We provide an update on the recent amendments to the Pension Funds Act and the Income Tax Act – in respect of increased foreign exposure (to 45%) and annuity income tax directives - and our plans for implementing these.

Foreign exposure limit increased to 45%

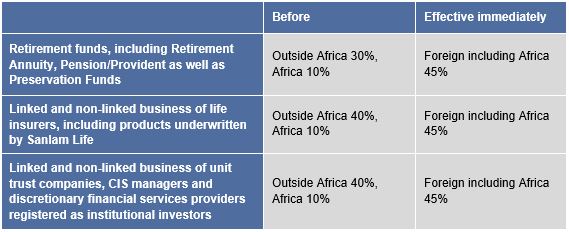

Exchange Control Circular No. 10/2022, in effect from 23 February 2022, confirms that the foreign exposure in terms of prudential limits applicable to institutional investors has been increased to 45% of total retail under management.

How the offshore limits changed

What this means for:

- Retirement savings: All retirement fund members may invest a maximum of 45% of their investment portfolios offshore.

- Endowments, sinking funds and living annuities: Life companies may invest a maximum of 45% of their retail offshore. Sanlam Life currently has sufficient offshore capacity and is not placing any restrictions on offshore exposure in the Glacier Vantage Plan, Vantage Life Plan and the Living Annuity.

Implementation at Glacier

This change has been implemented at Glacier. It affects:

- business transaction systems such as the intermediary web and the Investment Hub,

- financial planning tools, such as ICE,

- documentation and marketing collateral.

Annuity income tax directives: annuitants with more than one source of income

The industry has been given a choice to implement the rates either on 1 March or 1 April 2022, due to a second file with rates being made available after the budget speech on 23 February. As previously communicated, Glacier will be implementing these rates on 1 April for affected living annuitants. Sanlam Life implemented these rates on 1 March for the affected life annuitants.

Affected life annuitants will notice a difference in their income at the end of March, while affected living annuitants and investors in the FlexiGuarantee Life Annuity will notice a difference during the month of April 2022.

Please contact our Communication Centre or your Business Development Manager should you have any queries in this regard.