26 February 2024

From 1 March 2024, the payment date will determine the inception date and therefore also the first income date of Sanlam life annuities originating from internal, as well as external sources.

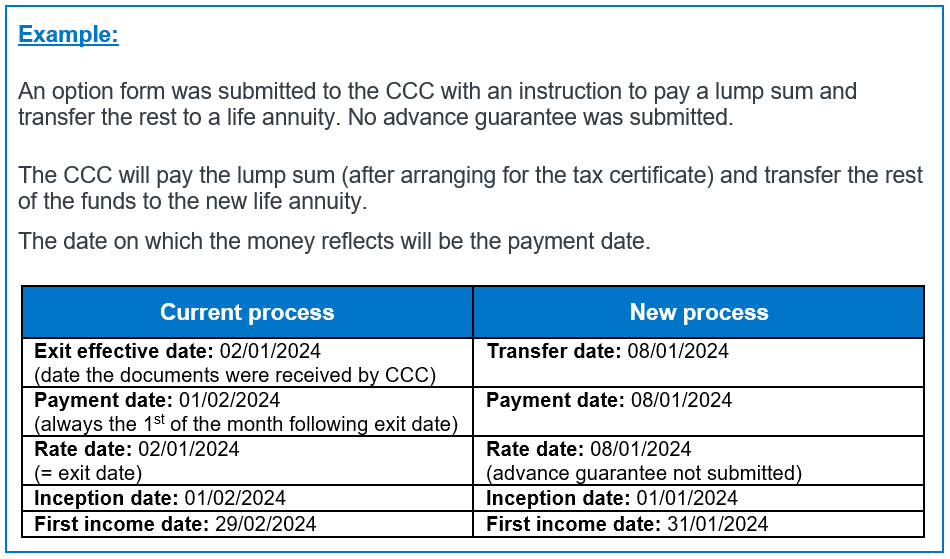

Currently, the inception date of life annuities where the funds originate from an early retirement from a Sanlam policy depends on the exit effective date of the original plan. This process is specific to internal funds and can be confusing.

We are pleased to inform you that this process will change from 1 March 2024 to align with the process where funds originate from an external source. Going forward, the actual payment date will be used, and this will determine the inception date of the life annuity.

The process

The normal process should be followed when submitting a life annuity application. The CCC will still transfer the funds to the new plan, but where the 1st of the following month was previously used as payment date for the life annuity, we will now use the date on which the money reflects on the life annuity plan.

A P705 transaction can be drawn to see the date on which the money was transferred. This will be the payment date you will use for your final quotation.

Benefits of changing the process

- Clients should receive their first income sooner. With the current process the income is only payable at the end of the following month.

- Income will be adjusted automatically, depending on the payment date. (If the payment date is on or before the 15th of the month, the inception date will be the 1st of the current month; if the payment date is on or after the 16th, the inception date will be the 1st of the next month, and the interest accrued from the payment date to the 1st will be reflected in the rate.)

- If an advance guarantee was not selected/submitted, the rate will default to the one applicable in the week of the payment date.

- Regions will be able to do these quotes, and fewer special quotes will be required from Product Development, which will save time and effort.

Additional information

- Quotation and application forms: No changes need to be made to the quotation or application forms.

- Advance guarantee: This will still be available. The process to lock a rate remains the same.

- CCC cases issued: These will remain as they are and will follow the current process using the exit date.

- Pipeline cases: If a case was submitted before 1 March 2024 and the instruction to transfer the funds was given to the CCC before this date, the current process will still apply.

Please contact your business development manager if you have additional questions or concerns regarding this enhancement to our current process.