Within the financial advice environment, it is a well-known fact that every new investment will be accompanied by some form of risk tolerance analysis. Some financial advisory institutions even make this a compulsory part of the compliance process. It’s also fair to say that this is, and should still be, an important function when investing money. My reasoning sits within the very definition of what an investment is.

Defining an investment

The definition of an investment is taking an amount of money with a current purchasing power, investing it in an instrument, at a predefined level of risk, over a specified period of time, with the ultimate goal of having more purchasing power in future. Therefore, investing for growth could be seen as striving for an increase in purchasing power within the growth of money. (Reilly/Brown, 2006).

To argue with the importance of risk profiling would mean to disagree with the very definition of an investment itself.

Risk profiling

A risk profile is defined as a measurement of a client’s willingness and ability to take risks - in other words, their appetite for volatility. (CFA Institute)

The question this leaves me with is, can we apply risk profiles for growth or volatility in the financial planning process when we enter the post retirement space? Investment goals in the accumulation phase in the build-up of capital tend to differ from the goals one has once you retire - in terms of primary need or the reasons the capital is needed.

Accumulation phase

In your accumulation phase of the savings journey:

- You have time on your side and can accommodate volatility, as there is still a longer investment timeframe as you are younger. There is therefore a tendency to start with a higher risk profile and scale down as your reach retirement age.

- You are told how rand cost averaging of recurring premiums is a good thing. Remember if you buy in a dip, you enter the market at a lower price and receive more units.

During the accumulation phase the risk of not reaching the requirement amount of capital needed, is dependent on the underlying risk and return characteristics of the invested in. Having as much risk as possible in your portfolio will increase the maximum amount of growth that is possible, but for this – sufficient time is needed.

When retirement age is reached and a new chapter of financial planning starts, we can argue that the primary goal of growth is now substituted with the new goal of providing income for life, i.e. using your accumulated capital to purchase an income that will now substitute your salary. During this period, along with market volatility risk you are now also faced with the additional risks of longevity, inflation and the need to balance capital and income over time (income stream management).

Retirement phase

In your retirement phase and income stream journey:

- You are guaranteed to have volatility in the form of drawdowns. Remember a 6% income need results in a guaranteed 6% loss of capital, along with market movements. So regardless of what happens for the next 12 months, you are guaranteed to lose 6% of your capital plus costs.

- In many cases investors reduce growth asset allocation for fear of capital volatility. Yet the retirement journey has never been seen in general as a short-term period, which would in theory contradict this behaviour as a long-term investment period within the accumulation phase would carry a higher growth asset exposure.

- Generally, the income need is accompanied by the need to grow capital along with income to keep up with inflation, again driving the argument for more growth . Further pressure is added by the need to leave a .

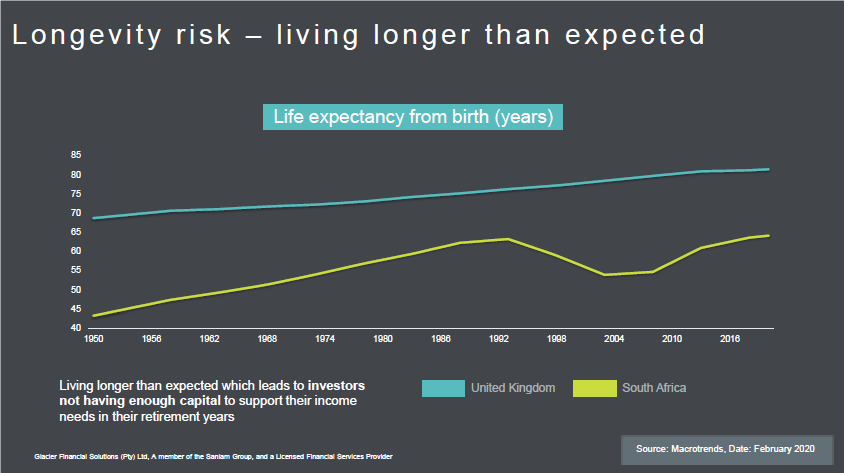

- Life expectancy has increased, placing greater risk in the form of additional longevity and income expectation.

Does risk profiling apply in retirement?

