3 October 2023

By Suren Govender, Business Development Manager at Glacier International

For most South Africans, the uncertainty of today’s world and the weakening rand infuses everyday life with anxiety and worry. Often, we reflect on the good old days (sometimes as recently as four years ago), when the rand was R13 to the US dollar. Suren Govender, Business Development Manager at Glacier International, points out that the weak rand is unfortunate, but we have an opportunity to change an unfortunate situation to a positive one for investors.

Simple economics

In order for any economy to prosper, a country must efficiently maximise its opportunities presented by its land size and citizens, to generate goods and services that create jobs and livelihoods, take care of the nation and contribute to the world. Entrepreneurs understand this need and create businesses. And in order for a business to expand, it has to raise capital. Listed companies raise capital from investors and the public, and thereby generate larger volumes of sales revenue from a national distribution network.

Consumers participate and are critical to this process. Importantly, the profits and goodwill of these companies impact on discretionary investments, retirement funds, retirement annuities, unit trusts and s. One of the key variables that contribute to the growth of businesses and the economy is growing market share around the globe. This means attracting customers who find their products appealing, regardless of where they live.

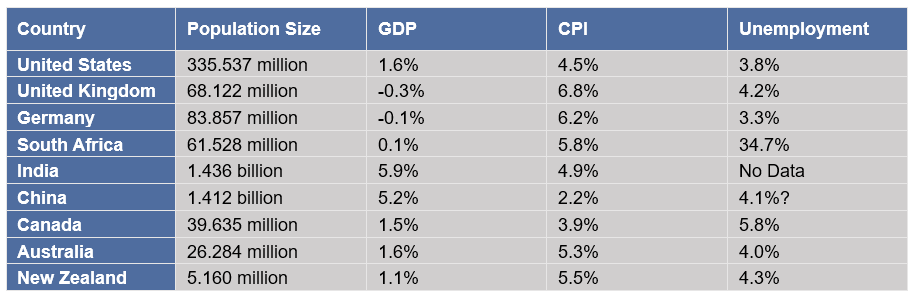

See the snapshot below of a few economies as measured by the International Monetary Fund for the period ending June 2023:

One of the biggest detractors in our economy is the depreciation of the rand relative to developed markets. The US dollar is the global reserve currency and therefore we become despondent when the rand weakens against the dollar. Our lifestyle is dependent on our currency earnings in our respective countries. So, it makes sense to participate in global companies’ profits and foreign currency, and benefit from the strong dollar or pound sterling. Your participation in an offshore market can influence the quality of your life positively, as a resident in South Africa.

The numbers speak volumes

The graph below demonstrates the return of a World Index in ZAR measured against South African Equity and Inflation:

How to access global markets with Glacier International as your partner

Earning local income that is sourced from global opportunities in offshore markets is not as difficult or complex as you may think. Here are some things to think about to include global investing in your diversified portfolio and why choosing Glacier International as your partner makes good sense:

- Simple tools and processes. Glacier International helps you access global markets in any major currency. With the use of simple tools, invest using any currency – US dollars, pound sterling, the Australian dollar, or the euro – for as little as R5 000 per month.

- Be on top of regulatory changes, especially those related to retirement planning. Changes in regulation like the increase in offshore allocation to 45% for retirement savings, are critical to know, to maximise the outcomes in your diversified portfolio.

- Benefit from dollar-cost averaging. That means investing the same amount of money at regular intervals over a certain period of time, regardless of price. By using dollar-cost averaging, investors may lower their average cost per share/units and reduce the impact of volatility (risk) on their portfolios.

- A focus on tax benefits and administrative efficiencies. One of the many features of the Glacier International offering is the investment solutions around tax and foreign estate administration, for example, the tax advantages of using roll-up funds.

- Rigorous research. With the global investing universe totalling around 325 000 funds, you can benefit from Glacier International’s deep-dive and due diligence into the global investment landscape, ensuring that the funds on our investment platform are of the very best. We have narrowed down the top ones to 900 funds and exchange-traded funds (ETFs).

- Choose any bank account on the planet. Through Glacier International, you can pay your investment capital to a bank account anywhere in the world, and then re-invest your foreign income in global markets, which means you continue to enjoy the benefits of this investment strategy.

Things to consider before investing offshore as a South African earning rands:

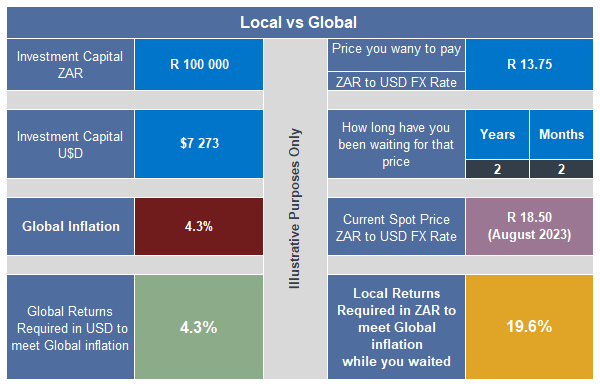

- The last time the rand was R13.75 to the US dollar was in June 2021. If you had invested R100 000 then, how would you feel about the rand/dollar performance currently? The exchange rate at the time of writing this article was R18.50 to the US dollar, which is what it has been for a few months.

- Pre-COVID, global inflation was 3.5% per annum; at present, it is 6.6% per annum. The International Monetary Fund is forecasting an inflation rate of around 4.3% at the end of 2024. The actual outcome is uncertain.

- Your local investment strategy in rands will need to give you a return of 19.6% per annum to meet global inflation at 4.3% as measured in US dollars based on current exchange rate of R18.50 to the dollar.

- Your offshore returns in US dollars, while living in South Africa closes the Consumer Price Index (CPI) gap for you, many times over.

- Another key advantage is that direct offshore investing does not attract capital gains tax on currency depreciation.

- If you’re considering taking advantage of the global opportunities with a depreciated currency, your decision needs to be informed. You also require an investment partner that understands all of the complexities of offshore investing and can distil this information to create simple solutions that help you on your path to investing with confidence.