There are many important considerations when investing offshore, but investors often tend to focus their attention exclusively on the rand. Many are reluctant to invest when the rand has weakened. Dean de Nysschen, a research and investment analyst at Glacier by Sanlam explains why the benefits of investing offshore often tend to outweigh potential gains made by trying to time the investment decision.

Timing the externalisation of funds

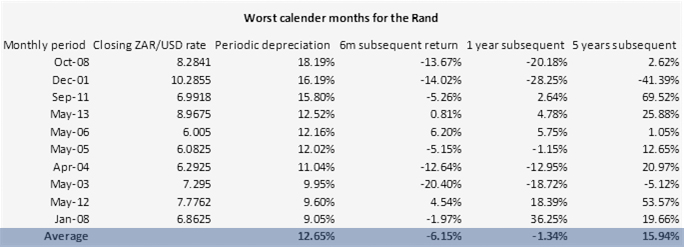

Upon evaluating the most extreme monthly movements of the exchange rate over the last 20 years, we see a few interesting trends. Firstly, it is unsurprising that the worst month for the local exchange rate was in October 2008 (in the midst of the Global Financial Crisis), where the exchange rate weakened by 18%. Six months later the ZAR had strengthened by about 14%, while over a one-year subsequent period (to October 2009), it had strengthened by 20%. This would seem a rational development and may be a good example of why investors tend to avoid externalising when the ZAR has substantially weakened – the belief that the exchange rate should normalise back to its fair value. Interestingly, however, if we look at the average of the ten worst months for the exchange rate, we see that while the ZAR tends to strengthen by around 6%, six months after the blow-out – over a subsequent one-year period the change becomes almost insignificant. Perhaps most importantly, over a subsequent five-year period, the ZAR continued to weaken approximately 16%, and already provides a good reminder that externalisation should be a strategic and long-term decision, rather than one based on shorter-term market movements.

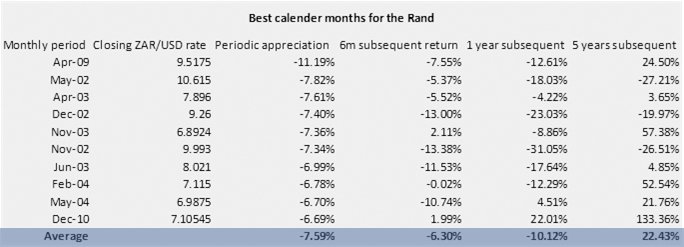

Now, let’s take a closer look at the historical periods where the ZAR strengthened the most (the scenarios after which investors would naturally be most tempted to externalise). On a subsequent six-monthly basis, the average movement of the ZAR after severe strengthening, is actually very similar to the movement of the ZAR, after severe weakening (-6%). Even more interesting is the fact that subsequent one-year returns, after periods of significant rand strength, would - on average – indicate that the exchange rate doesn’t actually weaken (the way investors who externalised may have anticipated), but that the currency actually strengthened further (in this case by a further ten percent, which would be negative for your externalised funds). Although the expectation for the exchange rate to normalise after a blowout may be reasonable, history shows that over the shorter term, it could go either way. On a longer-term basis, however, the currency will continue to depreciate (as the subsequent five-year returns suggest), regardless of your entry point.

What is the best course of action?

Given the trends outlined above, if an investor expects the ZAR to weaken, then they shouldn’t necessarily be fixated on waiting for the perfect investment entry point. Investors may be tempted to exclusively externalise their money just after the ZAR has strengthened - and obviously this would be preferential to any investor, if it works out. But what the data shows us is, regardless of your entry point – a well-planned and longer-term externalisation strategy will reward you over time. Theoretically, the ZAR is a depreciating currency, relative to developed market countries (with lower inflation and lower interest rates) and therefore over a longer period this depreciation trend will continue. The best course of action for investors is therefore to externalise their investment for strategic reasons – according to their unique goals and risk profile – as well as the several benefits these offshore markets can provide (we explore these below in more detail).

Offshore investing is for the long-term investor

An offshore component is an important part of any well-diversified portfolio but should generally be reserved for funds that an investor is willing to invest for the long term, and that are not needed to match rand-based expenses.

Looking back over the last five years, the MSCI has produced 15% (in ZAR terms) against the ALSI’s return of 4%. Over the last ten years, those percentages are 19% (again in ZAR terms) versus 11% from the ALSI. In USD terms, the disparity is similar – the ALSI produced five-year returns of negative 3.50%, while the MSCI World produced 6.90%. Over a ten-year period, the ALSI returned 2.17% in USD terms, while the MSCI World returned 9.95%.

If we refer to the above historical data one last time, we see that – on average - the subsequent five-year return, after periods of ZAR strength, is approximately 22%, while the same average subsequent five-year return figure is 16% for periods after significant ZAR weakness (implying a 6% return difference, based on whether you externalised after either extreme ZAR strength or weakness). Optically, this may seem like a large gap, but when considering the differential in historical long-term returns between local and offshore indices (discussed in the above paragraph), the data implies that this timing-related gap becomes immaterial – and more importantly, the ability to access a broader opportunity set (which should theoretically provide a greater chance of improved returns) may be just as important as your entry point. Ultimately, these factors should not be seen as being mutually exclusive – and should be considered holistically, when making your decision to externalise.

*The above data table references the top ten most extreme months for the exchange rate over the past 20 years, and only data with subsequent five-year return figures were considered for the exercise.

View 6 Good reasons to invest offshore – irrespective of what the currency movements are