Retirement is a life-changing event at the best of times, but retiring during market uncertainty can become daunting. Francis Marais, Head of Research at Glacier by Sanlam, gives some insight to help.

Times like these are tough for everyone – but if you're facing retirement, times are even tougher for you. So, what to do? Some investors seem to want to abandon growth completely – and who can blame them. But is this the right thing to do? A quote often attributed to Mark Twain says that history never repeats, but it often rhymes. So let's take a look at history to help us understand better how to navigate now, and the coming months.

What happens when you retire and disinvest from equities to reduce risk during a downturn?

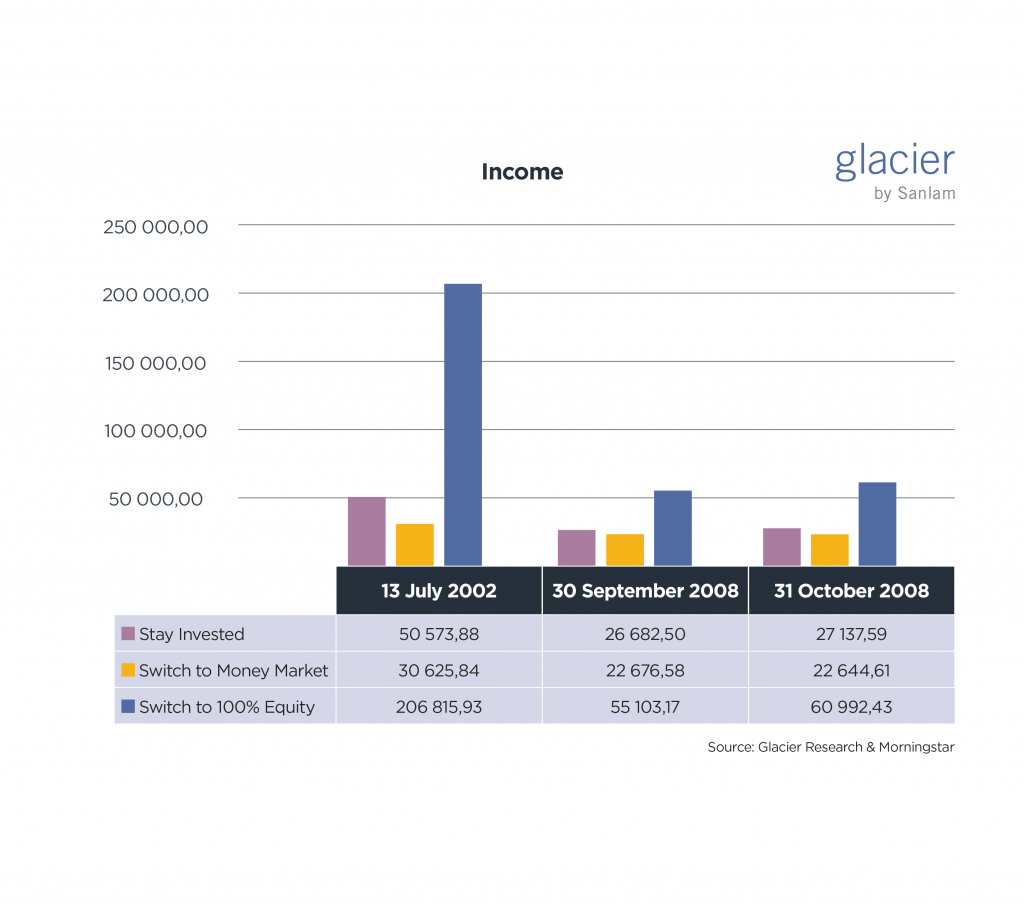

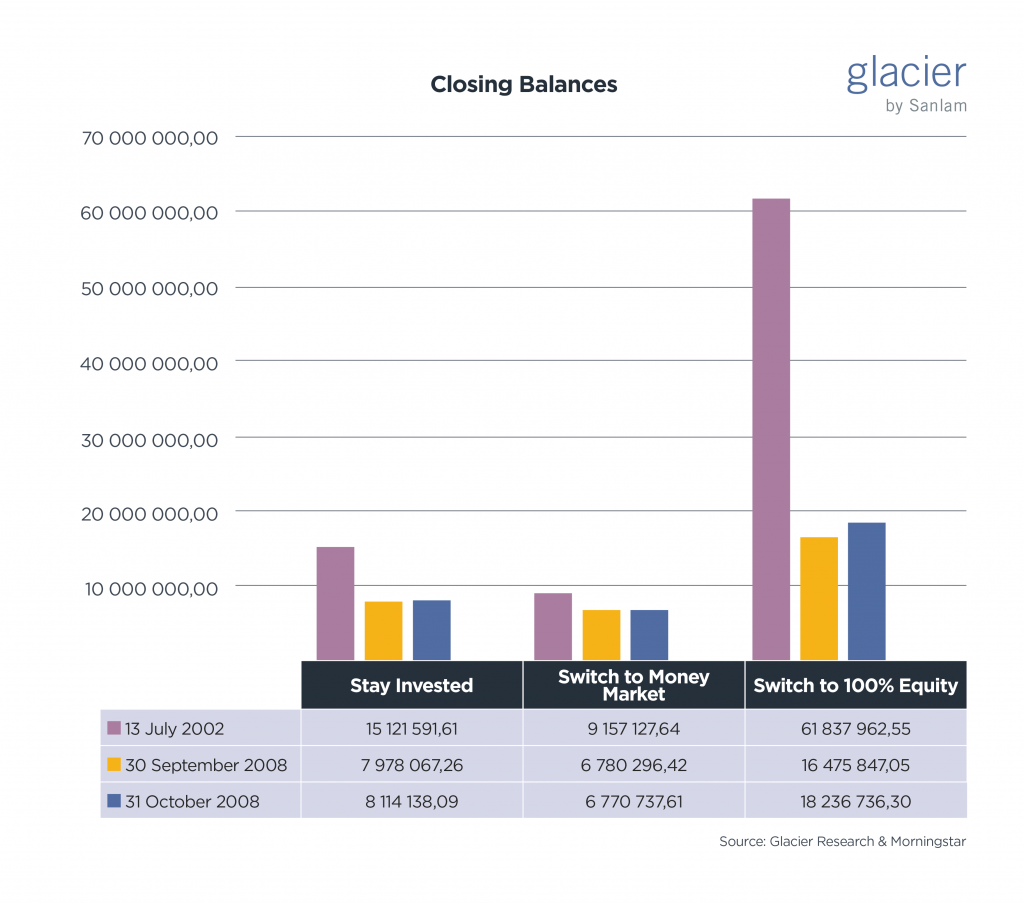

Since 2002, there were three months with significant negative monthly returns on the JSE: July 2002, September 2008 and October 2008, with returns of -13.44%, -13.24% and -11.65% respectively. What would have happened if an investor retired during each of those periods and disinvested from a medium equity fund, into a money market fund and stayed there, comforted by the fact that they no longer face any risk?

