July 2023

Renier de Bruyn, Head of Asset Allocation at Sanlam Private Wealth

A question currently being hotly debated in the investment world is whether the 2022 monetary tightening actions of central banks to combat inflation will result in a hard economic landing (a downturn) or a softer touchdown (a more resilient economy). In our view, it will be difficult for the authorities to sustainably cool inflation towards the target range without reducing the level of demand in the economy. Investors should, therefore, brace for a rough landing at the very least.

Miracle on the Hudson

“We’re going to be in the Hudson” are surely words no pilot ever wishes to utter. Yet these were the words of pilot Captain Chesley “Sully” Sullenberger on 15 January 2009 after US Airways Flight 1549 struck a flock of geese shortly after take-off from New York, losing all engine power. Given the airplane’s low altitude and inability to reach the nearby airport of Charlotte, Chesley had no choice but to land in the Hudson River off Midtown Manhattan. While it certainly was not a soft landing, all 155 passengers survived in what has since come to be known as the miracle on the Hudson.

Hard or soft landing

This event leads us to ask whether central banks – which are, in a sense, the pilots of the global economy – can emulate Chesley’s miracle and prevent an economic hard landing following the contractionary monetary policies implemented in 2022 to reduce the rate of monetary expansion and fight inflation.

In investment speak, the terms ‘hard landing’ and ‘soft landing’ are used to describe how the economy is impacted by the process of inflation being forced lower by central banks. A hard landing is accompanied by an economic downturn, while a soft landing sees a Goldilocks-like scenario of both lower inflation and a resilient economy (in other words, an economy that is not too hot, not too cold, but just right).

Investment clock

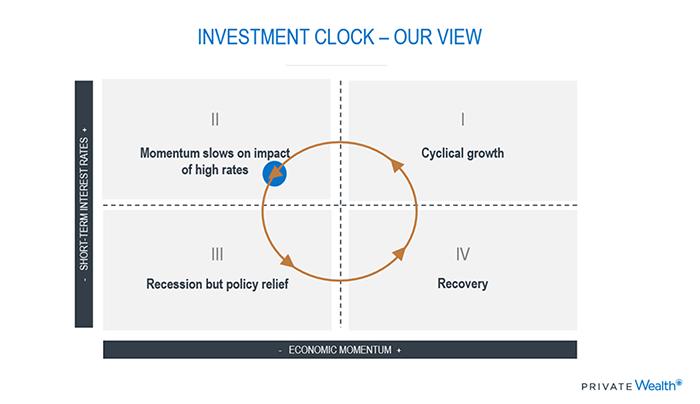

Given the uncertainty over how the global economy will ‘land’, how do we determine the best way of positioning a multi-asset investment portfolio in the current environment? The chart below shows the normal expected movement of the investment cycle, driven by the interplay between economic momentum and interest rates. We also indicate where the economy currently is in the cycle (the blue dot).

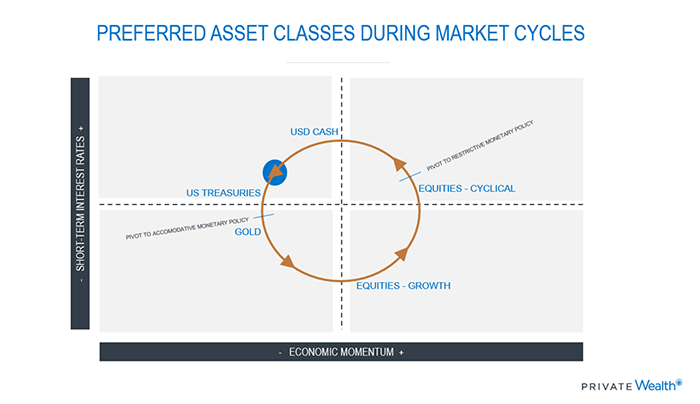

According to the investment clock, the next stage of the cycle is expected to be a recession, which should then lead to a relief in monetary policy through lower interest rates and more liquidity that ultimately sets the stage for a recovery and the start of a new cycle. Within each stage, we expect different asset classes to outperform, as shown on the next chart.

Unfortunately, given the complexity of the environment in which we operate, the investment clock doesn’t always move at a steady pace or sequence. We therefore continuously assess incoming economic data and market signals to determine whether our view of the cycle is still correct.

While financial market performance since the outbreak of Covid-19 in 2020 has very much conformed with the expected progression of the cycle, the recovery in both equities and bonds since November 2022 until a few weeks ago seems to align with the view of a soft landing in the bottom-right quadrant – the cycle therefore skipping the ‘normal’ recession phase and jumping straight to the recovery phase.

Miracle landing – or false hope?

While a soft economic landing following a severe round of monetary tightening isn’t impossible, it would certainly be contrary to the historical norm. Over the past 30 years, an interest rate hiking cycle has consistently been followed by a recession in the US.

Former Federal Reserve Chairman, Paul Volcker, who was responsible for finally breaking the back of inflation in the late 1970s, once said that tighter monetary policy reduces inflation by causing bankruptcies. Perhaps the recent failure of three US regional banks and the government-forced takeover of global financial services provider Credit Suisse Group by Swiss investment bank UBS are the first signs of cracks starting to appear in the system.

Something has to give

In our experience, the two primary drivers of market returns are the investment cycle and valuation. The holy grail of investing is to continuously redeploy capital from relatively overvalued to undervalued in tune with the investment clock. However, there currently seems to be a disconnect between global equity prices and the signals from the bond market. Simply put, equity prices are not factoring in a recession in terms of expected profits and valuation, while the bond market is already predicting a slowdown through an inverted yield curve and expectations of interest rate cuts later this year.

Sanlam Private Wealth’s investment strategy

Our base case is that it will be very difficult for central banks to keep down inflation rates without equally reducing economic demand, negatively impacting company profits and investors. The question remains whether too much or too little has been done in terms of tightening to date – which will determine the pace of the investment clock and the expected movement of over the next few months.

While ensuring that our clients’ portfolios remain resilient to different potential outcomes, at Sanlam Private Wealth, we have been tilting towards a more defensive stance by reducing equity exposure and increasing high-quality global bonds, particularly US Treasuries, in our multi-asset portfolios. Our global equity selection is also tilted towards more defensive, high-quality businesses.

By being more defensive over the short term, we aim to position portfolios to enable us to capitalise on opportunities that weaker markets may provide in a recessionary environment. Higher rates have created more room for central banks to stimulate the economy once inflation has been brought under control, but we’ll be subject to some economic suffering before they’re likely to act. Over the longer term, we’ll continue to seek out good quality businesses at attractive valuations to build wealth for our clients.