By Suvar Hariparsad, Product Actuary at Glacier by Sanlam

The Wealth Edge Endowment Plan, underwritten by Sanlam Developing Markets Limited and administered by Sanlam Life Insurance Limited, is a tax-efficient solution, which allows clients to take advantage of exposure to investment markets.

With all the uncertainty currently being experienced in the wake of Covid-19, the nervousness of clients to invest in the market is understandable. Clients need to be reassured however, that volatility in investment markets is to be expected, and that markets do recover. The importance of not getting distracted by short-term market movements is important to understand, so that they can benefit from this recovery.

Despite the evidence that, over the long term, investing in equity markets delivers better returns, clients place more value on limiting losses, rather than maximising gains. The optional unit price guarantee on the Wealth Edge Endowment Plan helps clients to balance both objectives.

Optional unit price guarantee

The optional unit price guarantee, which applies at the end of the initial five-year period of the investment, ensures that the unit price in calculating the maturity value is at least at a certain level. More detailed information around the optional investment guarantee can be found here .

To understand how the guarantee could have provided some protection during the recent market decline, a simple practical example is considered. A client with a moderate risk profile is assumed to be holding a well-diversified portfolio. The client invests R1 000 000 on 1 April 2015.

Table 1

| Fund | % Held | Guarantee Applicable |

| SATRIX Balanced Fund | 20% | Not Available |

| SIM Inflation Plus Fund | 20% | Greater of 100% initial unit price or 95% of the highest unit price |

| Allan Gray Balanced Fund | 10% | 80% of the highest unit price |

| Coronation Capital Plus Fund | 15% | Greater of 100% initial unit price or 90% of the highest unit price |

| Prudential Inflation Plus Fund | 20% | Not Available |

| Nedgroup Investments Opportunity Fund | 15% | Greater of 100% initial unit price or 90% of the highest unit price |

The model portfolio used above, together with others catering for different risk profiles, may be found here.

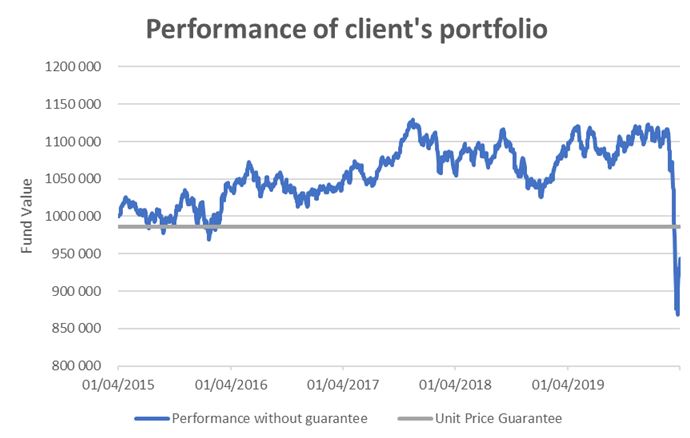

The graph below shows how this investment would have performed over the five-year period, as well as the impact of the recent market crash on the value of the investment.

Source: Initial data from Morningstar

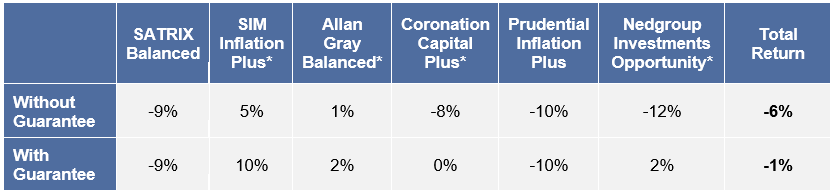

The total return over the five-year period for each of the funds, is compared to the return achieved with the optional investment guarantee selected.

Table 2

Source: Initial data from Morningstar

The total return on this portfolio as at the end of 2019 was 11%. As can be seen from the graph, the recent market crash resulted in a sharp and steep decline in the client’s investment portfolio. The return for the first three months of 2020 was -14%, which resulted in the total return over the five-year period being -6%. The return with the guarantee selected was -1%. While the client still experienced a loss with the guarantee selected, this loss is 5% less than if the guarantee had not been selected.

To understand the benefit of the guarantee further, one could look at the performance of the individual funds. The Nedgroup Investments Opportunity Fund without the guarantee, for example, gave a total return of -12% over the five years whereas the return with the guarantee was around 2%, which is 14% higher.

While investment markets can sometimes be volatile and losses are unpredictable, having additional protection in the form of the optional unit price guarantee allows the client to limit these losses but also benefit from market upside when markets are rising.