30 June 2025

The world appears increasingly disordered and volatile, with a growing number of wars and geopolitical tensions in recent years. The latest flashpoint is the conflict between Israel and Iran, which has also drawn in the United States. The Middle East now faces a dangerous escalation, as long-standing adversaries Israel and Iran, previously engaged in covert operations and proxy conflicts, have entered open hostilities. This confrontation could escalate in various ways, including more aggressive military action, especially given the significant US military presence in the region.

Other developments, such as a potential closure of the Strait of Hormuz, could be equally devastating, as approximately 20% to 30% of the world’s oil supply passes through this vital corridor. In such an environment, market volatility seems inevitable.

A conflict re-ignited

The current crisis began on 13 June, when Israel launched Operation Rising Lion, a coordinated air and intelligence offensive targeting Iran’s nuclear facilities, weapons infrastructure, and command centres. The operation reportedly included deep-strike missions using advanced aircraft and sabotage conducted by Mossad operatives inside Iran.

Iran retaliated against the offensive launched by Israel and both sides have suffered significant infrastructure damage and civilian casualties during the respective attacks on each other. The conflict took a new dimension when the US entered the fray on 21 June. Under orders from the President, American forces conducted Operation Midnight Hammer, a strategic bombing campaign aimed at crippling Iran’s nuclear capabilities. B-2 stealth bombers struck critical sites at Fordow, Isfahan, and Natanz.

President Trump described the strikes as “measured and necessary”, claiming intelligence had revealed imminent threats against US bases and embassies in the region. In a televised address, he warned Iran's leadership of further “unrelenting action” unless it ceased hostilities and entered negotiations.

Fallout and uncertain futures

Tehran’s response has been resolute. Supreme Leader Ayatollah Khamenei promised severe retaliation for what he labelled an act of aggression, while Iran’s Revolutionary Guard Corps declared US military and regional allies as legitimate targets. After the strikes from the US, Iran did respond by firing multiple missiles towards US military bases in Iraq, Qatar and in the surrounding region. The US did, however, intercept all missiles, and no damage or casualties were reported. The markets viewed this response as muted.

Market movements

A war in the Middle East has deep and immediate repercussions for global markets, primarily due to the region’s critical role in energy production and supply. As home to several of the world’s largest oil-producing nations, any conflict in the area tends to trigger sharp increases in oil prices due to fears of supply disruptions. These price shocks can fuel inflation across both developed and emerging economies, prompting central banks to reconsider monetary policy trajectories. Equity markets often react with heightened volatility, as investor sentiment turns risk-averse and capital flows into perceived safe-haven such as gold and government bonds.

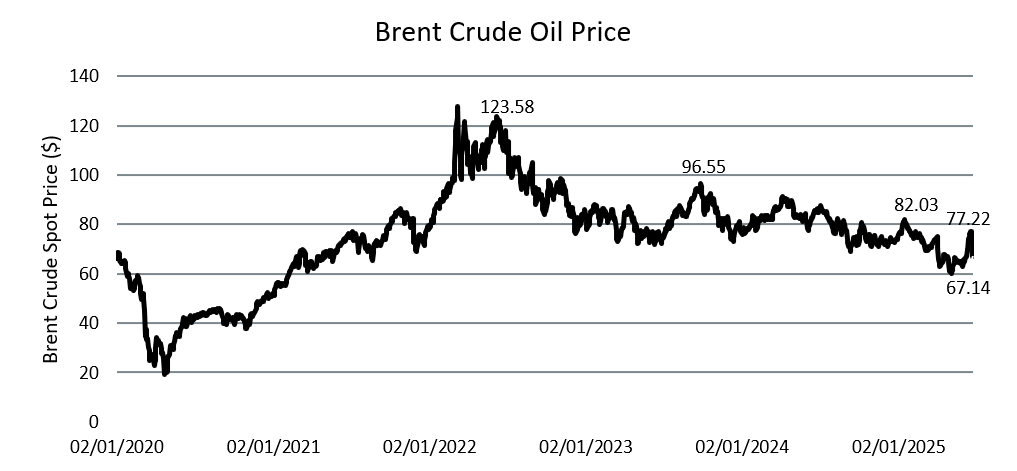

Oil prices initially surged, Brent crude spiked from under $70 to over $81 per barrel following Israel’s mid‑June strike on Iran’s nuclear facilities, as markets feared disruption via the Strait of Hormuz. However, when Iran’s response against US bases in Qatar was limited and the Strait remained open, prices swiftly slid back below pre‑conflict levels near $67–$69 (at the time of writing), reflecting diminished disruption fears. On the heels of a fragile ceasefire announcement and calming geopolitical signals alongside growing expectations of a US Fed rate cut, oil then recovered roughly 1–2%, hovering around $68–$69 per barrel.