All of these aspects would support the need to increase risk asset exposure, yet behaviour and observation prove otherwise. My question is whether risk profiling can be applied post retirement, or at least whether it should be adapted more to the specific situation it is applied to?

When a client retires, their primary need becomes income as opposed to the need for growth during the accumulation phase. So why not look at outcomes-based risk management at retirement? If the income need is 5%, then profile your portfolio or investment strategy for a 5% + CPI need. Move the risk profiling and need for advice to exactly where it should be, by focusing on the actual goal of income provision for life. Here the risk of not achieving the required income profile (which includes an expectation around volatility) is the ultimate risk to manage and profile for.

Glacier Invest has solutions to address these needs

Glacier Invest, our discretionary fund manager, has taken the challenge of building Living Annuity and more specific income-based solutions. By leveraging research capability and partnering with SMMI, Glacier Invest has access to not only the standard collective investment scheme universe, but also access to alternatives, exchange traded funds, hedge funds, private equity and smoothing options. So how do they work?

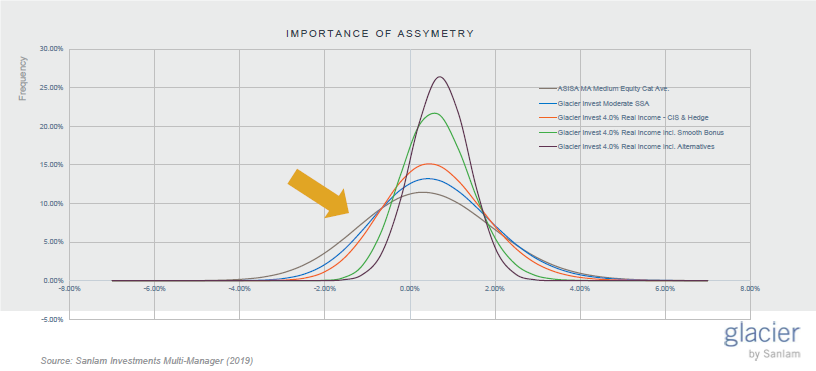

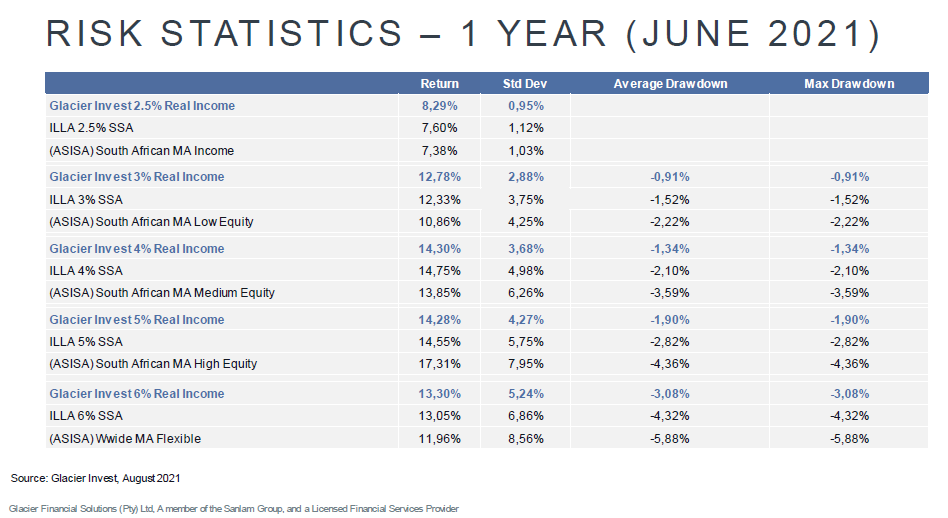

To create a more streamlined and outcome-based scenario which addresses sequence of return as well, these solutions include smoothing strategies, alternatives and hedge funds. Based on the below graph, the inclusion of these instruments contributes to creating a much tighter distribution of returns.

These solutions are specifically built and aimed at solutions to provide income for 2.5%, 3%, 4%, 5% and 6%.

