17 November 2022

These are stressful economic times, and they don’t seem to be improving. People are feeling the pinch of rising fuel, energy and food costs and the increase in the interest rate is not helping our individual efforts to manage debt. “Breathe”, says Janine Jacobs, Head of Financial Reporting at Glacier by Sanlam, “and take time to really look into your finances. That’s the first step to help you plan for what needs to be done to get you where you want to be.” She offers some insights and tips on how to reach financial freedom.

What is financial freedom?

This means different things to different people, but Janine points out that financial freedom means:

- Taking ownership of your finances

- Having cash flow to live the life you want

- Being able to pay bills and manage unexpected expenses

- Planning for the long term, a rainy day and retirement.

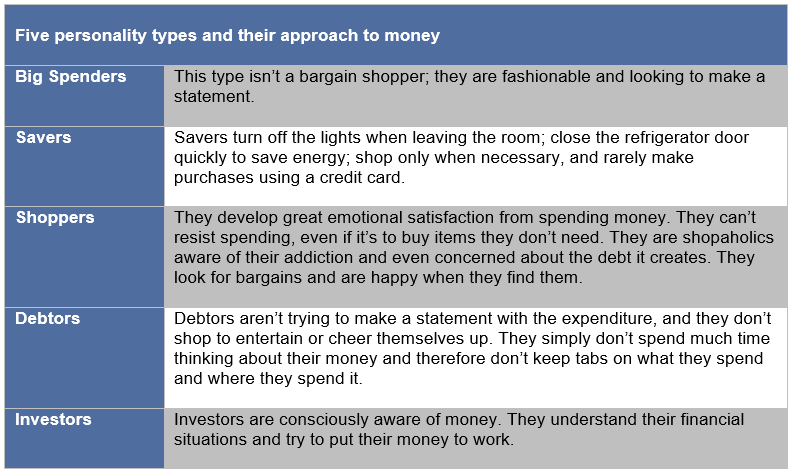

She unpacks five personality types and their different approaches when it comes to money. “Knowing your financial personality type takes you one step closer to managing your finances”, says Janine.

Eight steps to taking your financial power back

1. Know the point you’re at.

This starts with confronting your current financial situation so that you can move closer to where you want to be. It’s important to list your creditors and where you have saved money (e.g. shares, retirement savings). Important questions to ask are:

- How much have I saved?

- How much debt do I have?

- What do I need and for what purpose?

- Who do I owe money to?

If you don’t know about all your debt or the companies you owe money or you want to know your credit score, check out an organisation like the Credit Bureau or Credit Report SA.

2. Think of money differently.

It’s not just to pay for food and clothing. Money is a tool that will help you reach financial freedom. It can help you achieve your dreams, fuel your energy and live a stress-free life. Also, determine your motivation to make money. This will shape your goals. Do you want to create a better life for your children? Do you want to take care of your parents? Do you prefer not to be a financial burden on people in your old age? Whatever your motivation, managing your money today, gets you closer to your goals.

3. Track your spending.

Know what you spend your money on and don’t fall into the trap of unconscious spending. Are you buying a cappuccino at work every day? That’s around R25 a pop. Are you eating out on a whim, several times a month, or buying an item of clothing you don’t need? Thinking that buying something on a sale is saving you money is not sensible if you didn’t need the item in the first place. Download your bank’s track spending app on your phone and use it.

4. Pay yourself first.

The perfect spending ratio is as follows:

20% - Pay yourself first

30% - Housing which includes rent, bond payment, utilities

50% - Everything else, which includes school fees, groceries, entertainment, gym fees, etc.

Paying yourself first means putting away money before anything else is paid. It’s allocating money for a rainy day, saving for something, or settling debts.

5. Spend less.

Seems simple enough, but this needs to permeate in the biggest and smallest financial decisions. Why am I buying a cappuccino at work if they have a coffee station that’s free? Do I really need a new car or a bigger house? What are the hidden costs in the long term for these purchases? I have a wardrobe of clothing that I don’t wear, so do I really need a new pair of jeans?

Buying less means you have more money to save. You’ll also learn that you can have a happy, fulfilling life with less ‘stuff’.

6. Buy experiences, not things.

Try as far as possible to spend your money to enrich your outlook on life or to alter your perspective positively. As an example, travel (not products) can do that.

7. Create a side hustle.

If your debt is more than your income, create another income. Your salary is your active income, so consider a passive one like shares or earning rental income from your property. Creating another income stream requires sacrifice and hard work and needs to be managed so that it doesn’t impact negatively on your active income or create a conflict of interest.

8. Pay off your debt.

When you pay yourself first, focus on paying your debt, which relieves stress for you. Remember, your bond is debt until you pay your last instalment. Until then, your creditor (typically, the bank that holds your bond) owns your property. When you pay off debt you may adopt one of two approaches:

- Snowball – paying off the smallest debt first

- Avalanche – paying off the debt with the highest interest rate first

However you choose to approach managing your debt, it’s a big step closer to taking your financial power back.