2 March 2023

1 March 2023 saw the implementation of a very welcome amendment to the definition of ‘retirement annuity fund’ (RA) in section 1 of the Income Tax Act. Retirement annuity fund transfers for members with more than one contract (what Glacier refers to as a “plan”) in a particular retirement annuity fund no longer need to result in the transfer of one hundred percent of their interest in that fund (i.e. 100% of all their contracts/plans). This amendment is welcomed because it allows greater retirement planning freedom to help create sustainable retirement income for clients.

The new legislative rule

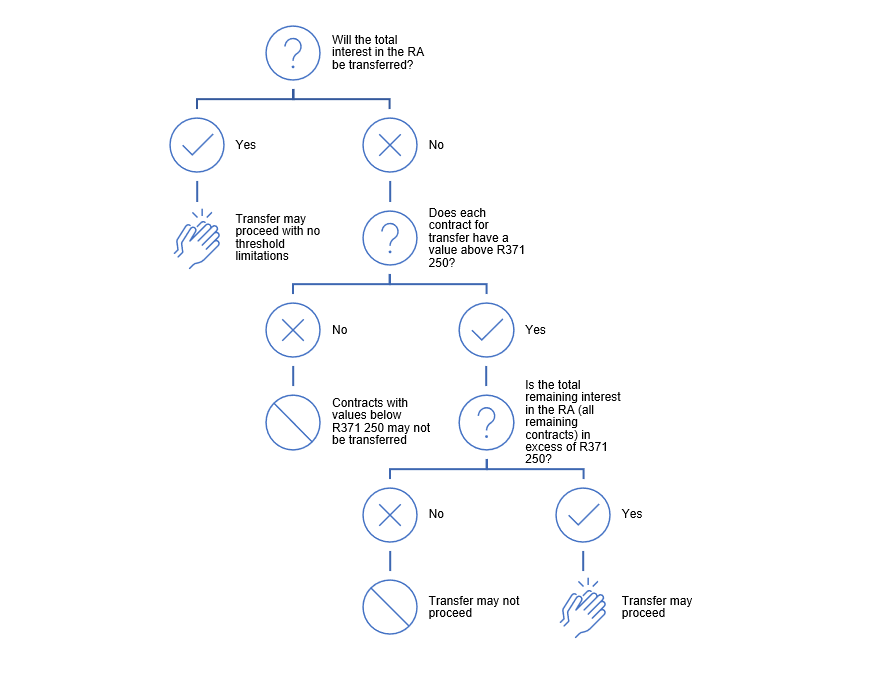

The ability to affect such separate transfers out of a singular RA fund is, however, subject to some conditions aimed at ensuring that the current de minimis thresholds are not contravened:

- The value of each contract(s) being transferred must exceed R371 250 (1.5 times the de minimis amount of R247 500); and

- If the member is not transferring all existing contracts, the total value of the remaining contracts must exceed R371 250.

If the total interest in the RA is transferred, a minimum does not apply.

The meaning of ‘contract’

The new definition of an RA does refer to the ‘contract’ being transferred to another RA. The meaning of ‘contract’ in the practical context of the Personal Portfolios Retirement Annuity Fund is as follows.

A contract is either a plan with a unique plan number allocated, or more than one unique plan number linked together in the following scenarios only:

- One application form was received by the Fund that indicated different investment options between collective investment schemes including local offshore funds, wrap funds and shares. The differing investment options chosen necessitated the issuing of more than one unique plan number, but these plan numbers are indeed linked as one investment (i.e., one contract); or

- One application form was received by the Fund with an ROT (Recognition of Transfer) document listing both vested and non-vested contributions. The differing status of the contributions received from the transferor fund necessitated the issuing of more than one unique plan number, but these plan numbers are indeed linked as one investment (i.e., one contract).

How to determine if the transfer request will be approved in terms of the new legislative rule

A quick example

The member has three contracts in the RA, valued at:

- R250 000

- R400 000

- R150 000

- If the member requests to transfer contract number 1, this request will be denied as the value of the contract is below R371 250.

- If the member requests to transfer contract number 2, this request will proceed as the value of the contract is higher than R371 250 and the value of contracts 1 and 2 are collectively higher than R371 250.

- If the member requests to transfer contract number 3 this request will be denied as the value of the contract is below R371 250.

We are ready

We are ready to assess any transfer requests in terms of the new legislative rule.

Please keep in mind that the value of the contract/s are subject to market fluctuations between the date of request and the processing of the transfer. The Fund will use the value as at date of transfer to determine the legislative compliance.

We look forward to being of assistance on the path to building sustainable retirement income for your clients. Should you have any questions, please don’t hesitate to contact your Glacier Business Development Manager or our Communication Centre.