1 December 2022

By Annalise De Meillon-Muller - Manager: Distribution & Sales Support at Glacier by Sanlam

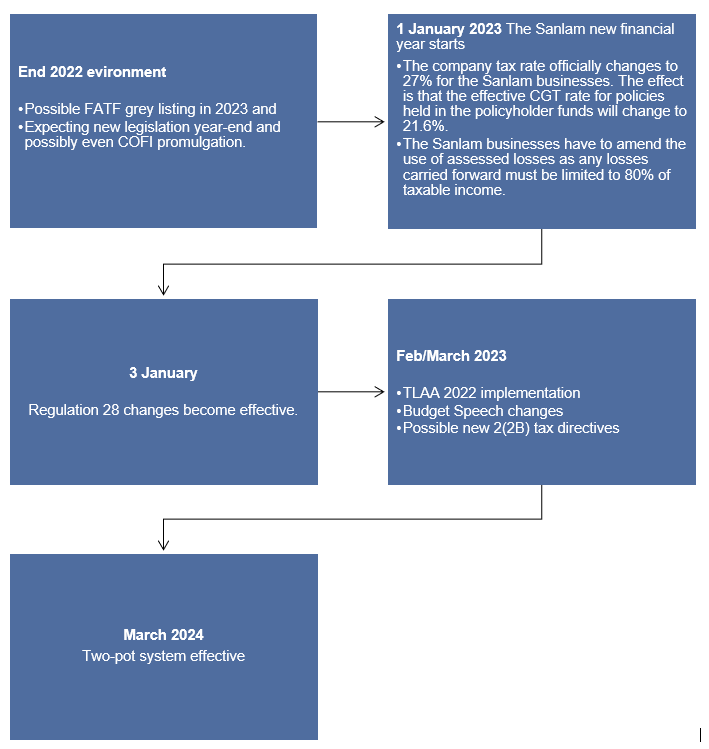

The financial services industry has once again experienced a jam-packed year from a change perspective. Some of the law-related changes have presented challenges while others may present hope for the future. In this article we briefly look at some of the changes that have and will be affecting your practice and clients. The pace of change has been quite fast this year, so the summary that follows represents the situation as at the beginning of November 2022.

To allow for an easier read, please take note that:

- Conduct of Financial Institutions Bill = COFI

- Financial Sector Conduct Authority = FSCA

- Taxation Laws Amendment Act = TLAA

- Pension Funds Act = PFA

- Government Employees Pension Fund = GEPF

- National Treasury = NT

- Income Tax Act = ITA

- Taxation Laws Amendment Bill = TLAB

- South African Reserve Bank = SARB

- South African Revenue Services = SARS

- Revenue Laws Amendment Bill = RLAB

- Financial Action Task Force = FATF

- Capital Gains Tax = CGT

The first half of 2022

Conduct

We are still waiting for the COFI Bill to be gazetted. We all know the intent - this will be our market conduct regulatory framework - but we still need to fully comprehend the impact of this industry-disrupting piece of legislation. Traditionally disruption has had a negative connotation, but more recently disruptive innovation has come to be viewed in a positive light where it leads to savings, efficiency and flexibility. It would be good to tackle this industry disruption with a positive mindset to ensure we identify the opportunities.

The FSCA has a few conduct standards that lay down requirements relating to industry institutions or business. This year the industry has seen the advent of the cross-sectoral Conduct of Business Return (Omni-CBR) Standard. Implementation is a multi-year process, and a draft roadmap was published by the FSCA in June 2022. The idea is to streamline reporting by financial institutions (also applicable to retirement funds). An important aspect is that evidence-based and data-driven approaches to regulation and supervision are further embedded with this Standard. The future of governance is not rules based but outcomes based. This is a very important aspect to remember as you prepare your practice to comply with and adapt to new rules.

Another interesting and potentially valuable development is the FSCA’s consideration to make the useful information they are in possession of, more easily available to the industry. At the same time, the FSCA admitted to some administrative deficiencies on its side that it is looking into correcting.

Retirement

The TLAA 2021 was promulgated on 19 January 2022 and this Act brought about a new rule effective 1 March 2022. In short, retirement fund members could, upon retirement, now purchase both a combination of ownership type of annuities (fund owned or member owned if fund rules allow) and a combination of types of annuity products (as long as each annuity contract is purchased with at least R165 000).

The COFI Bill will be consolidating some legislation into the ambit of the new Act, including the PFA. This may mean some amendments to the legislation regulating financial solutions and products. As an example, section 37D of the PFA is to be amended to allow for more instances in which a retirement fund may make deductions from pension benefits. Engagement between the authorities and the GEPF has been ongoing in order to determine how this fund will be brought into the ambit of the PFA and therefore COFI. Early in 2022 the aim was to promulgate COFI during 2022.