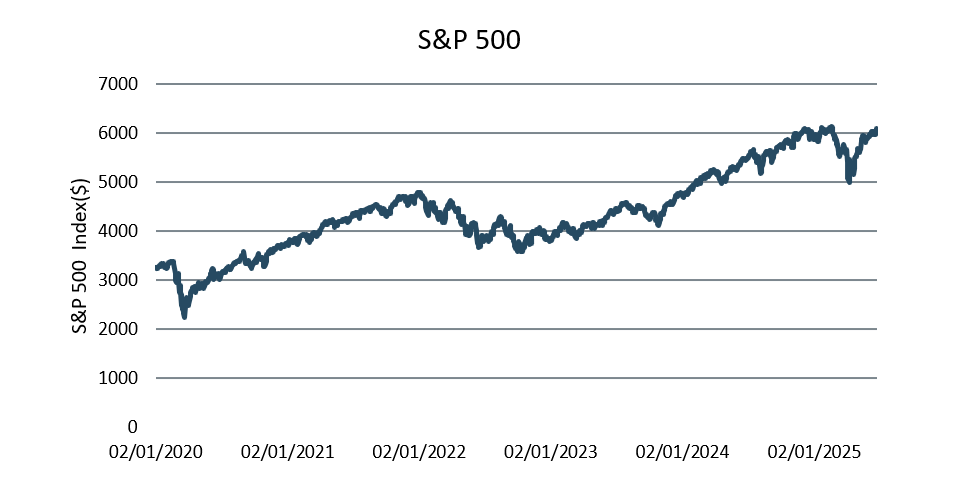

US equities have shown resilience amid the turmoil. In the immediate aftermath of initial strikes, risk briefly dipped, on 20 June, the S&P 500 and Nasdaq both ended lower as investors digested the uncertainty. Yet a tentative ceasefire and the perception that US military strikes would limit further escalation triggered a rebound: by 24 June, the S&P 500 was up roughly 1.1%, Nasdaq rose about 1.4%, as diminishing oil prices and a “relief rally” bolstered investor sentiment. As of today, S&P sits near record highs, signalling that although geopolitical risk remains elevated, markets are prioritising easing rate expectations and stabilising oil prices over escalation fears.

Despite the intensifying environment, a diplomatic window remains open. President Trump has indicated willingness to engage in negotiations. It does, however, seem that the US and Israel’s conditions to these negotiations will be a zero nuclear policy for Iran.

Analysts caution that the situation is precarious. The threat of a wider war involving Iran’s regional proxies and a broader US military presence looms large. At stake is not only the stability of the Middle East, but also the credibility of global institutions tasked with conflict resolution.

As of this writing, the world watches with unease. Whether this conflict leads to full-scale war or a return to diplomacy depends on the choices made in the coming days, not just by Israel, Iran, and the United States, but also by global actors seeking to prevent another lengthy crisis in the region.

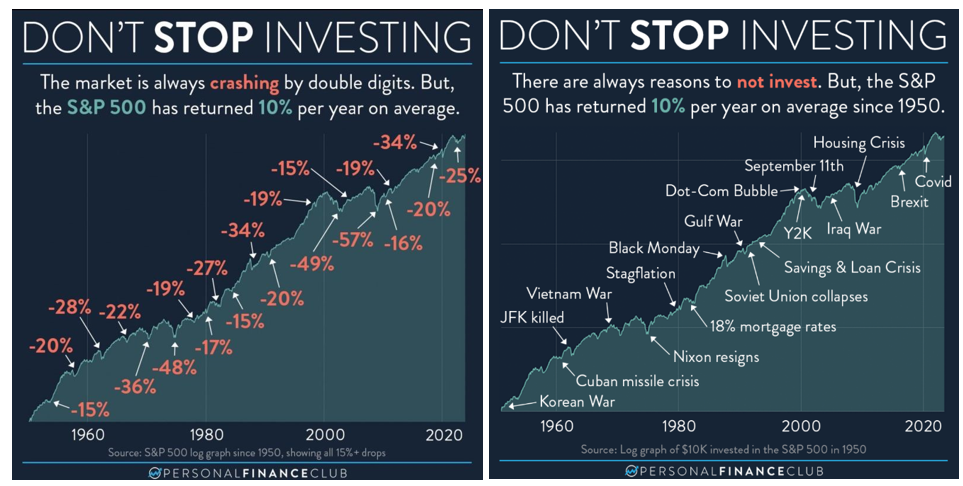

It is, however, important to not overreact in times like these, as investors can easily sell at the wrong time and that can have severe impacts on portfolios. The following is an illustration showing that even with multiple wars over a 70-year period, the S&P still returned on average 10% per year since 1950. Long-term returns are not driven by short-term volatilities like wars, but rather by sound fundamentals of the invest and profits of the investment.