By Richard Wiseman - Client Portfolio Manager, Fundamental Equity team at Goldman Sachs Asset Management

“Nothing will benefit human health and increase the chances for survival of life on Earth as much as the evolution to a vegetarian diet.” – Albert Einstein

Vegetable plot

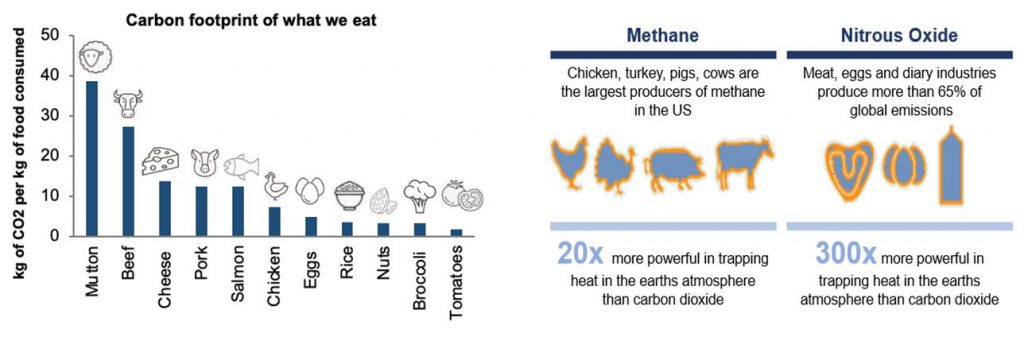

Although only sketchily recorded, vegetarianism appears to have arisen in ancient times as a lifestyle choice on ethical grounds – the abhorrence of doing harm to animals informing many religious and secular viewpoints. Concern for animal welfare remained the main motivation for vegetarianism through to modern times until, more recently, awareness of the detrimental environmental impact of livestock farming reinforced the argument.

Left graph - Miss-ocean.com

Right Image - Worldpress.com

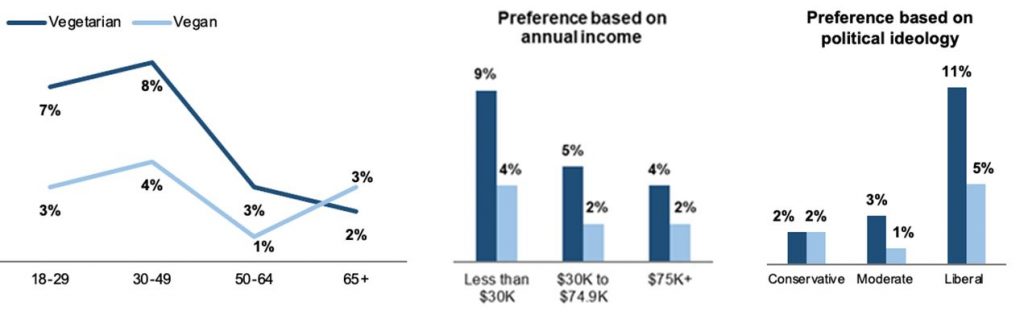

Younger generations – with a greater concern for environmental issues, better education and information than previous generations, and more choice as consumers than their parents – represent the largest cohort of vegetarians and vegans. As seen in the graph below, data from the US suggests that a greater concern for health and well-being engendered by the COVID-19 pandemic, as well as the focus it has placed on a ‘green recovery,’ may accelerate this trend.

Question: Do you consider yourself to be a vegetarian or a vegan?