Let's assume they retire with a R5 million lump sum and withdraw at a sustainable rate of 4% per annum. Here's what their outcomes would have been, as at 29 February 2020:

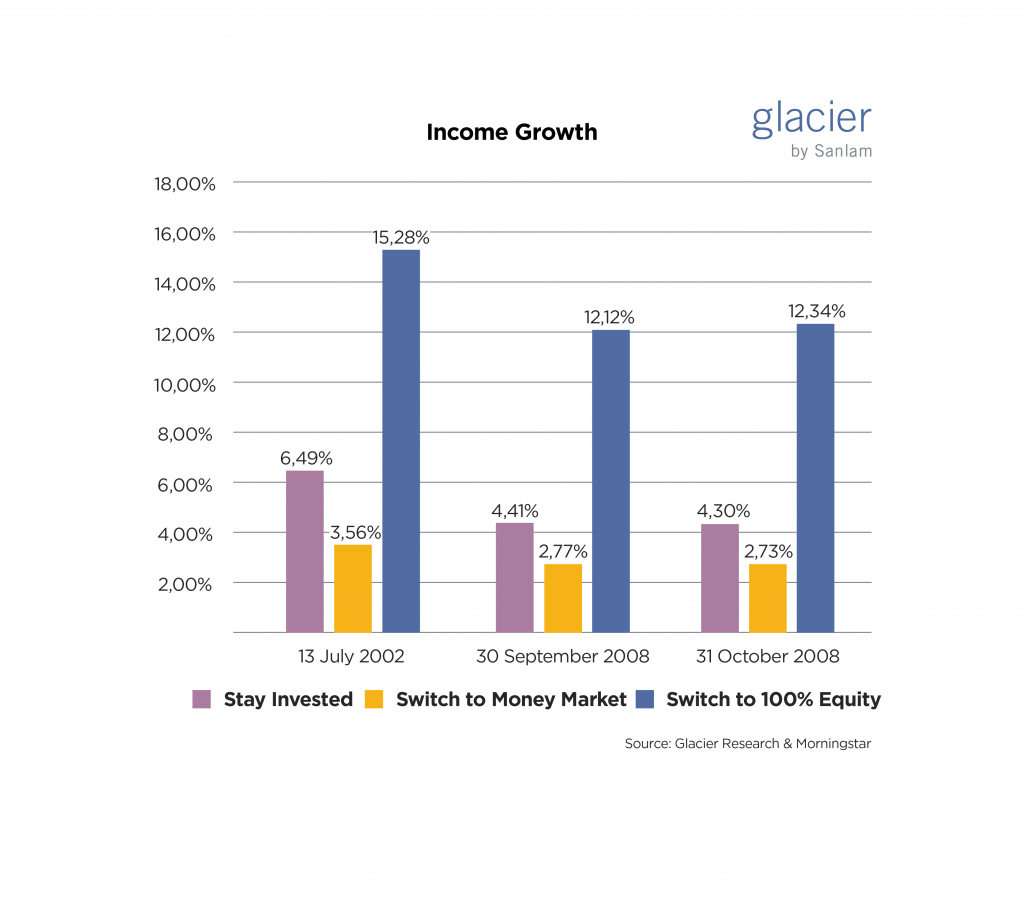

In each one of these periods, if you'd realised your losses and moved into a living annuity consisting of 100% cash, you would have been worse off. You would also have had lower monthly incomes as at today.

That's not all – staying invested outperforms a cash strategy

When it comes to income growth, staying invested during periods of downturn significantly outperforms a cash strategy over time, in terms of protecting your purchasing power into your retirement years.

Cash is not king

While it may be very tough, digressing from your current investment strategy into cash is not necessarily the best option. If you have taken a bit of a knock in your portfolio and you are currently in the process of retiring, try and see through the retirement event and continue with the same type of strategy you had pre-retirement. Naturally, it is best to work with a financial adviser to partner with you on this sometimes daunting journey.

Please consult with a financial adviser before you take any action regarding your savings and investments.