27 September 2023

By Patrick Mathabeni, Senior Research and Investment Analyst at Glacier by Sanlam

Artificial intelligence (AI) has had and will continue to have a profound impact on all facets of our society. The 21st century has been dubbed the digital era, or the fourth industrial revolution, and AI is the pinnacle of this time.

AI has made enormous strides

Recently, we’ve seen euphoria around a new type of AI technology called generative AI, whose purpose it is to generate new information from existing data, in a manner that has given people the ability to elevate output by combining human with machine with very little friction. Open AI ChatGPT is one example, having gained incredible popularity in a short space of time. It is the fastest adopted technology in history, hitting 100 million users in a just five days of its launch.

AI solves challenges in the investment industry

The asset management industry has historically been dealing with the following challenges:

- Human bias and emotions

- Huge volumes of existing data

- Rapid growth of new data and increased complexity

- Under-resourced teams

- Keyman risk

- Inconsistent application of the investment process

- High active fees

- Time lag between the investment idea and implementation

These challenges have had a profound impact on alpha generation. While modern investment theory is underpinned by an assumption that market participants are rational, there’s evidence to prove the contrary. Even the most experienced portfolio manager can be given to biases and inclinations that may be value-destructive at times. The use of AI, therefore, seeks to solve this challenge by averting human bias and emotions that may be inconsistent with the application of the investment process.

Humans and machines

Conversations and debates about AI have often been polarising, resulting in a “human vs machine” tension which has led some to be sceptical of AI, based on the idea of that machines will take over humans. For us at Glacier, we hold a firm view that human and machine can combine to create better outcomes and efficiencies for society. Essentially, it’s not “human vs machine” but rather “human and machine”.

While the Glacier AI Fund of Funds resolves challenges encountered by humans, there is a role that humans play, without interfering with the running of the AI engine. The construction of investment mandates, asset allocation, and the choice of underlying instruments all involve the human touch, but without interfering or second-guessing the AI engine.

The Glacier AI Flexible Fund of Funds

The Glacier AI Flexible Fund of Funds recognises that financial markets are complex, noisy, non-linear and non-stationary environments replete with constant change and evolution. Therefore, it continuously applies an unbiased investment philosophy in a timely manner, by deploying an AI engine that is:

- Self-learning – it learns autonomously from data and is not pre-programmed.

- Adaptive to new environments – it modifies its settings as markets change and it has no static rules.

- Predictive – it predicts asset price behaviour and capital loss risk and is not reactive.

The Fund has turned five

The Fund is the first of its kind on the South African Collective Investment Schemes (CIS) landscape, having fully adopted artificial intelligence (AI) for active management of underlying exchange-traded funds (ETFs) and being managed by an AI engine, without any human interference. The Fund has brought novelty and uniqueness to the South African asset management industry.

Portfolio construction benefits

The Fund continues to offer clients a differentiated investment strategy that is unique and complementary to traditional fund strategies. Here’s what to know about the Fund:

- It’s fully run by an AI engine.

- It trades weekly onshore and bi-weekly offshore.

- It has no human interference.

- It actively allocates between nine highly liquid ETFs (made up of local and offshore ETFs) and a money market fund, resulting in great diversification benefits.

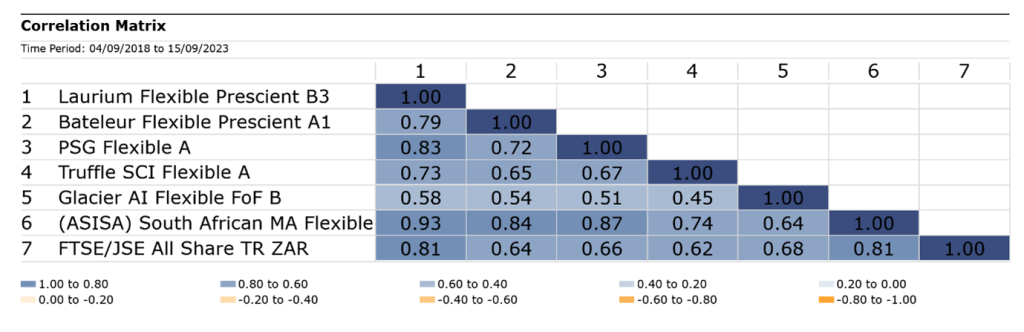

Since inception, the Fund has shown the lowest correlation relative to the Multi-Asset Flexible category average, the JSE All Share Index and Glacier Shopping List funds in the Multi Asset Flexible category.

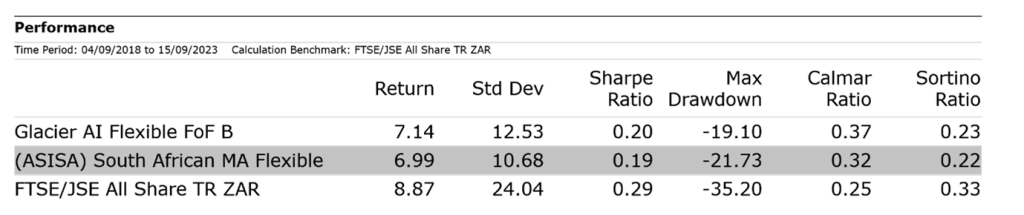

Since inception, the Fund has outperformed the Multi Asset Flexible category average, but at relatively higher volatility. However, this volatility has been well-compensated for as demonstrated by risk-adjusted return metrics (i.e., Sharpe and Sortino ratios) that are higher than the Multi Asset Flexible category. The Fund has delivered relatively lower drawdowns than the Multi Asset Flexible category average, accompanied by a higher Calmar ratio (which measures the return per unit of drawdown).

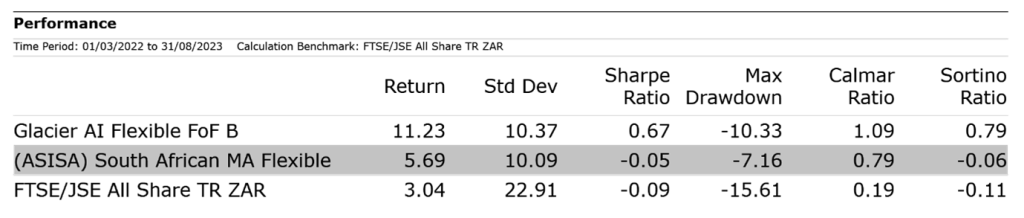

Recently, since early 2022, the Fund has been a stellar performer, significantly outperforming the Multi Asset Flexible category average and the JSE All Share, both a return and a risk-adjusted return basis.