Sequence risk

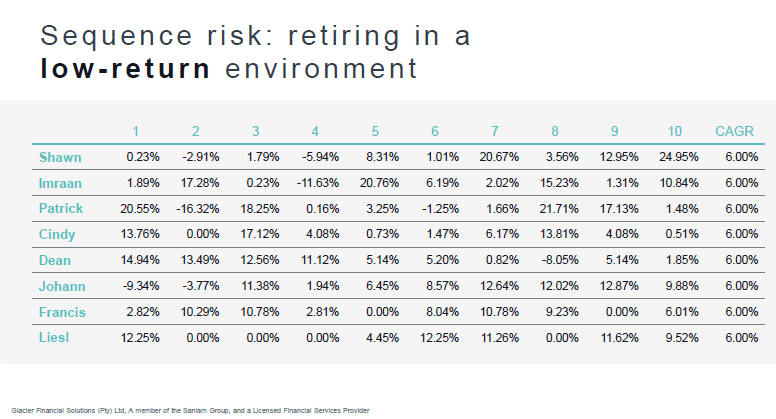

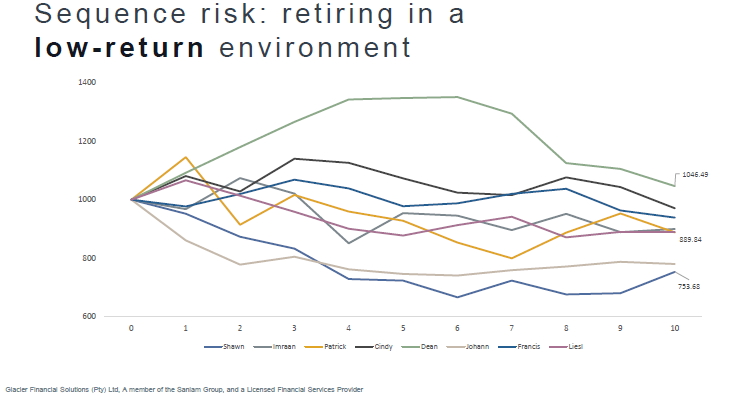

Why is sequence of return such an important factor to consider in the post retirement space? Consider the client profiles below. Over a 10-year period all have the exact same return average, although their return ‘patterns’ are not similar. The end result would still have been very similar had these clients invested a lump sum for growth.

But in the realm of post retirement, the outcome changes. Using the above table, if we now add an annual income drawdown, we’ll see how each client has a totally different outcome. Therefore, these outcome-based solutions are aimed at targeting specific drawdowns, reducing volatility and creating an asymmetrical as possible payoff profile for the investor.

Have these solutions worked thus far?

The Glacier Invest Real Income Solutions are managed with the retirement process and income profile of the retiree in mind. The goal is to partner with financial intermediaries and offer them a solution where they can continue their financial planning journey with investors. This again shows the importance of the role of an intermediary. Throughout the accumulation phase it’s possible to apply a risk-profile-based planning methodology, guide the investor and deliver feedback. As this need changes the intermediary can then apply an income goal-based investment strategy as the need changes, and again continue their journey with their clients in their new phase.

By considering these solutions, as well as the Glacier Retirement Income Solution Strategy (blending of post-retirement products), financial intermediaries are able to build customised solutions for a more granular client need and strengthen their advice proposition. Being able to risk profile a client for pre-retirement as well as income profile the client for post-retirement can only serve to strengthen the advice process.

Glacier Financial Solutions (Pty) Ltd and Sanlam Life Insurance Ltd are licensed financial services providers.

Glacier Financial Solutions (Pty) Ltd is a licensed discretionary financial services provider, trading as Glacier Invest FSP 770

Sanlam Multi Manager International (Pty) Ltd FSP 845 is a licensed discretionary financial services provider, acting as Juristic Representative under Glacier Financial Solutions (Pty) Ltd

The Glacier Investment-Linked Living Annuity is underwritten by Sanlam Life Insurance Ltd.

Glacier Invest is the discretionary fund management offering of Glacier Financial Solutions (Pty) Ltd (“Glacier’’). Glacier has partnered with Sanlam Multi Manager International (Pty) Ltd, part of the Sanlam Investments Group, to optimise the investment management responsibilities

References

Institute, C. (n.d.). Investment Risk Profiling - A Guide for Financial Advisors.

Reilly/Brown. (2006). Investment Analysis and Portfolio Management. Thompson South Western.