14 February 2024

Help your clients take advantage of the tax benefits provided by Retirement Annuities and Tax-Free Investment Plans before the end of the tax year.

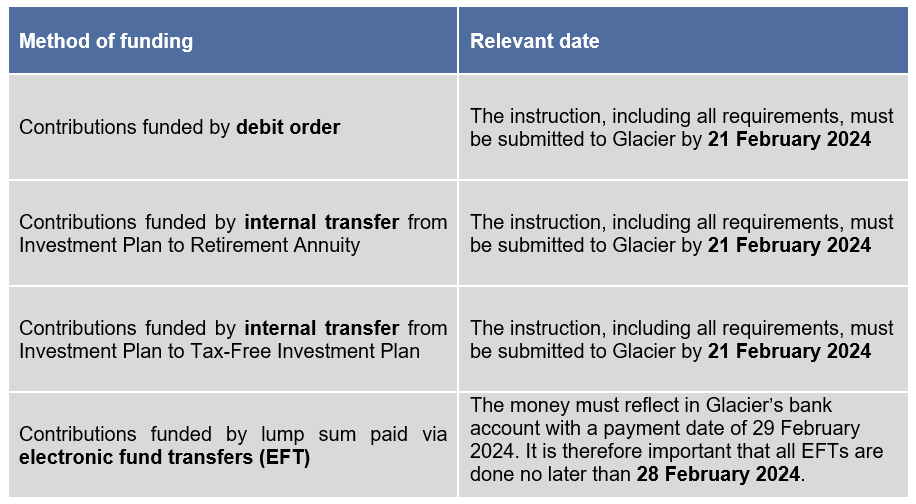

Dates by when lump sums have to be added

Freeze period on external transfers of Tax-Free Investment Plans

Please note that there is a freeze period on external transfers on Tax-Free Investment Plans, in accordance with legislation (Regulation Gazette No. 40758 – Section 9A.4.1: “A product provider must refuse to transfer any amount in respect of a tax-free investment during the last 10 business days of any year of assessment.”).

Therefore the following will be applicable:

- If we receive an instruction to transfer a Tax-Free Investment Plan before the 10-day freeze period, we will continue with the transfer and generate the transfer certificate.

- If we receive an instruction to transfer a Tax-Free Investment Plan during the 10-day freeze period, we will hold off with the transfer until the new tax year and generate the transfer certificate within the new tax year.