12 April 2024

“Personal debt – particularly the levels that people in South Africa have accumulated – is destroying our hopes of a confident financial future for ourselves and our children”. So says Sherwin Govender, business development manager at Glacier by Sanlam. “It’s the elephant in the room that we rarely talk about. Unfortunately, the elephant grows larger every year and has been taking over the room!” He unpacks what out-of-control debt looks like and means for us on our financial journeys.

What’s wealth exactly, and why is debt often a problem?

“In order for us to appreciate the risks attached to debt (and specifically, the problem of over-exposure to credit), we need to understand what wealth is”, says Sherwin. “In the simplest terms, wealth is what you own; the value of all of the money you have (your ), minus the money that you owe (liabilities).”

As an exercise, look at the total value of your accessible , such as investment property, tax-free savings accounts, or fixed deposits. Subtract the total value of all of your debt such as your mortgage bond and the outstanding balance on your car and credit card, from your accessible asset value. If the outcome is positive, then congratulations, you have disposable funds that you can use to grow your wealth.

| Why are retirement savings not counted as an accessible asset? It’s very simple: your retirement savings are there to pay you an income when you retire. Every rand that you use before you retire, is a rand plus that you will not have, when you really need it in retirement. |

The sum to establish your wealth is simple:

The size of the debt problem

In September 2023, private debt in South Africa accounted for 67.20% of its nominal GDP,[1] compared with a ratio of 66.88 % in the previous quarter. This means that, currently, more than two-thirds of our income is likely servicing our debt. Given this proportion, it is realistic to say that many South Africans are paying for food, transport, and children’s school fees using credit.

“This is a great worry”, says Sherwin. “When you use credit to live, that’s a financial red flag. Just as you will become very ill if you don’t manage your diabetes, not managing your debt means ill health, financially speaking.”

In the scenario of over-exposure to credit, it’s impossible to build wealth that can be used for the deposit on a new home, quality education for your children, travel, or your retirement.

[1] The Organisation for Economic Co-operation and Development (OECD)

Gross domestic product (GDP) is the standard measure of the value created through the production of goods and services in a country during a certain period. As such, it also measures the income earned from that production, or the total amount spent on final goods and services (less imports).

Let’s get to know Pam and do some math for her.

Pam wants to upgrade her car. It’s an entry-level vehicle and was new when her father bought it for her in 2017. It cost R100 000 then and now it’s worth R80 000. There is nothing mechanically wrong with her car. She services it regularly, which she pays in cash as the service plan has run out. The car is fuel efficient and she spends about R2500 per month to run her vehicle.

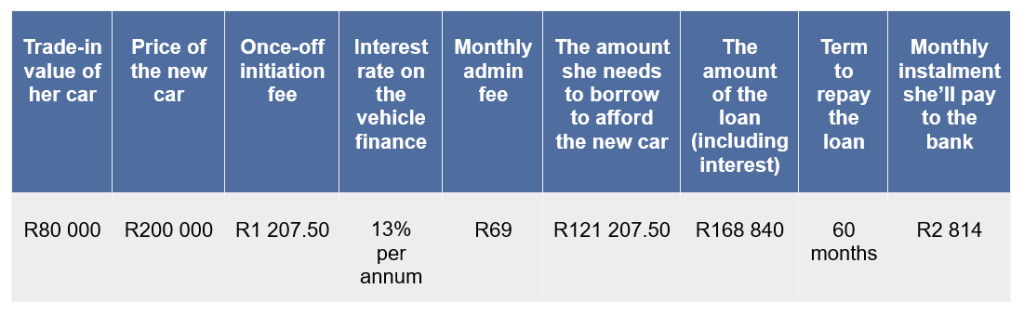

She has her eye on the 2024 model of her vehicle, which will cost R200 000. She plans to trade in her car but will need vehicle finance to be able to afford the balance on the price of the new car.

The table below illustrates what she will need to borrow from the bank and the repayment plan.

Pam has re-organised her budget to be able to afford repaying the debt on the new vehicle.

What if she invested the money instead of buying a new car?

Let’s imagine Pam decides to keep her current vehicle and invests the monthly instalment of R2 814 in a tax-free savings account instead. After five years, she will have accumulated R206 764[1] which she could use to buy a vehicle (a depreciating asset ) without incurring debt, or she could use it as a deposit on a house (an asset that grows in value). This investment will have the potential to create wealth whereas the car loses value every day.

[1] Calculated based on R2 814 per month invested for 60 months with an assumed growth rate of 8% per annum, applied monthly.

What to know about debt

- Know the difference between healthy vs unhealthy debt. It’s important to know the difference between healthy and unhealthy debt. It is rare that we can go through life without taking on some debt, and not all debt is bad. Your mortgage bond on your house is necessary and once paid in full, becomes an asset, with no liability attached to it, which would likely have increased in value. Debt on a vehicle is often unhealthy or unnecessary debt. Remember, your creditor owns your car until the very last finance payment, and by then this asset has depreciated in value. Using your credit card to fund an expensive night-out does not provide an asset and is unhealthy debt. Rather fund the good times with savings.

- Acknowledge your debt problem. If you have multiple credit facilities (such as loans, credit cards or overdrafts) and you are struggling to repay your debt, you have a debt problem. It will not go away – in fact, it will get worse if you don’t deal with it by executing a debt repayment plan. Debt management starts with being brutally honest and having a clear picture of how you spend your money and the pitfalls that are preventing you from embracing a healthier financial future. The more disposable income you have (that’s the remaining money you have left over from your income after all your bills have been paid), the more you will have available to save and invest. That’s real wealth.

- Destroy the villain in your wealth story. Most of us want to be wealthy. While debt is the villain in your wealth story, savings is the hero. If you can save 10% of your income from your first pay cheque and stay away from unhealthy debt, you are certain to become wealthy. Even if you feel it’s too late for you, instil savings habits in your kids. That way the next generation can be financially healthier and wealthier.

- Get help. An appropriately authorised financial adviser will consider your financial circumstances and put together a financial plan. Typically, such a plan includes a budget, an action plan to take charge of and manage your debt and sets you on the path to building wealth. If your debts are causing you stress and you feel overwhelmed, consider enlisting the help of a debt counsellor to help design a debt repayment plan.