24 August 2023

Living your best life is possible, and within reach, even years after you stop working. It takes some planning though, and recognition that it isn’t too early to plan the life that you want after your last pay cheque. People are living longer now than in any time in history, so celebrating your 90th birthday is a real possibility. But will your retirement savings last as long as you do? Waldette Stoffberg, business development manager at Glacier by Sanlam, breaks down the steps to a life worth living, from now until well into your old age.

6 Tips to help you YOLO for years to come

Tip #1 Think about the 60-year-old you, even as you’re launching into the world now.

You may be starting your first, second or even your third job, but you’re definitely following the career you want, and success is a non-negotiable for you. You’re truly adulting and it’s not all bad. You own your first car and have vehicle insurance, medical aid, and you love experiences like weekends away with friends, gin tasting and Afrika Burn. You’re planning your first overseas trip, soon. But what about saving for retirement?

“Planning for retirement is an essential part of your financial plan, even when you’re as young as your early 20s”, says Waldette.

Tip #2 Don’t go so low.

So, you think you’re saving for retirement by contributing monthly to your employee pension fund at work, but are you saving enough? In your 20’s and 30’s you might be contributing less than required to your pension fund.

“Any percentage below 10% is too low,” says Waldette. “If your after-tax salary is R15 000 per month, then your contribution should be no less than R1500 per month”, she says. “You have an opportunity annually to increase this percentage, and it really is sensible to do that.”

Many employers do not offer an employee pension fund, so saving for retirement is left entirely up to you to arrange privately, and let’s face it, you’d rather spend the R1500 per month on shoes or gadgets, right?

“It’s tempting not to save for something like retirement that is just so far away”, says Waldette, “but think of the experiences that you’re having now – in your 20s, 30s and even your 40s. Why should they stop the day you stop working at age 60? Why shouldn’t you upgrade your vehicle, or travel overseas, or update your kitchen or bathroom? Now is the time to imagine and build the life you want after your last pay cheque,” she says.

Tip #3 Add a retirement annuity (RA) into your financial plan.

Whether you’re contributing to an employee pension fund at work or not, here are some good reasons to invest in an RA:

- It provides a kickstart to your retirement savings plan. An RA can propel you on your retirement savings journey – as a standalone solution, or as part of a retirement savings plan.

- It offers flexibility. You can pause or reduce your RA contributions if you need to do so.

- You can enjoy tax benefits. A portion of your contributions to an RA is tax deductible, and you also don’t pay tax on interest or capital gains within an RA. So, you have more money to spend on yourself.

- It ticks many retirement savings boxes. An RA potentially offers you the opportunity for investment in a wide range of funds, risk-profiled solutions and a , customised to suit your needs and risk profile.

- You can’t touch it. Well, not until you’re at least 55. Once you invest in an RA, just forget you have it. Years from now, you’ll be so thankful for committing to an RA until you reach retirement age.

Tip #4 If you’re still young, don’t be too conservative in investing.

In your 20s and 30s, you have the advantage of more time to retirement than people in their 40s and 50s. Investing is a long-term pursuit, so while you’re young, you can take on more investment risk – which potentially secures higher returns – as you will have more time to recoup any possible short-term losses.

Tip #5 Know the monetary values that you’re working towards.

Knowing what you’re saving for and how much you can expect as a monthly income in retirement will help motivate you to start and keep going.

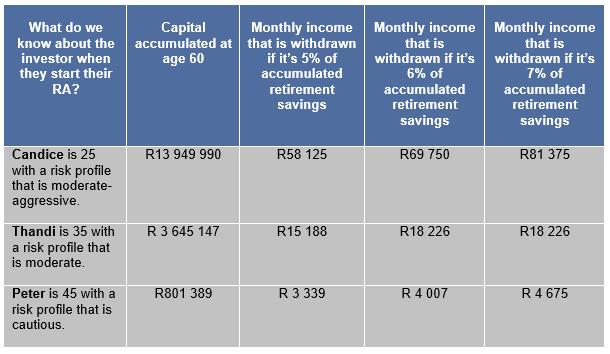

See the illustration below of how much you can save and the retirement income you could expect at 60. Let’s assume three investors all start saving R1000 per month in an RA until they are 60. They each decide to increase their contribution by 10% every year.

Tip #6 Don’t go it alone.

An appropriately authorised financial coach will help you put together a holistic financial plan, that takes into account your financial circumstances, needs, goals and investment objectives.