investment manager risk. This is because it thinks differently than human managers do and moves very differently in its tactical asset allocation movements. The AI’s risk management focus to minimise capital loss and time in loss also acts without emotion or bias. This is incredibly helpful in a world where a market crisis takes place every few years. As per the charts above, the proof is in the pudding…sorry, cake!