1 December 2022

Aspiring to a higher bottom line

Powerful forces for change are reshaping global business and society. As a new human-centred economy emerges, the financial services industry faces a pivotal point in its evolution. By embracing the values of a higher bottom line, forward-thinking firms can play a major role in restoring public trust and cultivating a just, inclusive, and sustainable world without having to make significant trade-offs between profit and positive social impact.

The bottom line is evolving

Profits and people. Growth and goodness. Success and sustainability. These coexisting forces will shape capitalism’s future. See what it means to be part of a higher bottom line.

A new perspective on the future of financial services

Explore our vision for a more human-centred future of financial services, the forces driving it, and the massive role financial services firms must adopt to not just prosper in it, but define it.

Key messages:

- Financial services companies have a unique opportunity to address major societal issues and make new markets, without a significant trade-off in growth or profits. This imperative puts firms in a position to impact almost every corner of the economy, proactively rebuild trust, and transform not just financial services, but also our collective human experience.

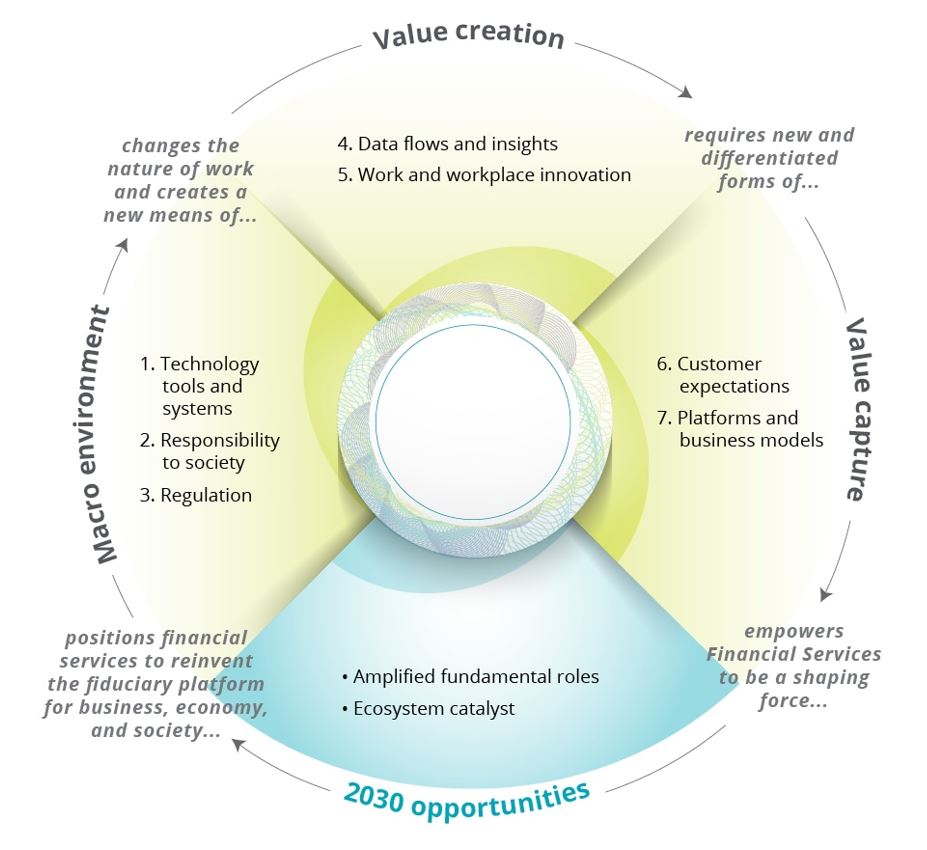

- Seven fundamental forces are working across the broader environment, as well as in the ways value is created and captured, to drive the industry towards 2030. Together, they will build upon each other to amplify the challenges and opportunities ahead. They will also provide industry leaders with the inspiration to act boldly – not just to ensure a prosperous future, but to help shape it.

- As advancing technology expands the quantity and quality of data sources, access to data flows is becoming a critical resource. Firms’ ability to meet customer expectations will hinge on their access to and insights from these ever-increasing flows of data, now the fifth (and perhaps fastest-changing) factor in production. Incumbents will need to reinvent their data strategies to stay competitive, striking a delicate balance between sharing data with alliances and maintaining stringent control over proprietary information.

- As customers become more sophisticated and services more commoditised and disintermediated, they will increasingly act as competitors to financial services players. Customers’ needs and wants will continue to evolve, while new platforms will increasingly allow them to service their own financial needs. Treating customers as stakeholders and delivering on their expectations (particularly those of high-value customers) will put firms in a better position to retain existing customers and attract underserved ones.

- The marketplace of 2030 will be unprecedentedly fluid and interdependent. It will be marked by the continued emergence of new disruptors such as FinTechs, digital giants, players from other industries, and even new entrants, each of which have distinct beliefs, strengths, and weaknesses. Innovative business models and alliance ecosystems will be required for incumbents to respond to these dynamics, create new revenue streams, and establish strategic advantage.

