In these financially trying times when many people are retiring or being offered early retirement, investors are faced with financial choices that could affect them quite significantly during their retirement. It’s reasonable that as an investor, you are looking for certainty regarding your future income.

You’ve worked hard for your retirement savings. You want peace of mind knowing that you have a sustainable retirement income and that you could leave some capital for your family when you pass away. It’s a lot to ask for, but all of it is possible, says Linda Blom, Business Development Manager at Glacier. She unpacks how having your cake and eating it is well within reach, even in this time of economic turmoil.

Decisions, decisions

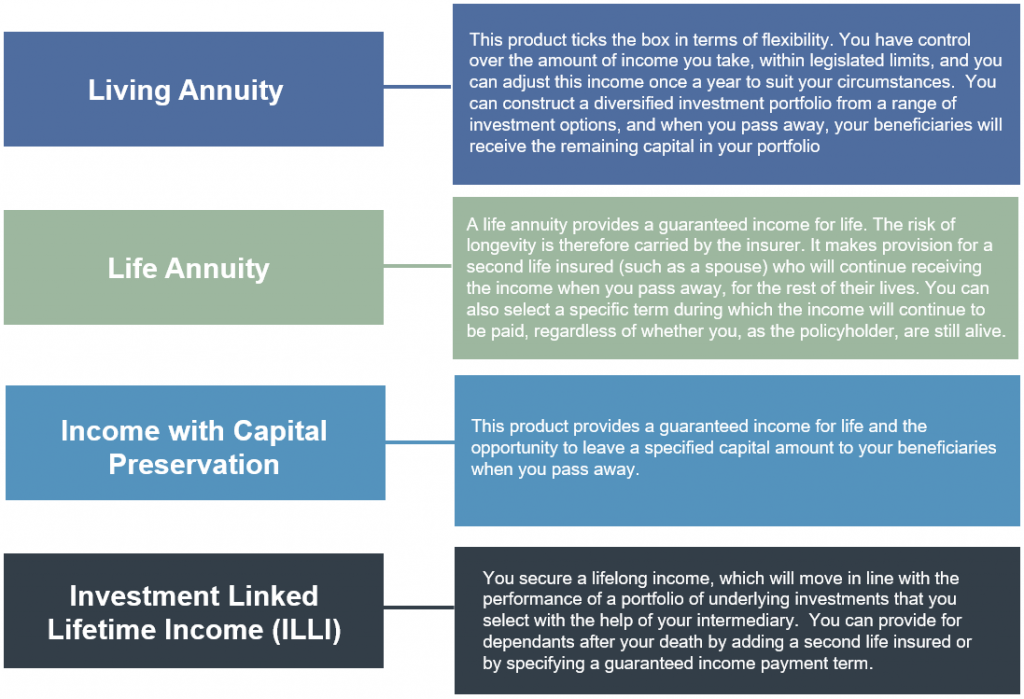

A single product or solution will not tick every box for you, says Linda. So, combining retirement income products and features is absolutely the way to ensure the best outcome for your retirement. First, let’s consider some of the individual retirement income solutions on offer (see the image below)

It’s in the blend

An investor’s requirements for a guaranteed retirement income, income growth and the need to leave capital for their loved ones, have forced intermediaries to look at multiple solutions that work together in a well-rounded, diversified retirement income portfolio, says Linda. This is a sure-fire way to ensure the best retirement outcome.

No one-size-fits-all solution

Retirees are as diverse as their taste in shoes. So, there really isn’t a one-size-fits-all product or solution when it comes to your retirement income. Your financial intermediary will blend a solution based on financial goals that are unique to you. Here are two examples of possible combination solutions:

| Combo Solution 1 |

| Sanlam Income with Capital Preservation, which offers: a guaranteed lifelong income; and the opportunity to leave a specified capital amount to your beneficiaries when you pass away; PLUS A Living Annuity, which offers: an opportunity for your capital to grow due to ; flexibility in terms of investment choice and income choice; and the opportunity to leave your remaining capital to your beneficiaries when you pass away. |

| Combo Solution 2 |

| A Living Annuity, which offers: an opportunity for your capital to grow due to ; flexibility in terms of investment choice and income choice; and the opportunity to leave your remaining capital to your beneficiaries when you pass away. PLUS a Life Annuity, which offers a guaranteed lifelong income. |

In every combination solution, as in every financial plan, the investor’s unique personal circumstances and financial needs are taken into account along with their income and aspirations for the future, says Linda. Getting to the custom-made solution takes time and skill, and Linda has a few things you should consider if you are at this particular life-stage.

Five things to consider when you are facing retirement:

- Get help. Don’t make these decisions on your own. If you don’t already have a financial intermediary, it’s not too late to appoint one. Check that they are qualified to advise about investments and all tax implications that affect you. Appointing an intermediary can save you money and future hardship due to bad financial decisions.

- Manage your expectations regarding your retirement income. A financial intermediary will design a retirement income plan with the savings you’ve accumulated. Be realistic about your financial ambitions into retirement.

- Now more than ever, it’s important to have a budget. It will improve your peace of mind and lessen your stress about money in your golden years. Also, calculating your budget will help you avoid spending too much of your nest egg too soon – a mistake many retirees continue to make. A good, detailed budget helps you live within your means, enjoy your life, and make your savings last as long as possible.

- You might have a spouse, partner, parents or a disabled child who is financially dependent on your income after you die. This can impact how your retirement savings will be structured and the combination of solutions that will need to work together to provide an income or lump sum for your dependants after your death.

- Leaving a for your family is generous of you, but the reality is that most South Africans start saving too little too late for their retirement and often it’s not possible to leave one at all. Remember, your retirement savings were meant to be a nest egg for you after many years of hard work, so your retirement savings providing a comfortable life for you, should be your first priority.