6 July 2023

“We cannot solve problems of the future with the solutions of the past” Albert Einstein

Patrick Mathabeni, senior research and investment analyst at Glacier Research, unpacks the impact that artificial intelligence (AI) has on our world and how Glacier is using fascinating technology for future-fit investing, with very positive outcomes.

AI is growing in scope and impact

A massive revolutionary trend is upon us – generative Artificial Intelligence (AI). In their paper on “Generative AI”, Feuerriegel et al (2023) describe generative AI as computational techniques that have enormous capacity and capabilities of generating new, meaningful content such as text, images, or audio from the data they are trained on. Unlike other forms of AI which are used to analyse data, generative AI has a specific purpose of creating new information. Its recent popularity is on the back of Open AI’s ChatGPT programme which has seen the fastest adoption in history, marking 100 million users in the first five days of its launch.

To put it into context, it took Facebook 10 months to reach 100 million users and it took Netflix 3.5 years to reach 100 million users. ChatGPT’s ability to perform human tasks intelligently remains fascinating – it can write exams, essays, dissertations, and have conversations, just to name a few.

AI adoption is undoubtedly on an upward trend and is revolutionising many aspects and spheres of society – one of them being investments and financial markets. After NVIDIA announced its new AI-focused chip, the chipmaker saw an exponential rise in its share price which pushed its market value to over $1 trillion, higher than the market value of Facebook and Tesla. This has materially contributed to AI’s current buzz in the global financial marketplace. Interestingly, at Glacier, we foresaw this trend five years ago, when we launched South Africa’s first AI-run flexible fund of funds, and the SA industry’s second fully AI-run CIS fund that has no human interference.

Glacier AI Flexible Fund of Funds investment process

While many investment managers make use of AI (particularly those running quant-type or systematic strategies), very few managers have strategies that are run by an AI without any human interference. The Glacier AI Flexible Fund of Funds is one such strategy which recognises that financial markets are complex, noisy, non-linear and non-stationary environments replete with constant change and evolution. The Fund’s AI engine is, therefore, adaptative - a fundamental feature to survival given that past events may not necessarily be indicative of future events.

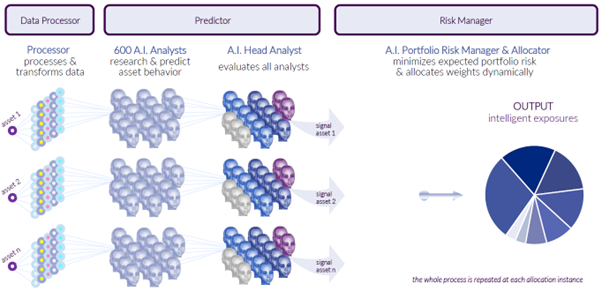

The Fund uses an AI engine called the Predictive Investment Engine (PIE) which is an integrated AI portfolio management solution that recreates and automates the entire portfolio management process – from idea generation to security selection, portfolio construction, and risk management. It incorporates a wide range of machine learning technologies. In the context of the Glacier AI Fund of Funds, this would entail three broad steps as displayed below:

As depicted in the diagram, there are three steps to the process as outlined below:

- Data processing

The raw data for each portfolio constituent is processed and in multiple ways to become more readable, interpretable and useable by the “AI analysts”. For e.g. extracting Nasdaq 100’s price data and making sense of it.

- Analysis

600 AI analysts analyse the transformed data (i.e., all 600 analysts analyse each instrument independently) using a variety of machine learning methods to predict the future price behaviour of each instrument in the portfolio (i.e. each constituent ETF in the Glacier AI Flexible FoF). Each of these 600 analysts are self-learning (learning directly from the data), adaptive (self-adjusts based on input variables, rules, parameters, and market memory) and predictive (generates predictions about behaviour of the instrument until next prediction point). This process dynamically takes places under the supervision of the “AI head analyst” whose purpose it is to evaluate the “600 AI analysts”.

- Risk management and portfolio construction

The AI portfolio risk manager dynamically allocates weights on the underlying portfolio instruments, driven by various relationships of instruments, market behaviour, and the need to minimise the portfolio risk of capital loss while seeking to meet the return objective.

How has the Glacier AI Flexible Fund of Funds performed?

The Fund primarily trades exchange-traded funds (ETFs) and does this actively every week in offshore ETFs and every two weeks in domestic ETFs, due to liquidity constraints, and based on the aforementioned iterative process. The Fund is currently made up of 10 ETFs – three local and seven offshore, across all asset classes and to which it dynamically allocates.

Performance has been nothing short of stellar and impressive year-to-date and in the last trailing year. The Fund is currently ranked no. 1 in the SA Multi Asset Flexible category, delivering a whopping return of 21.53% year-to-date and 22.14% in the last trailing year, comfortably outperforming the ASISA Multi Asset Flexible category and the JSE/FTSE All Share Index at lower volatility and drawdowns than both, the SA Multi Asset Flexible Category Average and the JSE/FTSE All Share Index.

While the Fund has seen notable underperformance in 2022 (which brought down its medium-term static returns), it has comfortably made up for this in its recent excellent performance.

AI offers diversification in your clients’ portfolios

The Glacier AI Flexible Fund of Funds continues to offer clients a differentiated investment strategy that is unique and complementary to traditional fund strategies, and results in great diversification benefits. There are three key pillars to the Fund:

- It is fully AI-run by an engine that has been running live investments since 2015.

- It averts keyman risk, human bias and emotion.

- It employs an engine that is data-driven and discovers knowledge autonomously, adapts to evolving market conditions and has exponential analytical and predictive capacity.