Sherwin Govender, Business Development Manager at Glacier, outlined some of the challenges retirees face when planning their retirement income and how a blended solution can significantly change the outcomes.

A bleak picture

Only 6% of South Africans can retire in comfort and enjoy a similar lifestyle to the one they had before retirement. Most retirees draw an income from a living annuity. The worrying trend is that 59,000 living annuity retirees saw their income halve between 2011 and 2018. In a survey conducted by Sanlam Employee Benefits, the following was discovered:

- 85% stated that certainty about their retirement income was most important to them

- 53% were supporting adult dependants

- 33% still had debt.

In the last five years, the JSE All Share has not been able to keep up with inflation, and as a result, retirees have the added challenge of “sequence risk” to contend with. This is the risk of market conditions being poor in the early stages of retirement. Negative market returns in the first few years of retirement coupled with high income drawdowns will lead to living annuity retirees running out of capital later in their lives.

A 65-year old married couple today has a 50% chance of living well beyond the age of 90, and a 25% chance of celebrating their 100th birthday. This could mean that your retirement could be longer than your working life. This results in “longevity risk” which is the risk that you outlive your retirement savings.

Statistics show that the vast majority of retirees invest all their retirement savings into Investment Linked Living Annuities.

When it comes to living annuities, there are negatives and positives.

A glance at the pros and cons of living annuities

| Pros | Cons |

| There is the possibility to leave a . | There are no guarantees on capital protection or income. |

| It is flexible in terms of income needs (the income level can be changed on an annual basis). | Income levels need to be balanced against the longevity of the capital. |

| It is flexible in terms of investment choice. | The individual has to deal with managing the investment markets – this is cause for stress in the life of a retiree. |

| The income benefit starts off adequately. Starting income can be selected to match lifestyle needs and wants. | It is possible for the capital to be depleted, leaving the client dependent on a state pension. |

Living annuities result in financial intermediaries performing a balancing act for their clients, especially in cases where clients want a high income, flexibility and the ability to leave a . The fact is that drawdowns in excess of 4.5% are going to eat into the capital, meaning that money can be depleted over the long term. Bear in mind, that the average income drawdown from a living annuity equates to 6.64% according to ASISA (Association for Savings and Investment South Africa).

Blended solutions for the best outcomes

Guaranteed life annuities mitigate longevity and market risk. However, benefits from these types of products are limited. The ones that do provide s come at the cost of monthly income. The most commonly used guaranteed annuity is the “level annuity” which does not provide for inflation. Inflation-linked annuities are better in the long term but the starting income is lower when compared with a level annuity.

So, what’s the best course of action? In simple terms, using the benefits of both products – giving retirees the ‘best of both worlds’.

