26 January 2024

The world has become increasingly complex and sophisticated, with technology amplifying access to information and news. Think about it, a simple tweet from Elon Musk can send shock waves through the stock market, and we often overlook the power of understanding the basics. Teneille Troskie, junior research and investment analyst at Glacier Research, examines what moves markets as often as they do, and how to invest with confidence, amid volatility.

The year that was.

2023 was marked by sticky inflation, robust monetary tightening, geopolitical tensions, and lingering recession concerns. However, global, and local markets remained resilient, exceeding expectations across various asset classes. As we navigate the uncertainties of 2024, it's crucial to reflect on fundamental factors often overlooked amid market noise. In his latest book, "Same as Ever," Morgan Housel sheds light on a valuable perspective. Instead of obsessing over the economy's trajectory in a decade, there's more wisdom in asking what will remain the same a decade or even a hundred years from now.

In the spirit of Benjamin Franklin's wisdom — "An investment in knowledge pays the best interest" — this article delves into fundamental factors influencing asset class performances.

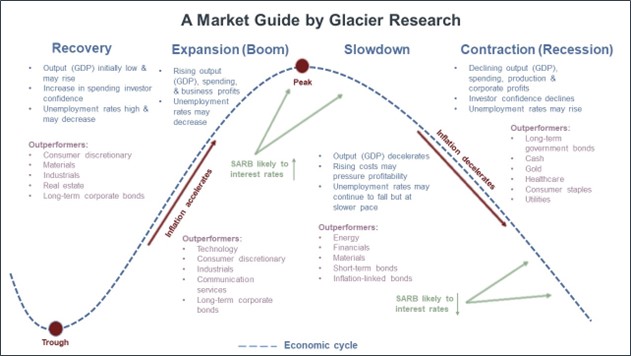

Different asset classes exhibit distinct behaviours during economic cycles, prompting investors to adapt their portfolios. This adaptability involves making assumptions about individual asset performances in different economic stages, with markets often deemed "forward-looking" by at least six months.

Let us start with understanding the economic cycle.

The economy and financial markets, while connected, follow different rhythms. The economic cycle, characterised by alternating phases of "expansion" and "contraction," depicts the rise and fall in goods and services production. But is it as straightforward as it seems? Far from it. Now, let's add the complex note of inflation to the melody…

How does inflation impact interest rates and asset prices?

Interwoven in the economic cycle is inflation, signifying rising price levels. The challenge is to control inflation, as rampant inflation can devalue a nation's currency. The South African Reserve Bank (SARB) aims for a targeted inflation rate between 3-6%, navigating a delicate balance. The SARB's monetary strategy involves hiking interest rates in response to excessive inflation and cutting them during periods of timidity. This interest rate dance orchestrates asset price movements.

When interest rates rise, the investor's script takes a turn. Short-dated bonds steal the spotlight, offering stability amid the rate hike. Equities face challenges, with potential derating threatening a risk-off environment. Investors seek refuge in fixed income and alternative . Housing affordability takes a hit, slowing the property market's rhythm, leading to hesitation among buyers and struggles for sellers. Meanwhile, cash and money market funds become more attractive.

On the flip side, declining interest rates bring lower-yield, longer-duration bonds to the forefront, promising stability and potential capital appreciation. The stock market benefits from lower borrowing costs, and real estate becomes more appealing. Cash loses allure as savings accounts and money market funds offer relatively meagre yields.

The figure below delves into the interplay of the economic cycle and how asset classes move through the cycle:

Recovery

Post-recession, rising GDP boosts investor confidence and consumer spending, propelling the stock market into a bull phase. Equities and cyclical industries thrive, while initial moderate inflation benefits long-dated corporate bonds, while holding cash becomes less attractive as investors seek better returns.

Expansion

Flourishing economic activity sees equities outperforming, with sectors like technology, communication services, consumer discretionary, industrials, and materials thriving. Commercial real estate may benefit from growing business activities. Long dated corporate bonds may excel, backed by improved economic conditions.

Slowdown

Economic activity peaks, prompting interest rate hikes. Sectors like financials may benefit. The energy and materials sectors may continue their growth amid concerns of potential real estate overvaluation. Short-dated and inflation-linked bonds tend to outperform, providing protection against inflation.

Recession

Economic decline leads to equity struggles, with non-cyclical sectors showing resilience. Risk-averse investors favour safe like cash, gold, and long-dated government bonds.

How to be a winner.

Fund managers need to have a view of economic cycles to anticipate market fluctuations and position their portfolios. Dedicated to providing insights for informed investment decisions, the Glacier Research team collates the Glacier Bull and Bear Report, summarizing eight fund managers' expectations for different asset classes, market performance, currency levels, and global trends over a 12-month period. It's a guide to understanding where these managers see us in the market cycles and how they're strategically managing portfolios. To be a winner, choosing the right fund manager is essential, considering their unique perspectives, philosophies, and styles. The Glacier Research Shopping List features diverse fund managers, each with distinct philosophies and styles.