By Francis Marais, Head of Research

Times like these are tough for everyone. Uncertainty abounds and markets show very high levels of volatility. In addition to this, South African investors, in particular, have had a tough period these last couple of years with risky not outperforming cash. Those who have managed to stay invested have been rewarded now with sharply negative returns and extreme levels of volatility.

As if retiring isn’t life-changing enough

There are, however, investors facing an even more difficult period – those who currently are retiring. So, what to do? Some investors seem to want to abandon growth completely - and who can blame them, but is that the right thing to do? A quote often attributed to Mark Twain says that history never repeats, but it often rhymes.

So, let’s look at previous periods where we had significant negative monthly returns. Since 2002, there were three months with significant negative monthly returns on the JSE: July 2002, September 2008 and October 2008, with returns of -13.44%, -13.24% and -11.65% respectively. What would have happened if an investor retired during each of those periods and disinvested from a medium equity fund, into a money market fund and stayed there, comforted by the fact that they no longer face any risk, i.e. completely de-risking their portfolio. In addition to that, let’s assume they retire with a R5 000 000 lump sum and withdraw at a sustainable rate of 4% per annum.

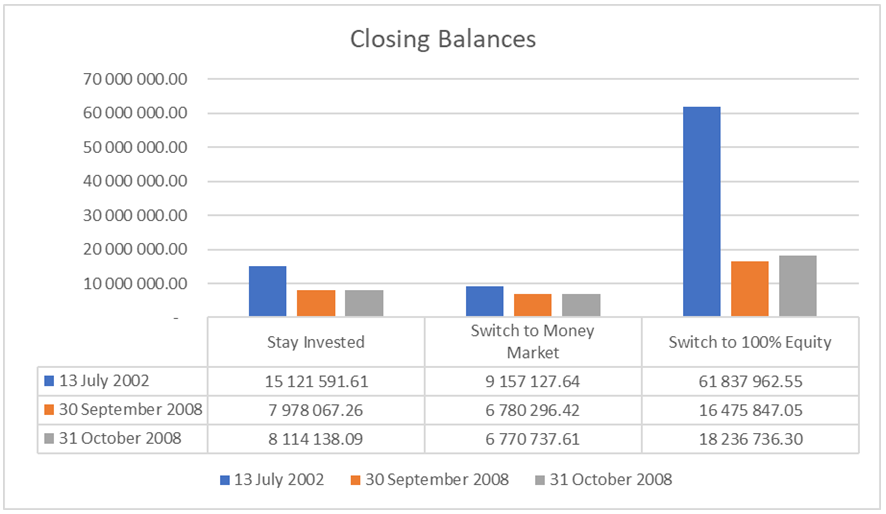

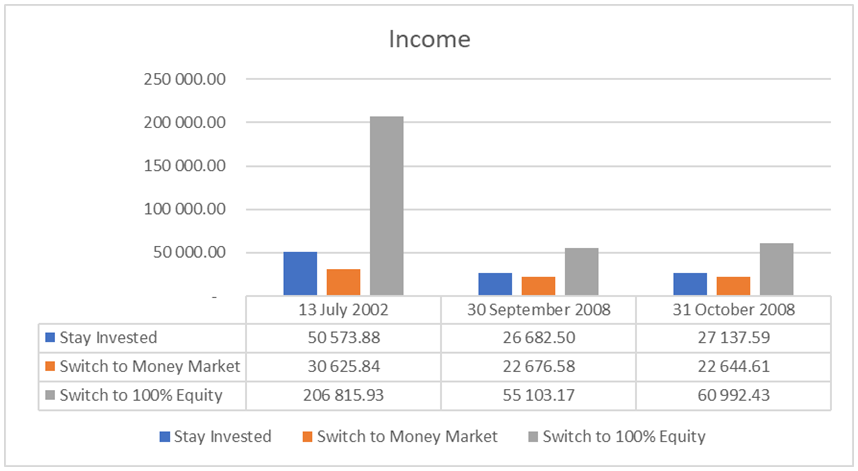

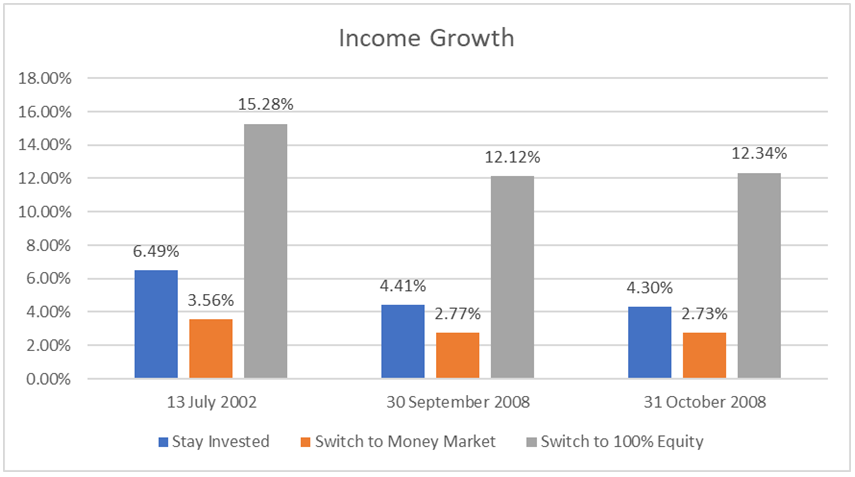

The table below summarises the different outcomes as at 29 February 2020.

In each one of these periods, if you had realised your losses and moved into a living annuity consisting of 100% cash, you would have been worse off. You would also have had lower monthly incomes as at today.

That brings us to the next point regarding income growth – where staying invested significantly outperformed the cash strategy in terms of protecting your purchasing power.

Cash is not king

So, what are we saying? We acknowledge the fact that it is extremely tough, but disinvesting from your current strategy into cash is not necessarily the best option. If you have taken a bit of a knock in your portfolio and you are currently in the process of retiring, try and see through the retirement event and continue with the same type of strategy you had pre-retirement. Naturally, it is best to work with a financial intermediary to partner with you on this sometimes daunting journey.

There is one column (the last one in grey) in all these graphs which we have not yet addressed and that is moving into a very aggressive portfolio once in retirement, consisting of 100% equities. While this is purely a thought experiment, it does show the advantages of having growth in one’s portfolio and if anything else, warns against the danger of excluding growth in one’s portfolio.

Aftershock

We have previously written extensively on facing sequence-of-return risk, both in the immediate pre-retirement phase as well as in the post-retirement phase. This article does not address that particular risk, but rather looks at what happens in a scenario of an extreme shock, as has already been experienced. As always, these types of events should be avoided as far as possible, by working with your intermediary and utilising our broad set of available product and investment solutions.