Retirement-related conduct standards have been few this year and to date only one on pension fund contributions has been published. In June 2022 employers and retirement funds were warned by the FSCA that they will be looking closely at both member and employer retirement contributions that are not transmitted timeously and remain in arrears. At the time, data showed billions in arrears from municipalities and private sector employers. With COFI looming, the publication of individual standards covering many themes was questioned. The idea of an omnibus Standard across topics started receiving public mention. Another interesting development is the intended paper on retirement savings costs disclosures. The paper under construction by the FSCA applies to umbrella funds but could possibly be customised to also apply to stand-alone funds.

On the retirement front, the two-pot system design took up a lot of NT’s time and focus from the start of the year. Implementation timelines became a topic of contention early on with a March 2023 implementation date labelled as too ambitious.

The rest

The big surprise that landed early in the year relates to the increase in exposure to foreign allowed. This was not a retirement-only change. Regulation 28 stipulates that the aggregate exposure to foreign is limited to a percentage, or amount, as prescribed by the SARB. During the February budget speech, Minister of Finance Enoch Godongwana confirmed that this exposure will be increased for institutional investors (therefore retirement funds, long-term insurers and collective investment scheme managers) from the respective 30% and 40% to a single limit of 45%. It was no longer necessary to distinguish between foreign as opposed to Africa. This increase came into effect on

23 February based on the publication date of the SARB’s ‘Exchange Control Circular’. The FSCA also confirmed this increase in March with the publication of a formal FSCA Communication. Practically this meant that retirement fund members may invest a maximum of 45% of their investment portfolios offshore. In the context of life insurance policies (such as endowments and sinking funds) as well as living annuities, the increase translates to life companies being able to possibly offer more foreign exposure as they may invest a maximum of 45% of their retail offshore.

With the promulgation of the TLAA 2021 came the issue of assessed losses. Section 20 of the ITA regulates the set-off of assessed losses carried forward from prior tax years for companies. Section 20 was amended to limit companies to a maximum assessed loss set-off of the higher of 80% of the taxable income determined in a particular year, or

R1 million. Any amount that is not set-off may then be carried forward to the following year of assessment and taxpayers will be able to add any current year loss to the balance of assessed loss.

On the bright side, the TLAA 2021 did at least provide clarity that the personal rights of heirs to a deceased estate - to claim delivery of the - only occurs on the date that the Liquidation and Distribution account becomes final.

However, the TLAA 2021 also gave us paragraph 2(2B) of the Fourth Schedule of the ITA issue. This began in 2021 but with the TLAA 2021, the amendments were enacted. In brief, it said that if a taxpayer receives remuneration from more than one source (including a pension from a retirement fund or insurer), the retirement fund, administrator or insurer shall apply a fixed tax rate stipulated in a tax directive issued by SARS in determining the amount of employees’ tax to be withheld. Initially the directive service from SARS was to be introduced from 1 March 2022 but implementation then became layered and complex with choice and additional directives received by the industry in July. Originally Sanlam Life implemented in March for life annuitants and Glacier in April for living annuitants. In July revised rates were received. At this point communication, understanding and the actual rates were already complex. Retirees were confused about the impact and the rates applied, however, the situation did get resolved during the second half of the year. More on this below.

The second half of 2022

All the planned pots (proposed two-pot system in the retirement reform drive) and Regulation 28 (PFA) ensured that some other legislative developments and plans were put on hold. The drive for retirement fund consolidation and the governance of umbrella funds are examples.

Conduct

In October the FSCA confirmed that all commentary with regard to the Omni-CBR Roadmap was being considered and that they hope to publish an updated roadmap in December 2022.

Earlier National Treasury confirmed the intent to send the final COFI Bill to parliament before the year ends. However, in conversation with industry expert Anton Swanepoel, it came to light that National Treasury is only intending to submit the COFI Bill to Cabinet in the first half of next year.

Retirement

Amendments to Regulation 28 of the PFA have gone through a lengthy process since February 2021. These amendments were gazetted on 1 July 2022. It is important to remember that the increase in foreign exposure for institutional investors has been allowed since 23 February 2022. The rest of the amendments will only be effective as from 3 January 2023. These amendments did not categorise infrastructure as a separate or new asset class. The main asset classes in the regulation remain cash, debt instruments, equities, immovable property, commodities, hedge funds and private equities. A retirement fund will have to indicate the percentage and rand value allocation to infrastructure per asset class. Regulation 28 previously defined hedge funds, private equity and other excluded as one combined asset class with a collective limit of 15%. Separately, this means a maximum allocation to hedge funds of 10%, private equity of 10% and other excluded of 2.5% is allowed as long as the collective exposure is not above 15%. These three asset classes have now been separated and there is no overall collective limit anymore. Private equity exposure is up from 10% to 15% while hedge funds remain at 10% and excluded at 2.5%. The 25% limitation on exposure to any one particular entity or company has been amended as well. Currently this limitation only applies to certain sub-categories of asset classes but as from 3 January 2023 will apply to all asset classes. It means that no retirement fund may invest more than 25% across all asset classes in any one particular entity or company. The only exception to the rule is for debt instruments issued by the government, loans to the government and debt or loans guaranteed by the government.