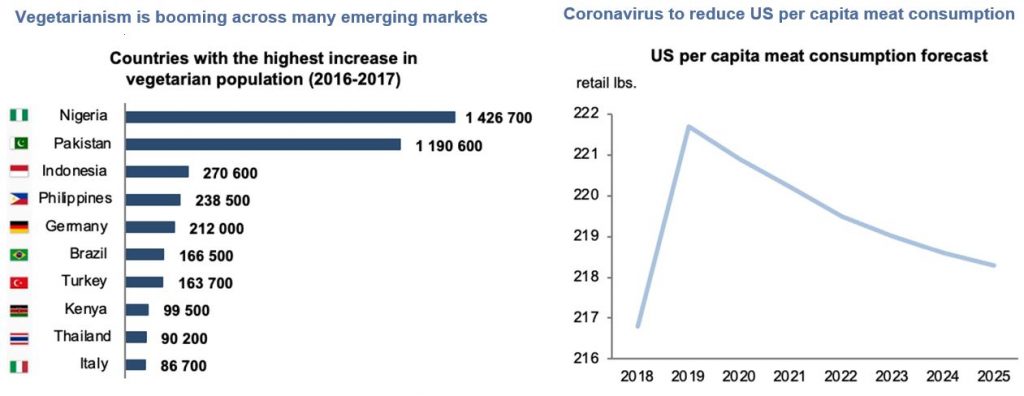

Data prior to the 2020 pandemic also suggests that, despite the increasing demand for meat as emerging nations develop, the growth of vegetarianism is a global phenomenon.

Left graph - Statista, Euromonitor International

Right graph - CBS Insights, University of Missouri’s Baseline Update for US Agricultural Markets

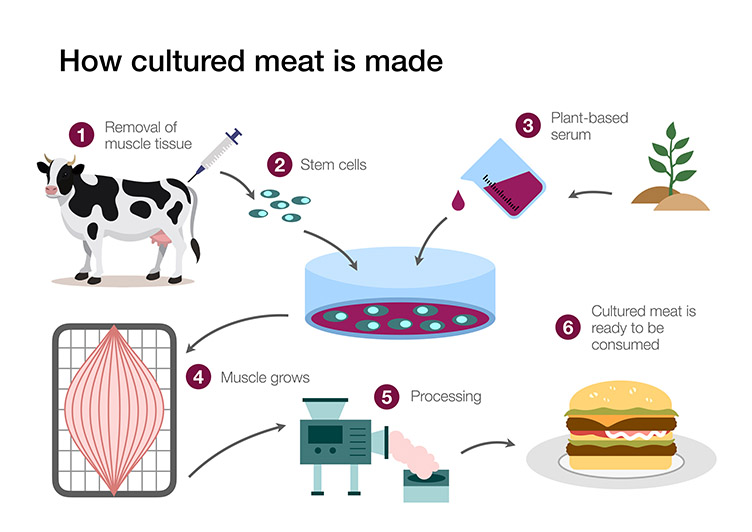

But what if meat could be produced without the agency of the slaughterhouse, and with negligible environmental impact? In fact, it can be.

Culture shock

Plant-based alternatives to meat won’t satisfy everyone; equally, while the environmental footprint of a non-meat product is compelling, the nutritional value is more questionable. But there is another alternative to farmed meat in development, which both eliminates the environmental impact and guarantees the same nutritional experience: meat grown synthetically in cell-culture, referred to as cultivated, or cultured meat.

Spawned from advances in biotechnology, the cultured meat industry is in its embryonic, pre-commercialisation phase. A complex process which may be many years away from price-competitiveness with standard foods, investment and innovation is required to drive down the production cost of cell-cultured meat. Referencing the pricing history of the semi-conductor and genomics industries (cf Moore’s Law), Jim Mellon – the serial entrepreneur, investor and one of the most vocal advocates of the New Agrarian Revolution – has termed the requirement to scale up cultured meat production to drive down costs as Moo’s Law*.

*Moo’s Law – An Investor’s Guide to the new Agrarian Revolution’ by Jim Mellon 2020

Drawing on tissue engineering techniques traditionally used in regenerative medicine, the production of cultured meat is a complex process, requiring the extraction of the living cells to be replicated in a bioreactor, a growth serum to facilitate development and proliferation and, depending on the required ‘look’ of the resulting biomass, a ‘scaffold’ or matrix to promote differentiation into structured tissue.

The first patty grown directly from cells was showcased in 2013 by Mark Post of Maastricht University and which became the basis of Dutch company Mosa Meat. The estimated cost of this burger was $300 000, but Mosa Meat believes that this cost has already fallen to a few hundred dollars, providing some validation of Moo’s Law.

The commercial breakthrough for cultured meat came in December 2020. The Singapore Food Agency’s approval of Eat Just’s ‘chicken bites’ marked the first time a cultured meat product passed the safety review of a food regulator. This chicken nugget is now available at Singapore restaurant 1880, retailing at around $17 for a set meal.