- Firms that move early to establish alliance ecosystems will secure significant advantages as they lock in the network effects that many-to-many value webs offer. When it comes to embedding financial services into other customer-centric businesses, firms have an opportunity to build a ‘financial layer’ in the technology stack; nonfinancial brands can then integrate that layer into their products to offer financial services to their customers and build new companies based on it.

Unprecedented disruption creates unique opportunities

Everything has changed. The COVID-19 pandemic has forced us to adapt quickly and prepare for new realities.

At the same time, the rebuilding of trust is a growing imperative, as the orthodox assumptions about the trade-offs between profit and service to our civic community steadily evaporate.

As we look towards the coming decade, financial services companies have a unique opportunity to address major societal issues without negatively affecting profits while proactively rebuilding trust in institutions. In other words, they can – and should – aspire to what can be called a ‘higher bottom line’.

Seven forces for change

As we look to a vision for the future of the US financial services industry in 2030, we believe that seven fundamental forces will drive transformational change and enable financial services firms to pursue a higher bottom line. These forces will, for the most part, accelerate and amplify the challenges and opportunities ahead, and provide inspiration to think differently and be bold – not just to ensure a more prosperous and inclusive human experience, but also to help shape the future of financial services.

We see these forces coalescing across three domains – the macro environment, value creation, and value capture – to create a new, human-centric forefront for the financial services industry.

Below, we explore these seven forces, what the future looks like, and what it means for financial services institutions.

1. Macro environment: technology, tools, and systems

Over the next decade, technology innovations such as 5G, machine learning, AI, blockchain, and smart algorithms will dramatically change how financial services firms operate and serve clients.

What does this mean for financial services?

Firms will rapidly adopt tools and systems that enable them to improve customer interfaces, aggregate massive amounts of data, enable more open collaboration and data-sharing, and understand and act upon that data.

New environmental and technology-related risks will create a changing landscape that financial services companies must navigate with great care as they move forward.

2. Macro environment: responsibility to society

Citizens are channelling increasing levels of expectation and responsibility towards the private sector. Companies’ ability to attract workers, raise capital, drive profits, manage risks, navigate regulatory scrutiny, and sustain profitability and growth will increasingly rely on their commitment to a net-positive social impact.

What does this mean for financial services?

Financial services firms are particularly well-suited to help the world address issues like climate change and advance financial inclusion. Firms that embrace opportunities to be socially responsible by tailoring their products and services to reflect the varied interests of a broad set of stakeholders will enjoy sustained advantage over those that do not.

3. Macro environment: regulation

Over the next decade, regulation will continue to play a critical role in shaping the financial services industry and its ability to respond to new technology. It will also enable new business models by supporting financial services experimentation and allowing for the adoption of foreign regulatory innovations, such as open banking.

What does this mean for financial services?

US regulators will move beyond granting customers greater control over their data by emphasising more understandable products and decision-making.

On the global stage, isolationism and protectionism will drive further regulatory divergence, with nations including the United States making efforts to protect their domestic economies despite potential cross-border impacts.

4. Value creation: data flows and insights

Financial institutions’ ability to design solutions and business models that meet customer expectations and enable integration across organisations will hinge on access to and insights from ever-increasing flows of data, now the fifth (and perhaps the fastest changing) factor of production.

What does this mean for financial services?

The more effective financial services companies are at harnessing data to generate offerings that put customers front and centre, the greater the advantage they’ll have in attracting, delighting, and retaining customers. How well financial services firms manage the data relationship with their customers will play an essential role in their ability to enhance consumers’ trust in their own firms and the industry as a whole.

5. Value creation: work and workplace innovation

In the coming decade, the US financial services industry is expected to face the greatest talent gap of any sector, with a deficit of 1.7 million workers. In addition to data science, AI, and human-centred design, deeply human skills will also be critical to understanding and effectively interacting with customers and other stakeholders in ways that are difficult to automate.

What does this mean for financial services?

The financial services industry has an integral role to play in supporting society through work, workforce, and workplace transitions. By developing new offerings catering to affected workers across the economy, financial services industry participants can serve as a model for other industries struggling to manage broader workforce disruption.

6. Value capture: customer expectations

Over the next decade, customer needs, wants, and behaviours will continue to evolve, with meaningful differences across segments. Retail and institutional customers alike will expect financial institutions to cater to them in more specific and amplified ways. Delivering on the expectations of high-value customers will be even more important, not just for profitability, but also to help support a broader social mission.

What does this mean for financial services?

Delivering against an ‘average customer’ will not sustain profits, let alone boost them. New capabilities, including technology and an augmented workforce, will empower financial services players to perform their fundamental roles in ways that are more direct, personalised, and socially responsible. At the same time, these new capabilities can help firms serve the needs of individuals that have operated outside the financial system in a way that makes economic sense for both sides.

