2019 was a year of uncertainty, however, investors were rewarded for staying invested in risky . Globally, equities were the place to be with the MSCI World surging 24.11% (in rand terms), while most regional equity indices gave investors solid returns with the S&P 500 leading the charge. On the local front, the ALSI advanced 12.05%, while local bonds gained 10.32%. We entered 2020 with optimism supported by signs of stablising global growth and progress on the trade war between the US and China. Sentiment changed rapidly over the past few weeks, with two overwhelming issues creating fear in the market and reminding investors of the 2008 global financial crisis.

The first issue has been the coronavirus in China and the second has been the sharp fall in oil prices due to the price war between Saudi Arabia and OPEC. Given that we live in an interconnected world, the impact of the coronavirus has been far reaching. The concerns are around the potential impact on global growth and whether this will lead to a global recession, as well as how other countries will contain the virus. As a result, volatility has spiked and we have seen a flight to safety. Year-to-date in rand terms (1 January 2020 to 9 March 2020), global equities gave up 3.61% and global bonds surged 19.58%, while local equity surrendered 15.03% and local bonds firmed 0.07%. The depreciation of the rand has helped offset the losses of foreign returns. If one isolates the period of distress (25 February 2020 to 9 March 2020), global equities surrendered 9.61% and global bonds rallied 10.12%, while local equity and local bonds gave up 10.73% and 2.09%, respectively.

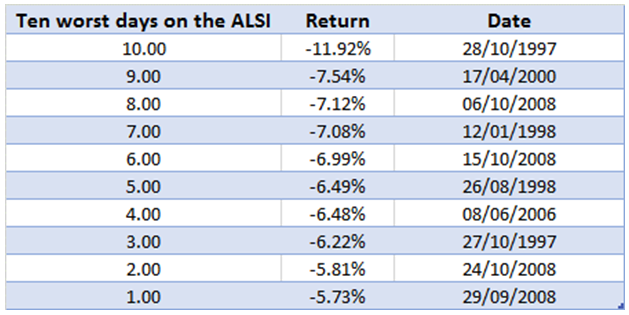

It is during times of market stress that investors make emotional decisions such as switching their investments to cash, which could hamper long-term wealth creation. In light of this, the remainder of this article will look at the daily returns of the JSE All Share Index (ALSI) in order to assess market returns after periods of distress. Table 1 below shows the ten worst days on the ALSI from 28 February 1997 to 28 February 2020. The biggest daily loss has been -11.92%, while the best loss of the ten worst daily returns has been -5.73%. The average loss across these ten data points was -7.14%, which is roughly in line with what investors experienced this past Monday, 9 March 2020, on the ALSI.

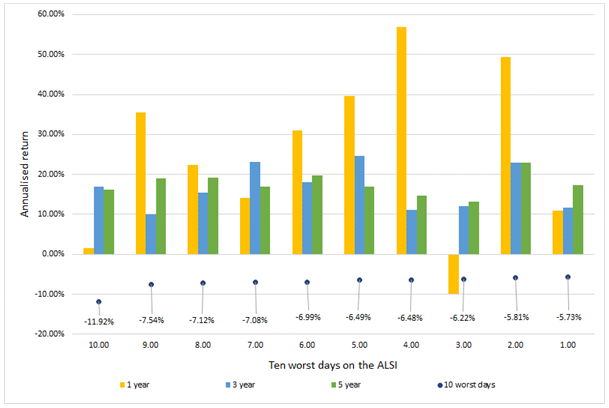

As human beings we suffer from a number of biases, which can lead to irrational behaviour, especially during stressful situations. If one uses the tenth worst daily drawdown experienced (-11.92%) as an example, this return is perceived like a doomsday scenario and investors tend to extrapolate this into the future. This bias is known as recency bias and the danger of this bias is that it skews our view of reality as well as the future. Keeping this in mind, let’s look at the results of the subsequent returns as depicted in figure 1 below, following the ten worst daily returns experienced on the ALSI.

In figure 1 above, the y-axis shows annualised returns, while the blue dot represents the ten worst daily drawdowns (ranked from worst to best - left to right on the x-axis) with the corresponding bar charts showing the subsequent returns after those drawdowns occurred. If one looks at the tenth worst daily return of -11.92%, the subsequent returns were: 1.63% (one-year); 16.86% (three-year) and 16.09% (five-year). When looking across the ten worst days, it is clear that the subsequent one-year, three-year and five-year returns have been compelling. The average subsequent returns after the ten worst returns were: 25.17% (one-year); 16.61% (three-year) and 17.60% (five-year).

Hindsight is perfect foresight and during these sharp drawdowns, it is extremely difficult to stay invested or better yet to use this as an opportunity to enter the equity market. The data suggests that you are rewarded for staying invested and that equity markets do in fact rebound. The experience of these drawdowns and how investors react are critical for future returns. At this juncture, investors are faced with two decisions: either stay invested or switch to cash. However, this requires investors to time the market, which is an extremely difficult task. When considering the two issues that have caused fear in the market over the past few weeks, both of these have been exogenous shocks which are difficult to anticipate. As always, it is important to remain calm and to stick to your long-term investment plan. It is during times of market stress that investors understand their willingness and ability to take on risk, which should be adequately reflected in their underlying investments. It is crucial to work with your financial adviser to make sure that you are invested according to your correct risk profile, which should go a long way in allowing you to navigate this volatile market and the years beyond.