A cultural future

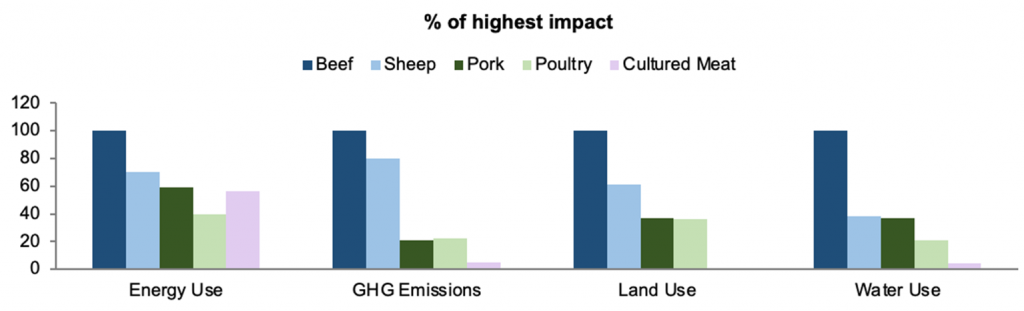

The environmental case for cultured meat is compelling. Although it remains an energy-intensive process, the emission profile and resource demand of producing cultured meat is a fraction of traditional meat farming (see diagram). Moreover, if the process is also applied to the production of fish meat, the benefits for the planet could be considerably greater still.

The planet needs meat substitutes. Despite the growth of vegetarianism described above, meat consumption will rise as the global population increases, driven by the rise of the middle classes in emerging nations. The Food and Agriculture Organisation of the United Nations (FAO) estimates that the demand for meat is going to increase by more than two-thirds over the next 40 years, and that current production methods are not sustainable. If alternatives are not developed and adopted, the vicious cycle of environmental damage caused by more livestock farming – the release of methane and nitrous oxide, deforestation to create grazing land and the demand for water and other resources – could accelerate past the point of no return.

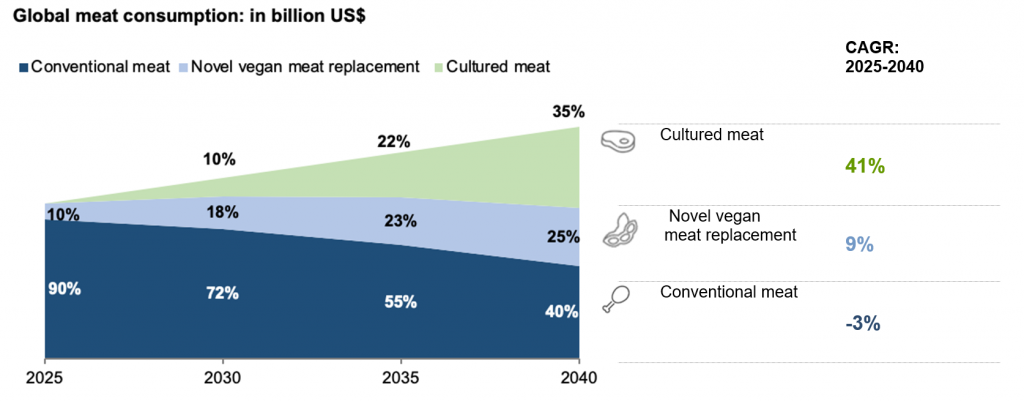

Cultured meat is the real thing, produced differently. Plant-based alternatives are not. For this reason, cultured meat is likely to satisfy the growing demand for meat from a growing global population once it achieves commercial viability and price competitiveness. On this basis, the market for cultured meat is forecast to grow dramatically over the next two decades. Therein lies the potential investment opportunity, with the added ingredient that the barrier to entry in the cultured meat market will be considerably higher than for plant-based foods, due to the complexity of the production process.

There are many unanswered questions concerning this embryonic industry. Some of the more intriguing questions concern the potential end market: for vegetarians who avoid meat on the grounds of animal welfare, for instance, would cultured meat be acceptable? In research conducted by Surveygoo on behalf of Ingredient Communications in 2018, 29% of US and UK consumers said that they would eat cultured meat, with 40% of Americans happy to do so and 60% of vegans prepared to give it a try.

The experience of the recent past is that the future arrives much quicker than we expect. Innovation in food is delivering critically important solutions for the sustainability of the planet and future generations and, as a result, it is likely that current scepticism around cultured food will be confounded sooner than expected as well. Moo’s Law will eventually provide the opportunity for investors to benefit from this innovation but, as always, it will be important to be ahead of the herd.