Glacier Business Development Manager Neal Sinclair took delegates at the recent Public Sector webinar through Glacier’s extensive range of non-retirement (discretionary), investment solutions. These solutions, as Neal pointed out, can be added to a portfolio or blended with retirement products to add to a retiree’s existing retirement income.

Glacier’s range of investment solutions

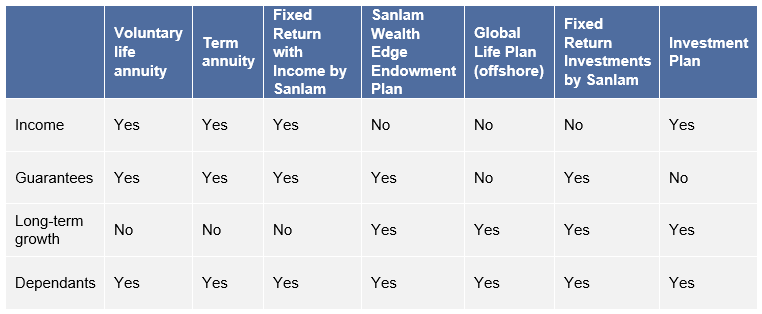

Glacier offers a broad range of savings and investment solutions to address different client needs.

In determining the best solution, these are just some of the questions to consider:

- whether your client needs to draw an income

- whether the income – or a portion of it – needs to be guaranteed

- what their risk appetite and profile is

- how much capital growth they require

- their investment time horizon

- how soon they need to access the money

- whether they have dependants that need to be provided for, and

- the tax-efficiency of the solution and how that relates to their tax profile.

Here is a brief summary of the main characteristics of our investment solutions:

One particular solution might not meet all the client’s requirements. However, it may be possible to achieve a more sustainable outcome by blending different solutions.

Let’s look at an example:

Our client in this example is Mrs Ndlovu. She is single, aged 65 and requires a guaranteed income to supplement her existing retirement income from her employer. She also needs to create an emergency fund. Her personal tax rate is currently 26%. Her available capital (non-compulsory retirement lump sum) amount is R1.5 million.

- The capital of R1 500 000 can be split in two:

- A life annuity of R1 000 000, with 5% escalation. Single life, and utilising the tax exemption resulting from section 10A of the Income Tax Act; and

- R500 000 in an investment plan with a cautious mandate. This portion serves as her emergency fund.

The life annuity portion will provide her with a guaranteed income for life, starting at

R6 183.* In addition, the investment plan can be used to provide a further income to supplement that received from the life annuity, if required.

*This amount is based on quotations as at mid-January 2022. (Rates are subject to change).

She will also enjoy a tax benefit from section 10A of the Income Tax Act, as the life annuity is purchased with discretionary money. This example shows how blending traditional retirement and discretionary solutions can provide a better retirement income result for the client.

Glacier is committed to partnering with you to provide comprehensive and tailored solutions for your clients. Please contact your Glacier representative for more information.

Back to Glacier Public Sector Summit 2022