On 4 November the FSCA published a draft Standard on the quarterly reporting requirements for retirement funds in the context of Regulation 28. The industry will have to report quarterly on a prescribed format, which includes non-compliance on both a fund and member level, infrastructure and matters related to environmental, social and governance (ESG) factors. Reporting requirements have been a recent concern with fears around sufficient time being allowed for the system changes required in the industry to allow reporting. The draft Standard is open for comment until 7 December 2022.

The long-awaited concept drafts for the two-pot system were published in the RLAB on

29 July 2022.The industry welcomed the NT’s September response to the public commentary on the proposed system an confirmed an implementation postponement to at least

1 March 2024. The proposed system aims to enable the avoidance of financial hardship, a way to save and grow capital for the purpose of emergency savings and better retirement savings preservation, all using what is arguably the biggest source of wealth for most South Africans, their retirement savings fund. It is of course not an easy task to completely overhaul the retirement rules, and make provision for these in the context of the other big change in recent years, for example the annuitisation of s. Pots and vested rights have never before been so often referred to in the retirement landscape as in the past few years. It is understood that the new system will be compulsory for both defined benefit and defined contribution funds but the application for defined benefit funds is causing a lot of uncertainty. The Actuarial Society of South Africa is assisting NT in this regard. Further legislative amendments to the PFA and Divorce Act, for example, are required to accommodate the new system. How these changes will coincide with other amendments expected via the implementation of COFI remains to be seen. The industry will be extremely busy on this front in 2023 and are hopeful of a positive outcome.

A bone of contention at the moment is the length of time it takes for FSCA approval of Section 14 transfer applications between funds and insurers. The industry is expecting a Circular from the FSCA on the matter by end of November 2022 but in the meantime the FSCA has commented that the latest trustee register should accompany applications, that communication between transferor and transferee should start sooner, transfer rules should include unclaimed benefits in principle and to heed against outstanding reports that are currently delaying approval.

The arrears retirement contribution topic from the first half of the year is expected to culminate in an official name-and-shame exercise before year end.

Lastly the foreign pension trust binding ruling from SARS also took up industry time. SARS has made it clear that ‘under the radar’ retirement savings structures are going to be watched carefully.

The rest

Regarding the paragraph 2(2B) tax directive issue, the industry received amended tax directive files in July and implemented new rates. The addition of more parameters built into the SARS calculations resulted in less affected retirees. Any annuitants that previously opted out of the directive for the tax year did not have to do so again. The industry is expecting new rate files in 2023 and most industry players have managed to make plans for more efficient implementation. Glacier is currently working on technology enhancements to streamline future implementation of related tax directives.

The draft TLAB 2022 was published on 29 July and the Bill itself at the end of October with the medium-term budget. One of the important proposals is to allow a retirement annuity fund member to transfer one or more contracts in a membership to another fund as long as the amount to be transferred is more than R371 250 and the remaining amount is also more than this same amount (this amount is 1.5 times the de minimis amount of R247 500). Initially the minimum suggested amount was R495 000 and this has been lowered due to push back from the industry. It is important to understand that if the total interest in the retirement annuity fund is transferred, this minimum will not apply. Another proposal in the draft Bill centres around the apportioning of the local interest exemption and the annual capital gains tax exclusion when a taxpayer ceases to be a tax resident, to avoid undue benefit. Industry has requested clarity around the unintended consequences of this change. The Bill now clarified the proposal to be for the interest exemption to be apportioned and a rule that the capital gains tax exclusion of R40 000 per annum may not exceed this amount in any twelve-month period, to allow for assessment years in cases of cessation of residency that are less than twelve months. The protection afforded to historic vested rights with annuitisation in March 2021, comes under threat when a transfer is made into a public sector retirement fund. This is contra to the intention and is proposed to be corrected. Annuities paid by public sector funds that operate like s, should also be included in the definition of gross income in the ITA. The intent is to amend this with the TLAA 2022. It is clear that retirement remains a big focus and public sector funds also come under the spotlight. These are just some of the proposed amendments and we expect the promulgation of the Act in December or January, as has become the norm in recent years.

Into the future

The FATF, which is an inter-governmental body promoting measures for combatting money laundering, terrorist financing and proliferation financing, evaluated South Africa in November 2019. The findings were published in October 2021 with a warning that major improvements are necessary. South Africa was obliged to show remedial actions by October 2022, failing which, would result in a possible grey listing. While not as punitive as black listing, grey listing could result in economic sanctions. Some of the deficiencies highlighted included a tick-box focus on compliance in our industry as opposed to an outcomes focus. In addition, our industry’s understanding of risk was too basic, we do not monitor compliance efficiently enough on an ongoing basis, we do not sufficiently identify high-risk clients and do not report suspicious transactions. Grey listing will be particularly detrimental to the investment industry and we now have to address the shortcomings before February 2023 to avoid this. It could be speculated that the increased pace of regulatory change is partly aligned to these deadlines. Government has taken some steps to address this and show intent, but there is still much work to be done. As players in this industry, we all have a duty to understand, document and meet compliance requirements with a risk- and outcomes-based approach.

We will provide updates on the above matters as and when the information is available.