Numbers don’t lie

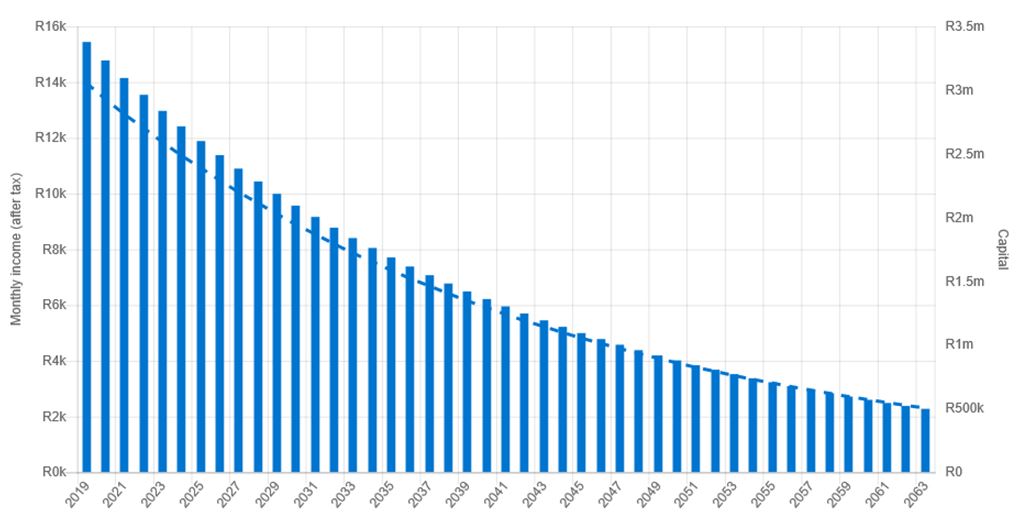

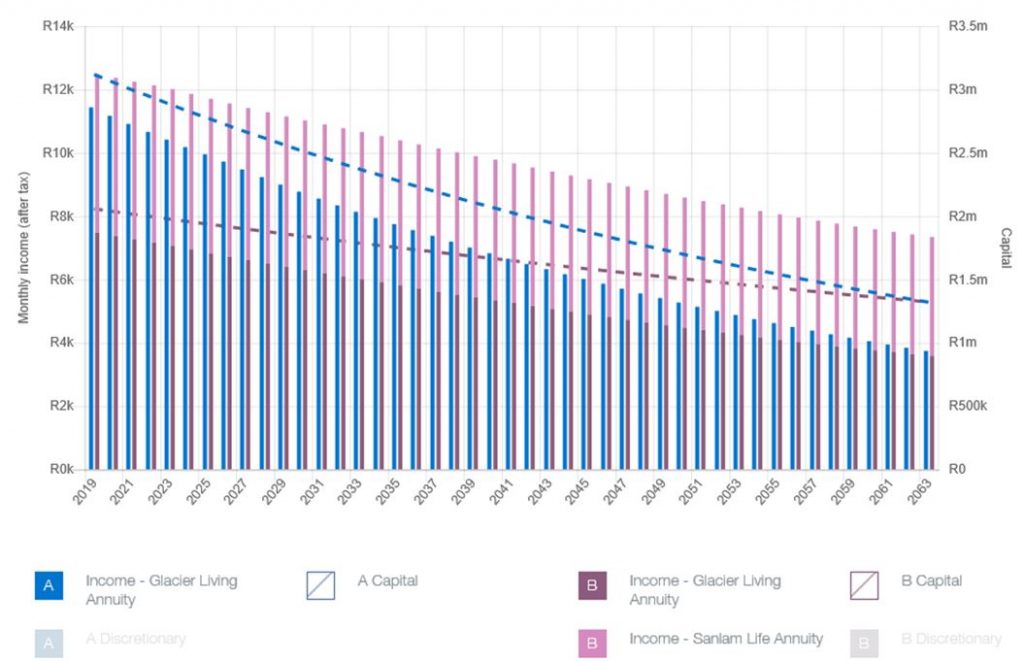

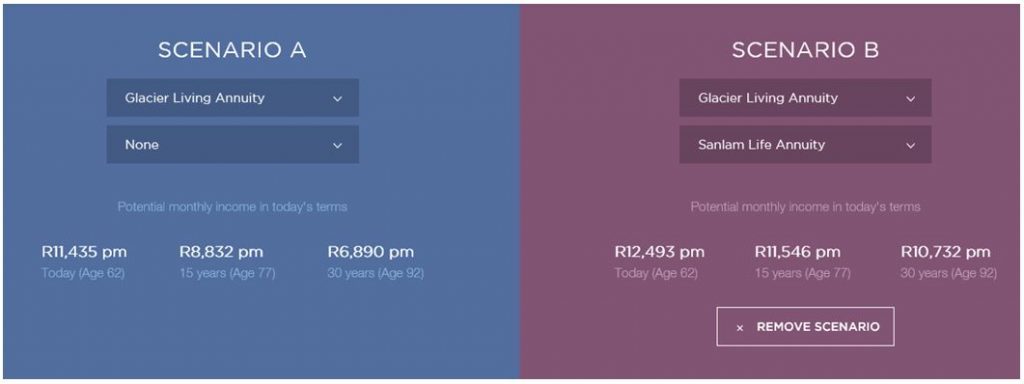

Using the Glacier Retirement Income Tool, and comparing two scenarios, a solid case for combinations is evident below:

In our example, we look at the living annuity of a man retired at 59 with R3,000,000 and taking an income drawdown of 7%. A moderate investment profile is assumed here. The graph is in real terms with inflation taken into account.

Let’s consider the same client now using one-third in a 5% escalating guaranteed annuity and two-thirds in a living annuity. See the rand income comparison of the two scenarios (also in real terms) in the picture below.

The calculations were performed using the Glacier Retirement Income Planner, a tool designed by Glacier for intermediaries in their advice process. The graphs are for illustration purposes only. Guarantee rates will vary and personal circumstances need to be taken into account. Therefore, you must consult a financial planner.