By Francis Marais – Head of Research

Two months can make a big difference. As at 31 December 2018, the one-year return figure for listed property was a depressing -25.26%. Fast forward to 28 February 2019, and this figure would have improved to -5.20%.

How can two months make such a big difference?

Two things happened. Firstly, during the month of January property returned a whopping 9.18%. Secondly, the one-year period up to 28 February 2019 obviously excludes the first two months of 2018, i.e. January and February, during which listed property suffered drawdowns of -9.91% and -9.90% respectively.

The example above does a great job of illustrating the impact of focusing on specific investment time horizons, and by implication, offers a stark warning to not get fixated on short-term performances, as they can change rapidly. Two people invested only two months apart can have very different experiences. More importantly, the example also highlights the pitfalls of selling-out at the wrong time, realising your losses and missing out on good subsequent returns which compound over the long term.

For the one-year period ending 28 February 2019, offshore would have been the best performing asset class, mainly assisted by a sharp depreciation of the rand, which lost roughly 19% of its value against the dollar. Foreign property was the best performing asset class, returning 36.65% in rand terms, followed by global equities (returning 20%) and global bonds (returning 18%).

Diversification pays

If you had a portfolio with a diversified offshore exposure during this period, it would have contributed to performance and more importantly, shielded you from negative inflationary effects due to a depreciating currency.

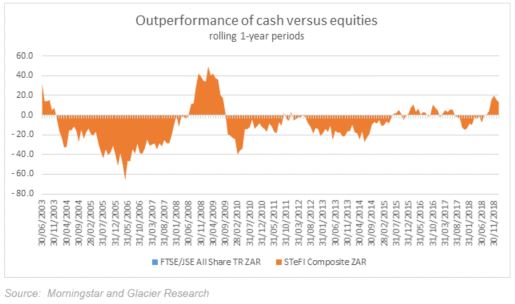

Turning our attention to local , only cash (+7.2%) and bonds (+4%) managed to deliver positive performances over the previous 12 months, with only cash managing to meaningfully outperform inflation (+4%). Domestic equities were down 1%, while property delivered -5% as mentioned above. The outperformance of cash seems to be a recurring phenomenon. On closer inspection, however, this is only true over the shorter term, and is clearly cyclical.

Staying invested – the best strategy

Investors are increasingly giving up and either disinvesting from equities and reinvesting in less risky asset classes (like cash), or opting to not invest at all and keep their savings “safely” tucked away in the perceived safety of their bank accounts. This is potentially very dangerous and could lead to unfavourable outcomes over the longer term.

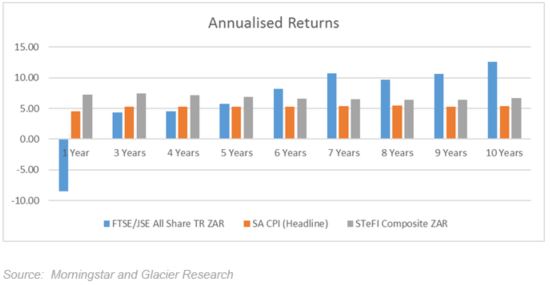

Equities outperform over the longer term, as can be seen from the graph below. If you were invested in equities for the last six years (including the poor performances of 2018), you would have handsomely outperformed not only inflation, but also cash. The longer the investment period, the greater the outperformance.

One has to remember that the prices of equities are ultimately determined by supply and demand and not necessarily by their true value. At times, equities can be overvalued by the market, pushing their prices up, and at other times they could be undervalued, pushing their prices down. Purchasing equities at a point when they’re undervalued could give an investor the opportunity to realise gains on their investment.

A few months can indeed make a big difference and getting distracted by focusing on short-term, static performances can be misleading. One should also be careful in assuming that cash will always outperform equities, as outperformances are usually cyclical and indeed, the longer you are invested in equities, the higher the probability of the equities outperforming both inflation and cash.

It is therefore important for investors to focus on their long-term investment objectives, established with the help of a financial adviser, and to have a diversified investment portfolio.