21 July 2023

The energy crisis in South Africa is having a significant impact on the profits of companies with local operations. With Eskom battling to keep the lights on, what are the implications of loadshedding for investment portfolios? David Lerche, Chief Investment Officer of Sanlam Private Wealth, shares his views

Impact on business

To start with, it’s important to note that a major proportion of the value in JSE-listed companies lies in operations outside South Africa. There are multiple ways to slice and dice the available data, but our analysis suggests that ~54% of the value of the FTSE/JSE All Share Index (our benchmark for South African-focused portfolios) is outside the country, while around 41% of the value of the FTSE/JSE Shareholder Weighted All Share Index (SWIX – the benchmark for many of our peers) lies beyond our borders.

Businesses with local operations have, in the main, adapted to be able to handle occasional power cuts to some extent – loadshedding has, after all, been with us for a number of years now. So even with the increase in the intensity of loadshedding over the past few months, companies have generally been able to make a plan. The problem is that the higher levels of loadshedding translate into increased costs for local businesses.

Loadshedding affects the companies listed on the JSE in three main ways:

• The most direct impact is typically felt by businesses that require electricity for the creation of products, including manufacturers, miners and telecom operators. If their operations are disrupted by loadshedding, these businesses will have less product to sell. Miners usually have agreements with Eskom for load curtailment rather than loadshedding, but they are also affected, particularly in the area of platinum smelting.

Larger manufacturers are typically located at national key points, where they are immune to loadshedding, but this isn’t always the case for smaller players. Cell phone operators, which have thousands of towers all over the country, don’t have the same protection and must rely on a combination of batteries and diesel generation. In general, capital-intensive businesses like these have wider profit margins, so the incremental costs don’t impact a particularly large proportion of profits.

• The next group of businesses that suffer are retailers. While these companies don’t make their own products, they need electricity to be able to sell them. Food and grocery retailers need electricity not only to keep the lights on and the credit card machines working, but the fridges and bakeries also consume a lot of power.

Grocers typically have thin margins. Shoprite, the most profitable of the South African grocers, had an operating profit margin after leases of only 4.3% in the year to June 2022. So, the additional impact of running generators hurts. Shoprite’s six-month results to December 2022 indicated the trading margin had fallen, despite excellent revenue growth.

• Finally, service businesses experience the least pain. While it costs a lot to keep offices illuminated, this expenditure is relatively small compared to the ‘people’ costs of running a bank or insurer.

Impact on economy

Businesses with customers within South Africa will also feel the pain of slower local economic growth resulting from the impact of loadshedding on the wider economy. This means we can expect slightly lower growth over the coming years than would have been the case without the high levels of loadshedding.

Investors should also be aware of loadshedding’s implications for capital allocation. All the management teams of companies impacted by loadshedding that we’ve spoken to are looking at options to generate more of their own power. The telecom companies, for example, are spending billions of rands on batteries and generators for their towers. Many businesses are installing solar panels on rooftops, while several miners are involved in larger-scale solar projects. However, spending this capital on solving electricity problems means less is available for other growth initiatives.

Impact on portfolios

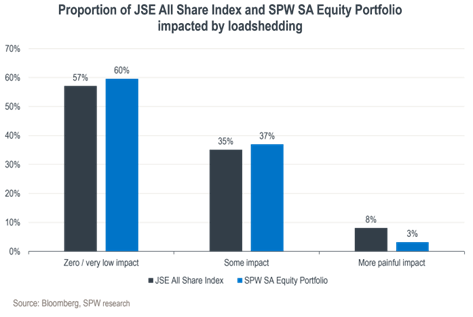

What are the implications for investment portfolios? The graph below illustrates the exposure to loadshedding within Sanlam Private Wealth’s South African equity portfolio, as at the end of May compared to the wider local market. The ‘zero/low impact’ block includes companies like Richemont, Naspers, Bidcorp, British American Tobacco and BHP, where most of the value sits offshore. In the second group, we find companies such as FirstRand, MTN, Sanlam, Bidvest and Pepkor that are impacted by the slower general economy, but whose direct costs are not too painful in the context of overall profits. The third batch contains businesses where the impact is most keenly felt, like the platinum miners, Pick n Pay, Vodacom and Tiger Brands.

As the chart shows, Sanlam Private Wealth’s South African equity portfolio has a greater proportion of its holdings in businesses with zero or very low impact from loadshedding, and most importantly, materially less exposure to those businesses where the impact is most painful. Our client portfolios are thus relatively less affected by loadshedding than the wider market.

Already priced in?

While the above analysis shows which businesses are affected more than others, it doesn’t show how much of the good or bad news has already been baked into prices. It should be remembered that the price one pays for an asset is a key determinant of whether that asset delivers market-beating returns or not.

While it’s crucial to position an investment portfolio in such a way as to ensure protection from the worst impacts of loadshedding, it’s also important to remain vigilant for opportunities where the market might be pricing in a worse scenario than what actually plays out. Therefore, over the past few months, we’ve increased our positions in select South African-centric companies, including Pepkor and Absa.