6 May 2024

by Connor McCann, Research and Investment Analyst at Glacier by Sanlam

Global markets have faced heightened levels of uncertainty and volatility over the past few years. This is evident whether looking at the rapid COVID-related decline in 2020, the swift recovery thereafter, ongoing global conflicts or the resulting high inflation and rate-hiking cycle. In the face of this uncertainty, human emotions can play havoc on portfolio construction and performance.

While experienced and disciplined active portfolio managers are able to reduce certain emotional biases, these still tend to be evident in portfolios in some form or another. Artificial intelligence (AI) eliminates these biases and emotions when allocating and constructing portfolios. The Glacier AI Flexible Fund of Funds (FoF) uses its flexibility to take advantage of short-term opportunities to deliver over time.

What to know about the Glacier AI investment process

- Glacier’s AI engine is adaptive, meaning it is self-learning and changes as market conditions change.

- It manages the entire portfolio management process, including idea generation, security selection, portfolio construction and risk management within the broader constraints of the mandates and regulatory limits.

- It uses 600 independent AI analysts to research and predict asset behaviour, with the recommendations then evaluated by a head AI analyst.

How AI constructs the portfolio

Rather than select specific securities within each asset class, the Glacier AI Flexible FoF offers diversified local and global exposures by investing in a range of exchange-traded funds (ETFs). These include ETFs for:

- SA equity

- SA bonds

- US and global equity

- US bonds

- Global developed market property

The Fund maintains diversified exposure to local and offshore exposures to limit specific geographical risks. In addition, the AI engine actively manages allocations to ETFs on a weekly basis for offshore holdings and every two weeks for local holdings (due to liquidity constraints), which allows for the advantage of shorter-term trends within markets and protecting the portfolios where necessary.

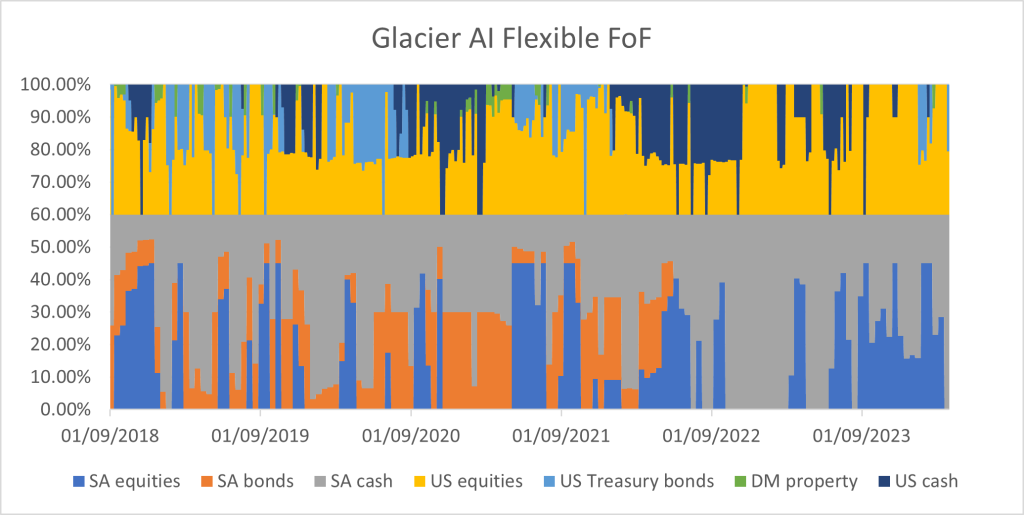

The graph below shows the asset allocations of the Fund since inception, which highlights the extent of changing asset class allocations over time.

As depicted, the Fund has tended to maintain a more consistent exposure to US equities over time, as compared to SA equities, where returns have tended to be more predictable. In addition, cash (particularly SA cash) has been used to limit volatility when larger tactical shifts have been made to generally riskier asset classes, like equities or property.

Strong performances of the Fund

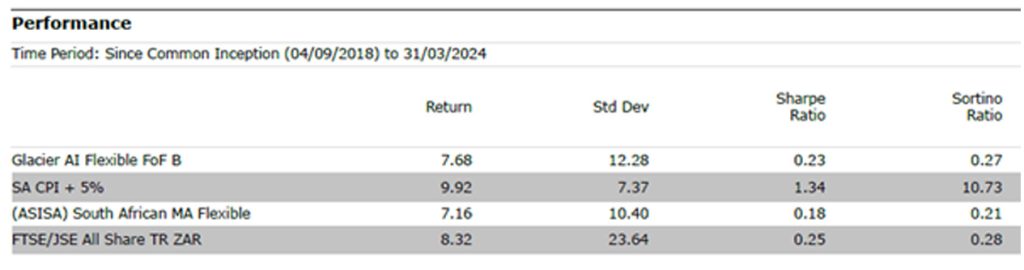

The performance of the Fund, together with its benchmark (CPI + 5%), the relevant ASISA category wherein the Fund falls, as well as the JSE All Share are shown in the tables below. Annualised returns are shown for periods of one year and longer. Actual annual performance figures are available upon request.

The Glacier AI Flexible FoF strongly outperformed over the past year. The three-year performance is somewhat lagging as a result of some underperformance in 2021 and 2022. However, the handsome recent performance has resulted in the Fund being a top-quartile performer in its category year-to-date and over a one-year period. The highest annual return for the Fund was 29.84% for the 2023 calendar year, while the lowest annual return was -11.92% for the 2022 calendar year.

A focus on risk management

The Fund focuses on asset allocation and risk management to generate good risk-adjusted returns for investors over time. As can be seen, the returns of the Flexible FoF have been close to that of the JSE All Share since inception, however, with significantly lower volatility than the JSE All Share (12.28% vs 23.64%). The Sharpe and Sortino ratios, both being risk-adjusted measures, have been better than the category average. This indicates that returns have more than compensated for the levels of risk taken.

Portfolio diversification benefits

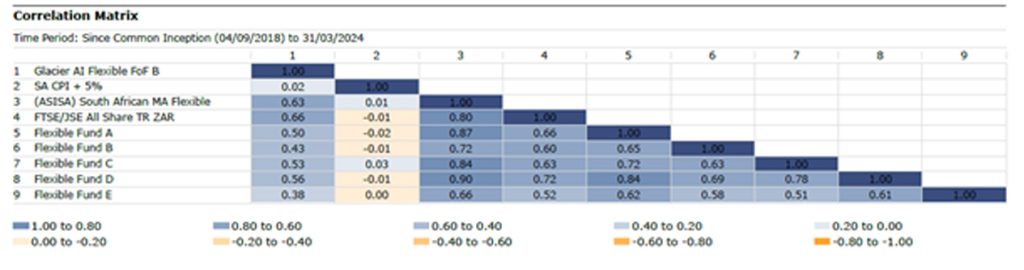

The focus of the Fund on active tactical allocation can result in large changes in underlying holdings over a given week or two-week period. This can therefore mean that the holdings differ in relation to many funds in the category, which tend to have more longer-term or strategic allocations to asset classes, with periodic smaller tactical shifts. This means that the Fund can add good diversification benefits relative to its peers over time.

Below are the correlations (since inception) of the fund relative to the category, JSE All Share, and to the five largest funds (in terms of AUM) in the relevant category.

Looking for a Regulation 28-compliant fund?

Glacier also offers a Regulation 28-compliant fund, the Glacier AI Balanced Fund, which is run using the same AI engine.

You can access the fact sheets of the Glacier funds on our website. A schedule of fees and further disclosures are found on the fund fact sheets on our website.