29 June 2023

“South Africans are so resilient” – Surely one of the more recent African proverbs.

If you have been reading the local news lately, it would have been challenging to find a good-news story, especially in financial media. The one consolation is that we appear to be leading the way in reducing carbon emissions ahead of our 2025 target, albeit against our will, as reported by Bloomberg. That seems to be the only positive effect of load shedding…but we’ll take any positive news at this stage.

So, what’s been driving the volatility of the rand recently? Firstly, it’s been a rampant US dollar over the past decade and more, following the global financial crisis as the dollar index (DXY) reached its lowest level in 2008 and touched those levels again in 2011. Since then, it’s been “one way traffic” as US handsomely outpaced global peers both in terms of their currency and equity markets. The graph below tracks the value of the US dollar from 1967 compared to a basket of foreign currencies. As illustrated, the dollar moves in extended cycles and appears to have reached a peak in September 2022.

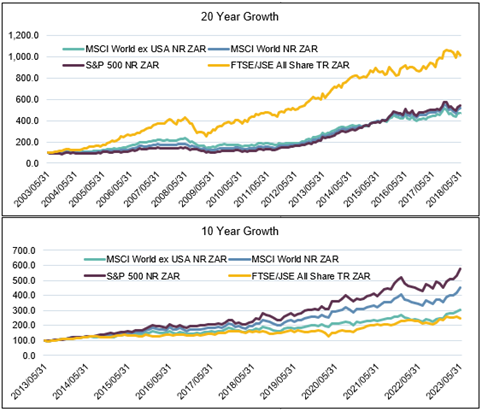

For South African investors, however, it’s been two distinct decades of varied outcomes over the past 20 years. The below graphs show the returns (in rand) of global markets vs local markets over the past 20 years and 10 years respectively. As evidenced below, the past 10 years have been excellent for global investing when converted to rand, but also illustrated is the big effect the US equity market (S&P 500) has had on total returns for the past decade. Pleasing to see, however, is that even though the rand has weakend from R10.07 to R19.70 to the US dollar over the 10-year period, our equity market (FTSE/JSE All Share Index) has managed to deliver competitive total returns when compared to global markets excluding the US (MSCI World ex USA Index).

When evaluating the 20-year numbers, the return differences are even more vast, with the SA equity market far outpacing global markets even though the rand weakend from R7.99 to R19.70 to the US dollar.

Additional factors which have caused the rand to weaken over time have been the deterioration in local economic growth per capita, high unemployment, junk status, grey listing, state capture, load shedding and more recently, questionable local political associations. These factors aside, there are more fundamental reason that the rand should depreciate to the US dollar over time, such as global economic conditions, the commodity cycle, monetary policy, but also a dynamic which is captured by the term: “Purchasing Power Parity” or “PPP.” PPP is an economic theory that compares different countries’ currencies through a “basket of goods” approach, which attempts to factor in the inflation differences over time.

Seeing that South African inflation has been much higher than US inflation over time, the currency weakness theoretically captures this inflation difference over time to achieve “parity” in a basket of goods. While this is far from a perfect measure, it does attempt to normalise cyclical factors over time.

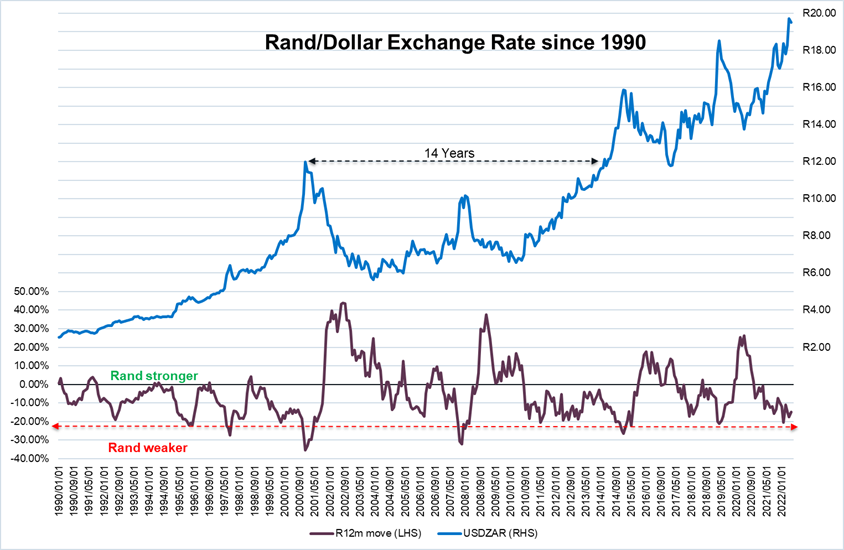

The graph below shows the rand/dollar exchange rate over time, and the bottom line illustrates the rolling 12-month movement in the currency. As illustrated, while the rand trends weaker over time, there are periods of excess strength and excess weakness. Only time will tell if the latest bout of weakness will persist, but history would suggest otherwise. Sudden movements in exchange rates are not uncommon, and do not necessarily indicate a long-term trend.

In these times of sharp currency movements, it is critical to separate emotion from investment decisions. While domestic news may remain negative, financial markets are complex, adaptive systems which factor in observed dynamics into asset prices far quicker than investors are able to position for it.

Offshore investing has numerous diversification benefits to investment portfolios, but irrational behaviour at extremes can be detrimental to one’s investments. It is essential to approach investments with a calm and objective mindset to achieve financial goals effectively.

Predicting currency movements is folly, so we won’t attempt to do so, but don’t be surprised if the rand is as resilient as us South Africans.

First published on EBnet on 23 June 2023