14 November 2023

What’s new?

When advising your clients regarding deceased estates, it is important to remain informed about the latest developments from the Master’s Office, to ensure compliance with estate reporting requirements. The Department of Justice and Correctional Services (“Department”) officially launched the deceased estate online registration system on 10 October 2023. The new system is expected to be available nationally in January 2024. This new innovative technology empowers all parties to engage more effectively with the Master’s office. Among the various advantages, the new registration system offers South Africans a convenient and efficient means of conducting business with the Master’s office remotely, even in the comfort of their home.

Several challenges experienced over the years, has led to the development of the Deceased Estates online registration system. These included having to turn clients away due to incomplete paperwork, document mishandling and manual processes that cause delays. With the new system, clients can register*, verify their relationship with the deceased and report the estate. This can be done simply by completing the necessary forms automatically generated for upload, upon successful registration. Depending on the value of the estate, a letter of executorship or letter of authority is issued to the interested party through the chosen method of communication, streamlining the deceased estate reporting process.

*Parties who may register the deceased estate using the online system:

- An individual, in their individual capacity and related to the deceased.

- Legal practitioners who act on behalf of their clients.

- Banking industry and fiduciary professionals.

- Accountants.

Safeguarding client information and verification process

Clients can rest assured that the online system involves human intervention. On the front end, when data is submitted, it is securely stored in the digital cloud. At the back end, an estate controller validates the information for accuracy and completeness before issuing a letter of authority. A Quick Response (QR) code is embedded in the letter of authority, allowing verification and validation of appointment letters and their current status at the Master’s office. Additionally, the information of the person or relative registering the deceased estate, is cross verified with the Department of Home Affairs, legal practice councils, and CIPC records. Also read: Safeguarding your clients and your practice against current fraud trends.

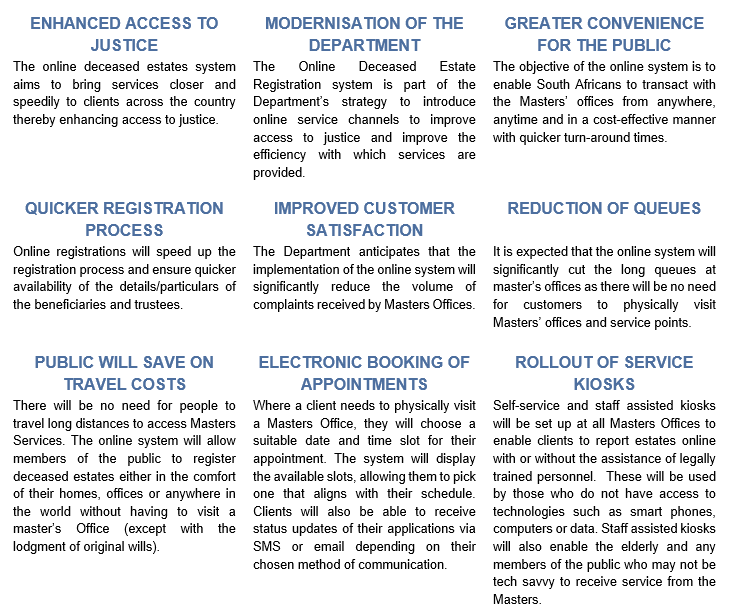

The Department highlights the following advantages of the online registration system for deceased estates in streamlining service delivery:

Click here for more details on deceased estates.

Access the Masters’ online registration system for deceased estates.

For support or further enquiries, email DojDEOnlineSupport@justice.gov.za

References:

- South African Department of Justice and Constitutional Development. (2023). Advisory on Estates. Retrieved from https://www.justice.gov.za/m_statements/2023/20231005-Advisory-Estates.html

- Master’s Deceased Estate Online Registration System. (2023). The Talking Point.

Retrieved from https://omny.fm/shows/the-talking-point/masters-deceased-estate-online-registration-system - Deceased Estates Master's Online Registration System. (2023). Accounting Academy. Retrieved from https://accountingacademy.co.za/news/read/deceased-estates-master-s-online-registration-system

- Deceased Estates: How to report an estate. (2023). Department of Justice and Constitutional Development, South Africa. Retrieved from https://www.justice.gov.za/master/deceased-how.html

- Department of Justice and Constitutional Development, South Africa. (2023).

https://dojonline.justice.gov.za/