With a five-year term, the Glacier Sustainable World Enhancer (GSWE) provides investors with the opportunity to potentially earn enhanced returns with the comfort of capital protection. As the new issue of this solution is open for investment until 25 March 2022, Mansoor Narker, Research and Investment Analyst at Glacier by Sanlam, examines the outlook for this structured investment solution in the context of the Russia/Ukraine conflict.

ESG standards and low volatility

The global portfolio, to which the return of this solution is linked, is well diversified across regions with the top four currently being the US (28.6%), France (16%), the UK (13.2%) and Japan (8.4%) and with no direct Russian/Ukrainian exposure.

The sector exposure broadly consists of large-cap holdings in the healthcare, pharmaceutical and consumer staple sectors, amongst others, with the underlying stocks selected according to their high ESG standards combined with displaying lower levels of volatility and higher liquidity.

The risk control mechanism on the underlying index further provides a smoother return profile by switching to cash when volatility is elevated, helping to steer the portfolio through turbulent times as we currently find ourselves in.

Equity market outlook

Despite the COVID-19 pandemic stretching itself out over two years, global equity markets have delivered robust returns coming off the lows of the March 2020 market episode. However, the reopening of economies and associated rebound in consumer activities coupled with supply chain disruptions and extremely accommodative monetary policies have been the perfect recipe for a sharp rise in global inflation.

Major central banks have pivoted to a decidedly hawkish stance as they signal the withdrawal of excess liquidity and the start of an interest rate hiking cycle. The full-scale invasion of Ukraine by Russia has compounded the volatility already seen since the start of the year and has brought about many uncertainties as the situation unfolds. Russia’s leading influence in a number of key agricultural, base metals and energy commodities will further feed inflationary pressures amid fears of supply disruptions. This also complicates matters for central banks who will need to move more cautiously as they look to balance the inflation risk and any slowdown in economic growth.

While global equities, and European markets in particular, could endure further volatility in the near-term given the current environment and elevated risks, the good news is that past experience suggests that should the conflict remain relatively contained, geopolitical events of this nature have little lasting impact.

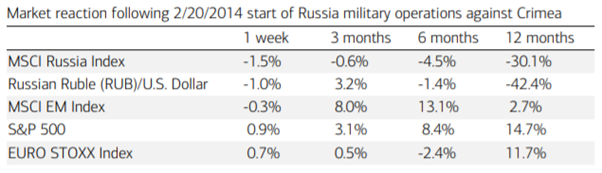

Looking back at the market reaction to the 2014 annexing of Crimea, equity markets outside of Russia delivered healthy returns 12 months past the event:

Source: Merrill, Bloomberg

Further out, equity market returns will be steered by more fundamental drivers of return including corporate earnings, the path of interest rates and the rate of economic expansion rather than short-term events.