10 August 2023

You love your lifestyle, right? You are building your career; you drive a decent car and you’re thinking about owning a home. You go on holiday when you can, and over weekends, you spend time with friends, go out to great spots and restaurants or you spend time on DIY at home. And you love having nice things.

“So many people in their late 20s, 30s and even their 40s think they’ve got a good life, and that it’s going to last forever” says Sherwin Govender, Business Development Manager at Glacier by Sanlam, “but very few consider how their lives will be when they leave work for good and no longer receive a pay cheque.” He suggests a checklist of things to do to get your retirement savings on track, as early as possible. It’s never too early to start.

1. Picture your life.

You have a Pinterest board for your kitchen makeover, your trip to Italy or your ideal wedding. Why not create one for your retirement? What does your life look like 20 or 30 years from now? Will you have paid off your home? Will you have dependent children living with you? Will you be able to travel abroad? How often will you replace your vehicle? Dream big and the more specific you are, the clearer the picture will be regarding how big the gap is between what you’ve saved and the life you want to live.

2. Know the jargon and know your number.

If there are just three words that people need to learn relating to saving, then they are net replacement ratio (NRR). Knowing what this means is absolutely critical to ensure that you have the life and lifestyle that you want, when you retire.

In a nutshell, NRR is the expected pension that you will receive at retirement, reflected as a percentage of the very last salary that you earned when you were working. It’s the calculation that indicates how much income your retirement savings will be able to create for you when you retire.

For example, if I earn R40 000 per month towards the end of my working career, and my replacement ratio is 50% (which means I have only saved enough to cover 50% of my predicted costs), that means my current retirement savings will be able to provide me with a retirement income of R20 000 per month. Basically, I’d have to cut my current lifestyle in half!

Know what your replacement ratio is – it’s specific to you. You need to know how much more you need to save to close the gap and have the life you want after retirement. It’s that simple.

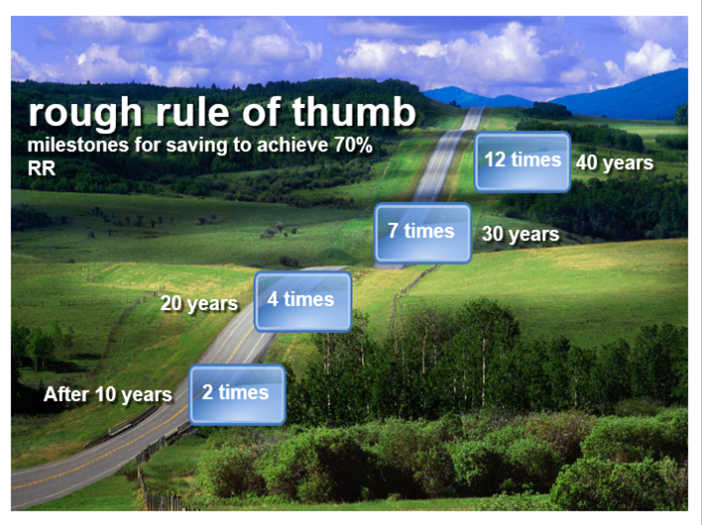

Figure 1 below shows your retirement savings milestones at different stages of your working life. So, after 10 years of working, you should have accumulated two times your annual salary, at your 40th working anniversary, you should have accumulated 12 times your annual salary.

Figure 1: Illustration of your NRR

3. Observe the retired people in your circle.

It’s natural for young people to only consider what is important today. Most people think that there’s so much more that they can do with their money than save for retirement, especially when they’re trying to accumulate , like a car or house, or providing a good education for their children. But the consequences of not saving for retirement or saving too little, could be dire.

Observe the people in your circle who have already retired. Who’s doing well? Who’s struggling to make ends meet? How do you think they got there? What could you do differently?

If you are already saving for retirement, good for you. But are you saving enough? The ideal replacement ratio is 75% or higher of your last salary earned, before you retire. If your NRR is 40% or lower, it is unlikely that you will be able maintain the lifestyle that you are accustomed to when you retire. Remember, that your employee pension fund, on its own, may not be enough to sustain you when you stop working.

4. Consider all your retirement savings options.

In addition to your retirement fund at work, a retirement annuity (RA) and a tax-free savings account (TFSA), as examples, could go a long way in closing the savings gap. Also consider taking one of those out for your child. If your parents had done that when you were born, you could have been a lot further along your journey towards financial confidence.

5. Do a deep dive into your debt.

South Africans are some of the most indebted consumers in the world. Of course, there’s healthy debt like a mortgage bond for your home or debt that is sometimes necessary such as vehicle finance. However, if you are using credit to finance a lifestyle you cannot afford – such as clothing, luxury items, or your social life – then you have unhealthy debt. This becomes a drain on your ability to save for anything – including retirement. It is important to remember that paying for something on credit is forking out two, sometimes three times the actual cost. Minimise using your hard-earned money every month to service debt and credit.

6. Appoint a financial coach.

If you think there is little or no value in enlisting the help of a professional financial adviser, think again. You wouldn’t do your own root canal or remove your own appendix, would you? You’d use the services of a trained professional, right? It’s very similar with financial planning and investing. An appropriately authorised financial adviser takes a holistic view of your personal finances – your income, expenses, needs, shortfalls, risk appetite and goals. A good adviser becomes a coach and a partner on your journey to financial fitness.

You can visit https://www.sanlam.co.za/tools/Pages/retirement.aspx to find out your own NRR. However, it is strongly recommended that you do so with an appropriately authorised financial adviser.