7. Value capture: platforms and business models

The marketplace of 2030 will be unprecedentedly fluid and interdependent, marked by ever-changing customers with ever-changing needs, expansive data flows, and mass shifts in the workforce. Innovative business models and alliance ecosystems will be required to respond to these imperatives, create new revenue streams, and establish strategic advantage.

What does this mean for financial services?

Ultimately, what could emerge are consolidated ‘one-stop shop’ platforms for offering and accessing various financial products and services, ranging from student and business loans to home mortgages, insurance coverage, retirement plans, and investment vehicles, with new revenue models for customer use and supplier access alike. Firms that move early to establish alliance ecosystems will secure significant advantages as they lock in the network effects that many-to-many value webs offer.

New roles for a new future of financial services

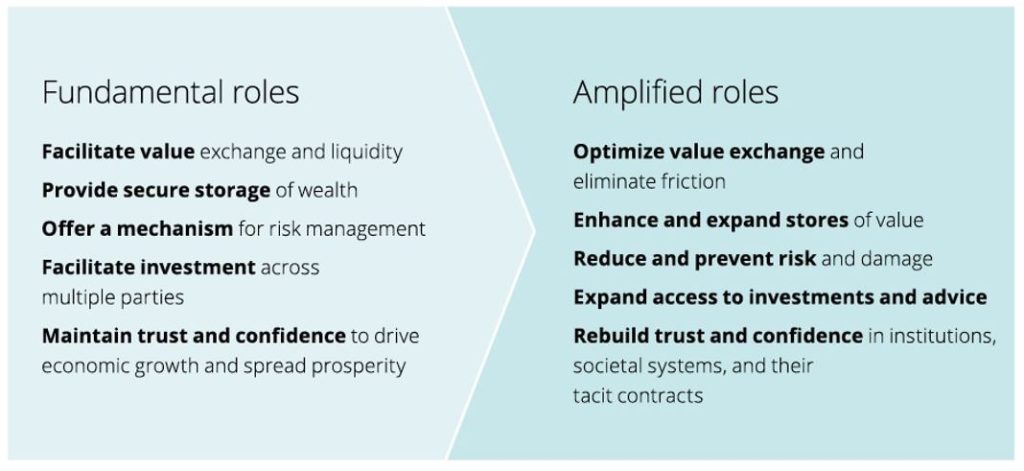

Financial services organisations have historically played a number of fundamental roles in enabling and shaping the modern world.

The seven forces for change present financial services companies with the opportunity to perform these roles in more direct, personalised, and socially responsible ways. Moreover, they can amplify their roles to catalyse and accelerate the human-centric ecosystems reshaping the economy, in addition to addressing the many societal challenges that urgently demand new solutions.

Meanwhile, new actors are emerging as ecosystem catalysts with an interest in participating in the industry. These disruptors – FinTechs, digital giants expanding into financial services, players from other industries, and even new entrants – bring different strengths, weaknesses, opportunities, and risks to the table.

Below, we look at how these actors must adapt to amplify, catalyse, and connect their roles to succeed in the future of financial services and create a higher bottom line.

Incumbents: evolve for greater impact

There are a great many advantages to being an incumbent, including robust existing customer bases, brand recognition and trust, expansive infrastructure, and regulatory and compliance expertise. Incumbents can, however, be hindered by dated technology, siloed operations, data usage and management challenges, and cultural reluctance to change. Unless they are willing to evolve at the same rapid pace as the transformation taking place, disruptors such as digital giants, FinTechs, start-ups, and even other industries will scale faster.

Disruptors: protect and gain expertise

Digital giants, FinTechs, and non-industry players are increasingly expanding into financial services and disrupting the status quo.

Largely free of burdens, digital giants benefit from access to world-class talent, deep war chests and investment flexibility, large customer bases with high stickiness and network effects, and data leadership. FinTechs share many of the same advantages as digital giants and, thanks to their mastery of customer experience and data, are poised to own many of the financial service customer interfaces for the future. Given their independent status, non-industry and novel entities –like independent data utilities, tech companies, and business service firms – could be viewed as honest brokers by private-sector players and therefore, better positioned to establish trust.

Embrace the role of competitor

By 2030, the customer will own the customer. New business models, interfaces, and regulations are already enabling customers to better control access to their data and achieve greater clout in their interactions with market actors. As customers become more sophisticated and services more commoditised and disintermediated, customers will increasingly act as competitors to financial services players, leveraging new platforms to service their own financial needs and rapidly scaling the next generation of peer-to-peer insurance and lending models.

Leading the way to higher ground and a higher bottom line

With our society at a crossroads, financial services firms are in a position to influence almost every corner of the economy and play a vital role in transforming it. Their ability to seize the emerging opportunities our changing world presents can have an enormous impact both on the industry and our collective human experience in the decade to come and beyond. Not everything will go smoothly—firms will need to prepare for the inevitable shocks that arise over the next ten years. However, if they embody the principles of a higher bottom line – placing people on par with profits, and actions over intent – financial services can lead the way to a more inclusive, educated, sustainable, collaborative, and profitable future.

This article first appeared on deloitte.com.